As Aptos’ 2025 price forecast gains momentum, investors are reconsidering APT’s long-term value after a period of significant price declines. The Aptos cryptocurrency is trading above $2.50, alongside strong fundamentals such as revenue growth, good TPS performance, and other positive user metrics, and the project looks poised for a significant recovery as fundamentals strengthen across the ecosystem.

APT’s current scenario reflects ICP’s recent breakout

Recent market attention has shifted to base layer protocols that serve as the underlying infrastructure for decentralized applications. Following ICP’s explosive rise from $2 in early November, many expect Aptos crypto to follow a similar trajectory, given its equal utility as a high-performance base layer.

Similarly, another post shared on October 31 pointed to a clear disconnect between sentiment and fundamentals and valuation. Despite the ecosystem’s continued expansion, APT’s price is currently at its lowest valuation in four years. The post suggests that sentiment may recover soon.

Based on this, the post states that if the momentum holds, it could head towards $5-6 in the coming sessions. Moreover, if a similar price recovery is observed, as ICP recently demonstrated, prices could reach $8 to $10.

Underlying growth marks early stages of comeback

In another post, we highlight recent data that suggests APT’s fundamentals are strengthening at an alarming pace. Application revenue has been steadily increasing throughout the year, peaking in October and expected to hit a new all-time high by mid-November.

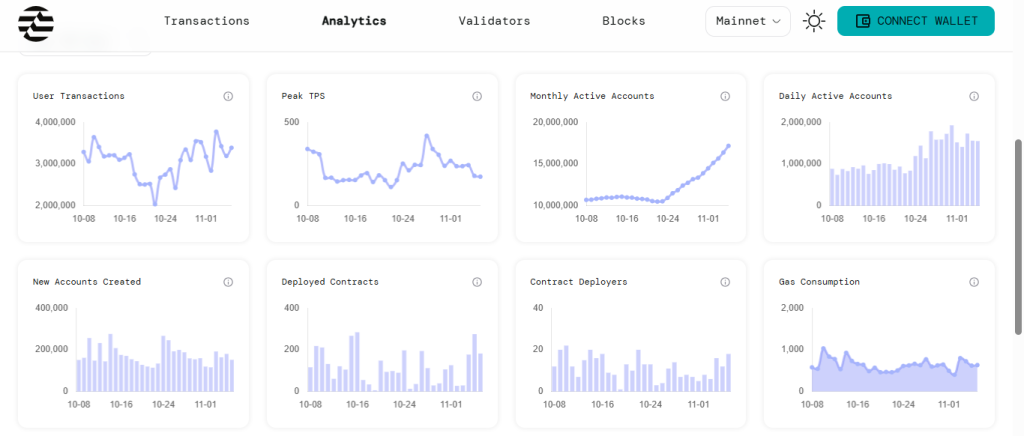

Meanwhile, other on-chain activity continues to grow, with user transactions increasing from 2 million to 3.3 million in the past 30 days.

Similarly, monthly active accounts jumped from 10.5 million to 17.17 million, indicating a significant increase in users. Additionally, daily active accounts remain over 1.5 million, reflecting strong network engagement.

This level of user activity is rarely seen in tokens that trade on a continuous downtrend over several months.

High TPS ranking strengthens long-term prospects

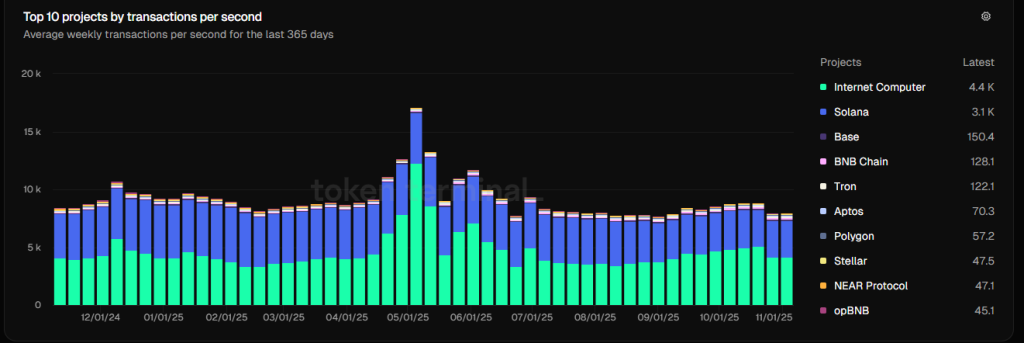

Additionally, Token Terminal data ranks Aptos among the top 10 blockchains in transactions per second (TPS). APT Crypto ranks 6th in the world at 74.1 TPS and is one of the most efficient smart contract platforms based on average weekly throughput over the past year.

This performance highlights why many believe the current Aptos price chart does not reflect the true strength of the project. High TPS, growing adoption, and growing revenue create an attractive backdrop for Aptos’ price forecast into 2025.

APT has stabilized around $2.50-$3.00, showing similarities to ICP before its explosive rally. Aptos Price Forecast 2025 suggests the market may be nearing a tipping point where fundamentals outweigh short-term sentiment.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.