summary

- Ethereum trades for around $3,900-3,950 and integrates traders with their December Fusaka upgrades to upgrade with Peerdas to enhance scaling.

- Breakouts above $4,500 could drive Ethereum price forecasts to $4,800-$5,000, but the obstacles run the risk of pullbacks to $3,600-$3,800.

- Fusaka is a powerful medium-term bullish catalyst, but macroemotion and movements close to BTC stability still depend on.

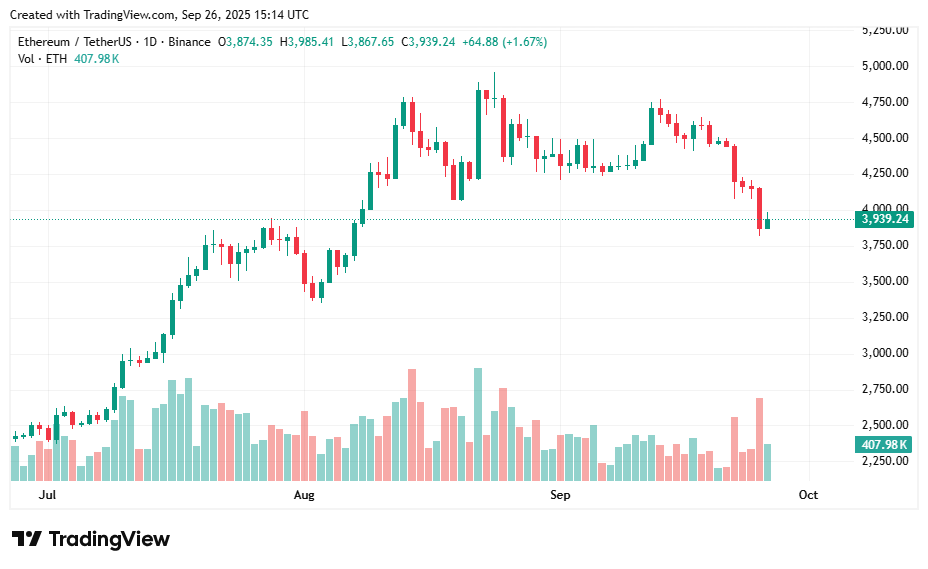

ETH is approaching $3.9k after a choppy.

With targeting the December Fusaka Hard Fork, which introduces Peerdas and other scaling adjustments, and targeting the testnet revitalization scheduled for early October, traders are asking if the foundation can overwhelm short-term risk-off flows and trigger breakouts over $4.5,000.

What is Fusaka?

Fusaka, the next major upgrade of Ethereum after Pectra, focuses on scalability, data availability, and node efficiency. Its key feature, Peerdas, can validate block data without downloading nodes completely, reduce costs and boost roll-up throughput.

The developers are targeting the activation of the mainnet in December 2025, and a testnet rollout was set up in early October, with small adjustments such as changing gas limits and infrastructure hardening being set.

Ethereum price forecast market data

ETH has moved between $3,800 in support and $4,200 in resistance, with volatility settling as the market awaits a clearer signal.

Fusaka’s heading feature, Peerdas (Peer Data Availability Sampling), is designed to reduce costs and increase rollup and L2 throughput, which could increase ETH demand as an on-chain activity scale.

The market is usually aggressively responding to date upgrade roadmaps, with Pectra already behind and Fusaka lined up, so confidence in Ethereum’s development cycle still rises. Still, short-term trading is dominated in the direction of macro sentiment and BTC.

Positive factors for Ethereum prices

If Ethereum (ETH) can regain $4,200 and exceed $4,500, traders are looking at the range of the rally towards $4,800-$5,000 in the fourth quarter. The October testnet and December hard fork timelines provide a clear catalyst, but improved scaling could attract new influx into the Defi and Ethereum ecosystem.

The bullish case is based on the expectation that Peerdas will offer cheaper and faster rollups. The existence of a concrete roadmap will reassure the market and could return to ETH if macro conditions improve.

Negative factors in ETH prices

Despite the upgrade story, ETH faces several risks. If the response to “buy rumors and sell the news” continues to be weak in Macro, it could be updated ETF leaks or US inflation rates. Running delays remain a threat, as developers treat December as a target rather than a fixed deadline.

Fusaka also has the issue of event magnitude, as it focuses on infrastructure improvements rather than headline grabbing capabilities. Failure to defend $3,800 to $3,900 in support could put ETH in deeper losses and revisit at lower levels in early September at 3ks.

Ethereum price forecast based on current levels

The base case for the next 2-4 weeks is that ETH continues to continue in the $3,800 to $4,500 range, with macro flow and BTC determining the instructions. The catalyst case shows a stronger move as the October testnet progress was successful and the December hard fork could cause a lasting breakout of $4,800-$5,000.

On the other hand, weak emotions or delays can limit ETH to less than $4,500 and pull back to $3,600-$3,800. Ethereum’s outlook remains medium-term bullish thanks to Fusaka, but short-term pricing measures are still closely tied to overall market conditions.

Disclosure: This content is provided by a third party. Neither Crypto.News nor the author of this article ends with the products listed on this page. Users should conduct their own research before taking any action related to the company.