summary

- Ethereum price forecast analysts hold ETH between $4,000 and $4,400, lowering volatility after the September fluctuations.

- The main resistance zone is $4,600. A break could send momentum to $4,800-$5,000.

- The system’s ETF inflow and staking activities continue to drive long-term demand.

- Analysts are predicting potential profits of more than $5,200 if supply tightening occurs from ETF staking.

- If ETH cannot maintain its $4,200 support, the price could fall below $4,000.

- The short-term view ranges from neutral to careful bullish, depending on ETH’s ability to regain resistance.

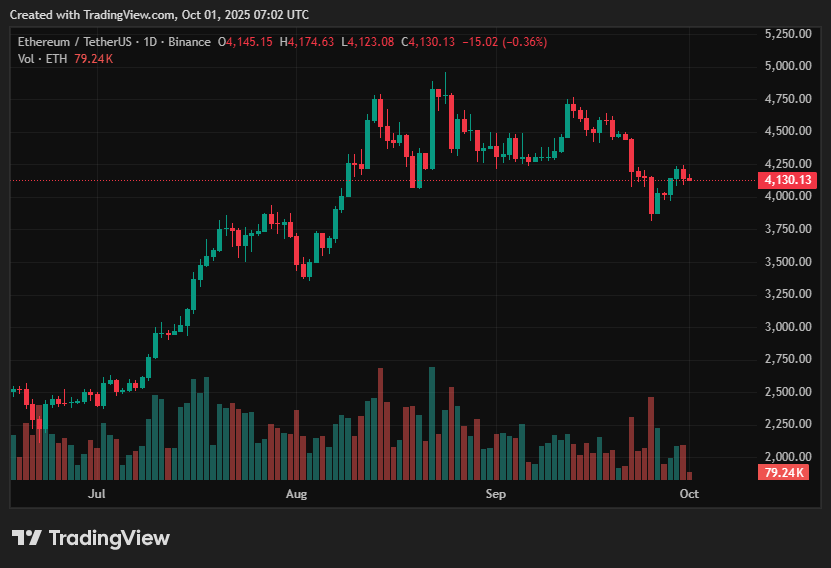

Ethereum price forecasts are focused as the coin traded nearly $4,140 and remained stable after September’s turbulence. The $4,600 zone has formed as a critical level of resistance for bulls, but the $4,000-$4,200 range remains a key cushion of support.

Traders are debating whether Ethereum’s current stability provides a foundation for another upward push, or whether the lack of momentum could lead to additional downside pressure. The institution’s ETF flow and consistent staking activity remain closely monitored as a potential catalyst.

Ethereum price forecast analysis

Ethereum is entering a consolidation phase of between $4,000 and $4,400, indicating a period of lower volatility than the rapid intraday changes observed last week.

Lightweight volumes indicate a short pause in market activity as traders are waiting for a stronger signal. Nevertheless, the underlying network activity remains strong, with the Defi protocol continuing to ensure significant liquidity and strengthening the Ethereum foundation.

Institutional flows also play a stabilization role. Spot ETH ETFs have seen inflows on many key days and show a gradual, consistent accumulation in long-term demand.

Although speculative impulses have slowed down, increased participation from funds and continued staking activities will help Ethereum (ETH) avoid deeper retracements, keeping price movements constructively within current ranges.

How to view Ethereum prices

Solid progress from $4,400 to $4,500 could start Ethereum from the path to a higher goal. The first is around $4,800-5,000. This level has been acting as a resistance in recent weeks, and by recapturing it, it could bring short coverage in the derivatives market and accelerate upward momentum.

Traders see the influx of ETFs as a catalyst that could ethically drive the next bullish leg. From the broader Ethereum Coin forecast, analysts could see momentum reaching the fourth quarter, with some looking for a push above $5,200.

The hope is that if staking elements are integrated into ETF products, the available supply could further shrink, eliciting more institutional allocations and fostering long-term gatherings.

Disadvantages of ETH prices

The biggest danger is that Ethereum cannot protect its $4,200 support zone. The derivative heatmap reveals thick liquidation clusters in this range, meaning a sudden drop could increase sales pressure to $4,000. Such a scenario is most likely caused by poor liquidity and rewinding of leveraged long bets.

Macroeconomic conditions add another layer of uncertainty. Political development, changing interest rate forecasts, or sudden ETF redemption waves can lose momentum and make ETH vulnerable. Even with solid basics, the background to risk-off can quickly suppress upward movement.

Ethereum price forecast based on current levels

The short-term direction of Ethereum depends primarily on whether it can maintain prices above $4,400-4,500. Violations confirmed above this resistance area can support bull forecasts of between $4,800 and $5,000 and reach $5,200 if agency flows continue to maintain support.

Traders consider this scenario to be increasingly plausible when ETF inflows continue at current rates. Conversely, a critical drop below $4,200 weakens emotions and opens the door to slides below $4,000. Such a move can cause liquidation and weaken short-term confidence.

For now, Ethereum’s outlook remains neutral to cautiously bullish, with the balance of expectations being based on its ability to regain resistance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.