surely! This is a polished and rewritten version of the article with a brief introduction, key takeaways, and preserved HTML structure, tailored for reputable publications on crypto markets and blockchain.

—

Maximal Extractable Value (MEV) continues to be a major barrier to mainstream adoption of decentralized finance (DeFi), especially by institutional investors. Experts argue that privacy-preserving transaction processing could be the key to mitigating the negative effects of MEV, reducing front-running, and promoting a more accessible and fair crypto ecosystem for retail users.

- MEV allows miners and validators to reorder transactions for profit, hindering DeFi growth and retailer participation.

- Implementing privacy-friendly transaction mechanisms can potentially eliminate front-running and sandwich attacks.

- Transparency risks limit institutional involvement in DeFi, impacting overall market liquidity and stability.

- Our commitment to MEV is critical to fostering a fair, decentralized, and resilient crypto market.

Maximum extractable value (MEV), the practice of miners and validators reordering transactions to maximize profits, continues to hinder widespread adoption of decentralized finance (DeFi). According to Aditya Palepu, industry expert and CEO of DEX Labs, this phenomenon is hampering both institutional participation and retail user experience, creating a barrier to mainstream DeFi growth.

Palepu explains that all electronic trading markets face similar problems due to information asymmetry, which allows exploitative tactics such as pre-emption. His proposed solution involves processing transactions within a trusted execution environment. This is a technology that hides order flow data until execution, preventing market manipulation.

“What makes these solutions impactful is the ability to process orders privately; the transaction intent remains encrypted on the client side and is only decrypted within a secure realm after being ordered,” Palepu said.

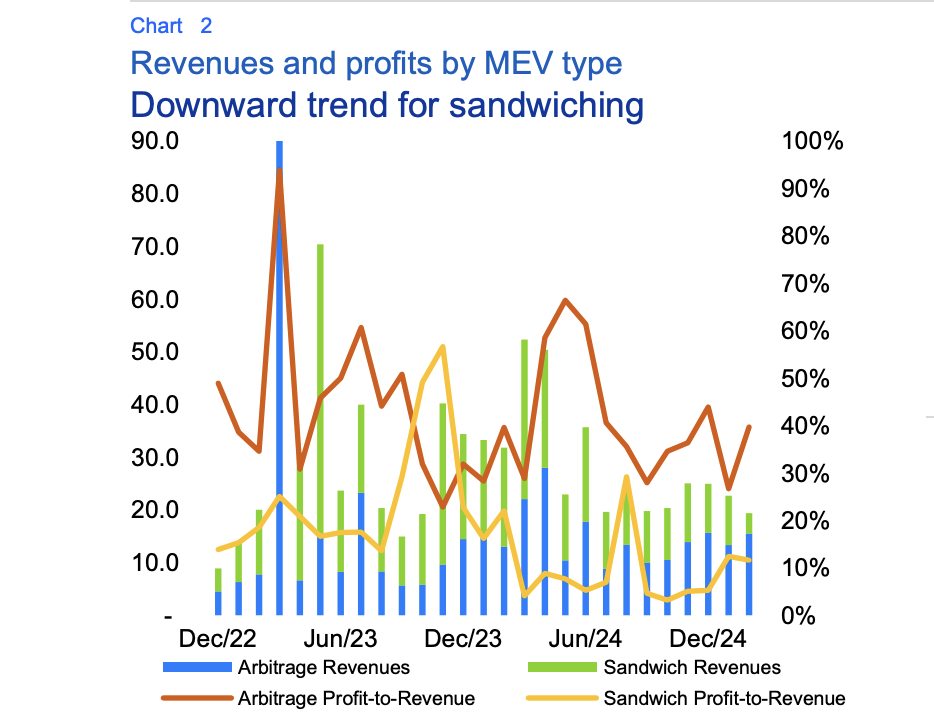

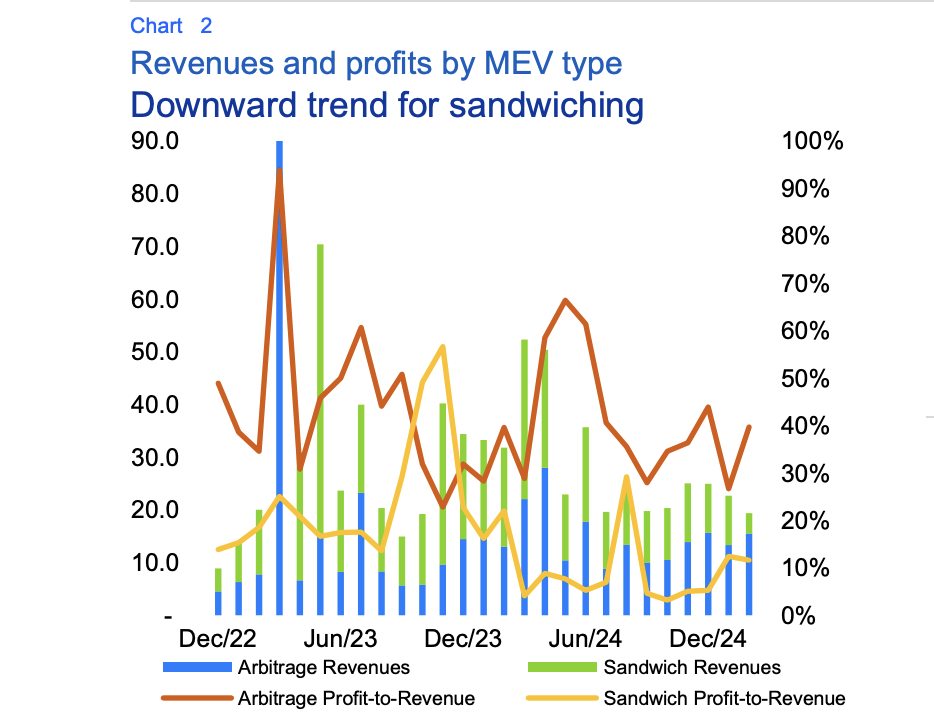

This type of privacy protection effectively eliminates front-line strategies such as sandwich attacks, which manipulate prices by placing trades immediately before and after users’ trades in order to profit. As a result, markets become fairer and less susceptible to manipulative behavior.

The ongoing debate within the cryptocurrency industry centers on potential centralization risks, increased costs, and the broader impact of MEV on market stability and scalability. Industry players are exploring solutions such as batch threshold encryption to make DeFi fairer and more secure.

Institutional reluctance hinders DeFi growth for individual investors

One of the main reasons financial institutions shy away from DeFi is the lack of transaction privacy. As Palepu points out, the transparency of blockchain transactions exposes financial institutions to proactiveness, market manipulation, increased risk, and discourages active participation.

“If institutions are unable to participate effectively, it will have a negative impact on retail users and the broader market,” he emphasizes. Institutional involvement is essential to developing the robust trading infrastructure needed for a healthy financial market to support the DeFi ecosystem.

Without institutional investor participation, liquidity could decline and market volatility could spike, increasing the potential for price manipulation and creating risks for retail investors. Additionally, high transaction costs and reduced market diversity may hinder DeFi’s potential to become a serious alternative to traditional finance.

Addressing MEV concerns and enhancing transaction privacy is seen as a foundational step towards a fairer and more sustainable crypto ecosystem, fostering increased institutional trust and retailer engagement, and ultimately fostering a more resilient blockchain market.

—