European cryptocurrency asset manager Coinshare has prepared and prepared largely for acquisitions to meet the US public list, increasing its strategic expansion in the US. The company’s move shows a strong drive to leverage the rapidly growing US crypto market, focusing on innovative investment products, including aggressively managed ETFs aimed at surpassing simple index tracking funds.

- Coinshares plans to acquire London-based Bastion Asset Management to expand its active crypto investment offering in the US

- The transaction strengthens trading, strategy and team capabilities for aggressively managed crypto products, as regulatory approvals are pending.

- Coinshares aims to implement aggressively managed ETFs in the US, combining systematic trading expertise with strict regulatory compliance.

- The company is also planning a US IPO through SPAC, aiming to access deeper capital markets and attract institutional investors.

- The rise of active ETFs shows a potential change in the way institutional investors approach the cryptocurrency market.

Europe-based Crypto Asset Manager Coinshares is making noteworthy moves to strengthen its presence in the US, including the planned acquisition of London-based Crypto investment firm Bastion Asset Management. This strategic step forms part of Coinshare’s broader efforts to expand the scope of actively managed crypto investment products amid growing institutional interest in strategies that are refined beyond passive index tracking.

The acquisition confirms that Bastion’s trading capabilities, teams and strategies will be integrated into the Coinshares platform, subject to approval from the UK Financial Conduct Authority. The transaction’s financial terms remain private, but the move highlights Coinshare’s commitment to deliver innovative products tailored to US investors.

Active and Passive ETFs

While most traditional crypto ETFs, such as tracking Bitcoin and Ethereum, are passive and matched to price indexes, active ETFs rely on professional management to choose their investments with the goal of surpassing the market. The move to active management of Coinshares is a response to increasing demand for more sophisticated and risk-adjusted strategies in the crypto space.

Holding the status of registered investment advisor under the US Investment Corporations Act of 1940, Coinshares is permitted to develop and deliver aggressively managed ETFs, including strategies that use systematic and quantitative trading techniques.

“The Bastion team has over 17 years of experience developing systematic, alpha-generating strategies with major hedge funds such as Bluecrest Capital, Sestematica Investments, Rokos Capital and Gam Sestematic,” a spokesman for Coinshares said. “Their quantitative approaches using academically supported signals to generate market orientation-independent returns are consistent with the goal of developing differentiated active strategies for the US market.”

Active ETF uplift

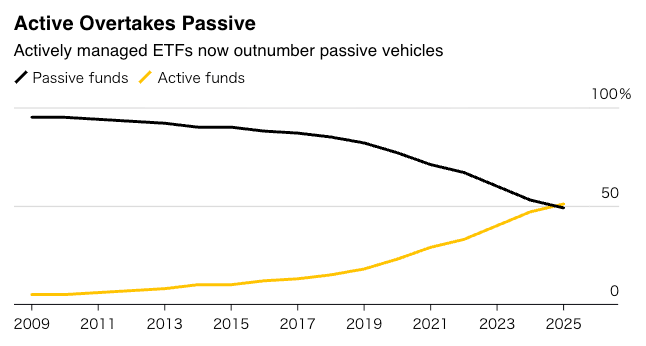

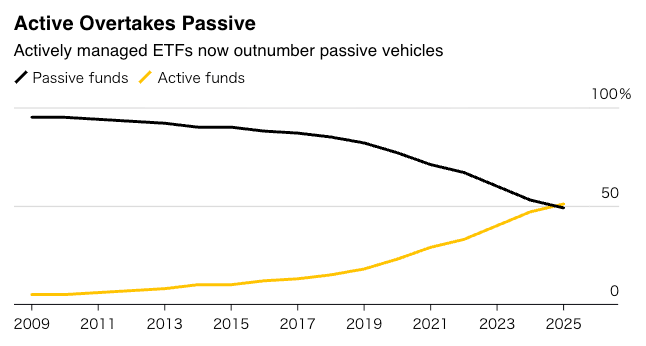

The US crypto ETF market is dominated by passive funds tracking bitcoin and ether prices, but recent developments suggest a shift. In July, Active Crypto ETFs surpassed the numbers of passive funds, a trend that has accelerated over the past five years.

Coinshares plans to offer both directional products designed to track market trends, and the strategy aimed at generating alpha regardless of market conditions reflects a more aggressive approach to cryptocurrency management.

Coinshares’ US expansion

The company’s push to the US market is consistent with plans to be made public through the Special Purpose Acquisition Company (SPAC), along with a pre-valuation of approximately $1.2 billion in money. The move will allow American institutional investors and businesses to deeper US capital markets, essential for the growth of the blockchain and digital asset sector.

This strategic US expansion comes shortly after recent tightening of regulations, including changes to SEC rules that could streamline the approval process for future crypto ETFs, reducing approval times from up to 240 days to about 75 days.

As Coinshares builds infrastructure and teams in the US, it aims to leverage the world’s most fluid and mature crypto markets to establish itself as a leading institutional player.