As Bitcoin approaches the expiration date of key options, traders are closely monitoring market sentiments to measure potential price movements. With nearly $23 billion in public interest set to expire, the event could have a major impact on Bitcoin’s short-term trends. Despite the optimistic slope among traders, broader macroeconomic factors and market uncertainty continue to cast a shadow over clear directional bias.

-

With the approximately $22.6 billion Bitcoin options expire, they focus on the market on short-term price action.

-

Deribit dominates the options market, with bullish call options outweighing puts, signaling the optimism of popular traders.

-

The main support level of $112,000 is extremely important. Holding this above may prefer even more bullish momentum.

-

Market sentiment remains cautiously optimistic, but the release of macroeconomic data could shake up the outcome.

The expiration dates for the upcoming September Bitcoin options represent a crucial point for traders, with $22.6 billion settling scheduled for Friday. The event highlights the importance of the level of support at $117,000 following a recently observed rejection. As long as Bitcoin is maintained above $112,000, the bullish strategy appears to be in a better position, although it remains a drawback in the uncertainty of the negative economy.

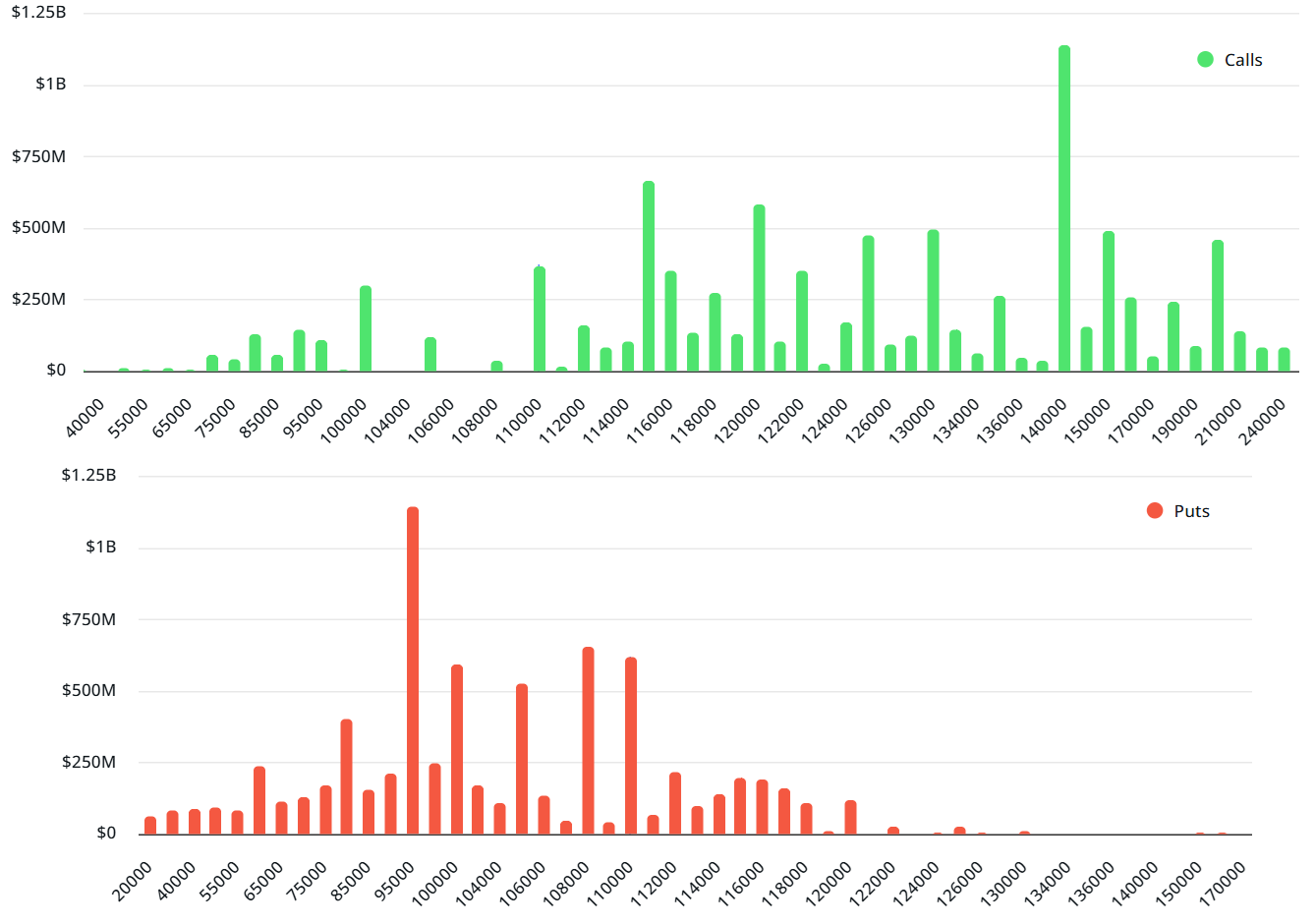

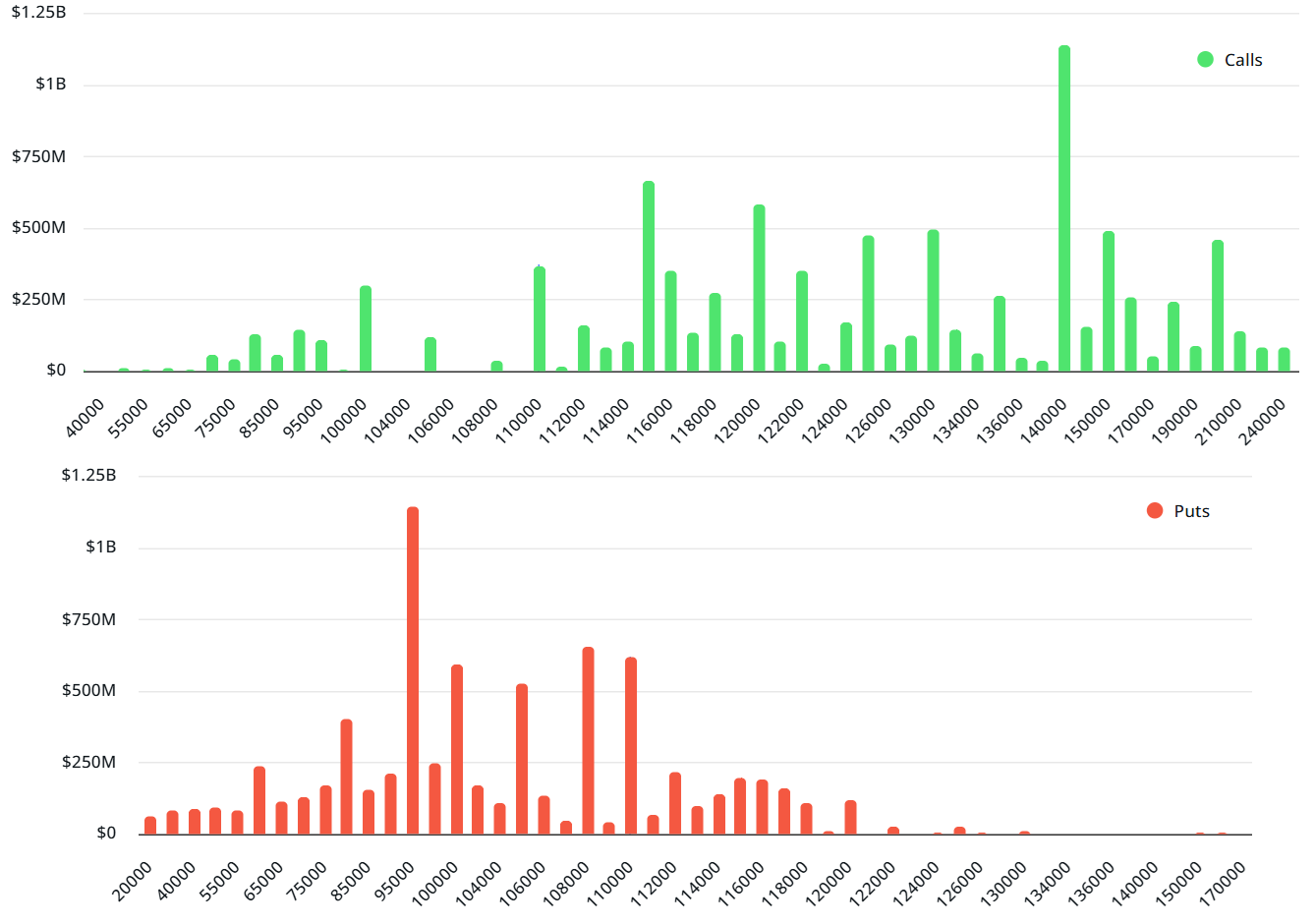

DeRibit continues to lead the market with $17.4 billion open profits against Bitcoin options on Friday, followed by OKX and CME, which host approximately $1.9 billion each. The prevalence of call options highlights the continued optimism of traders about Bitcoin’s upcoming outlook.

Neutral to fierce demand for Bitcoin locations dominates

The September expiration date remains at around $12.6 billion in total, with open interest in the PUT option remaining about 20% lower than the call option. The ultimate result is on the price of Bitcoin at UTC at 8am on Friday. Especially if it exceeds the critical $112,000 threshold.

Traders’ positioning at Delibit shows that BETs aiming for a level of between $95,000 and $110,000 is declining, indicating that the most open interest rate is above $120,000. Approximately $6.6 billion worth of call options stacked up at over $120,000, with just $3.3 billion realistic plays at these levels. Meanwhile, 81% of put options are set below $110,000, bringing just $1.4 billion on active contracts.

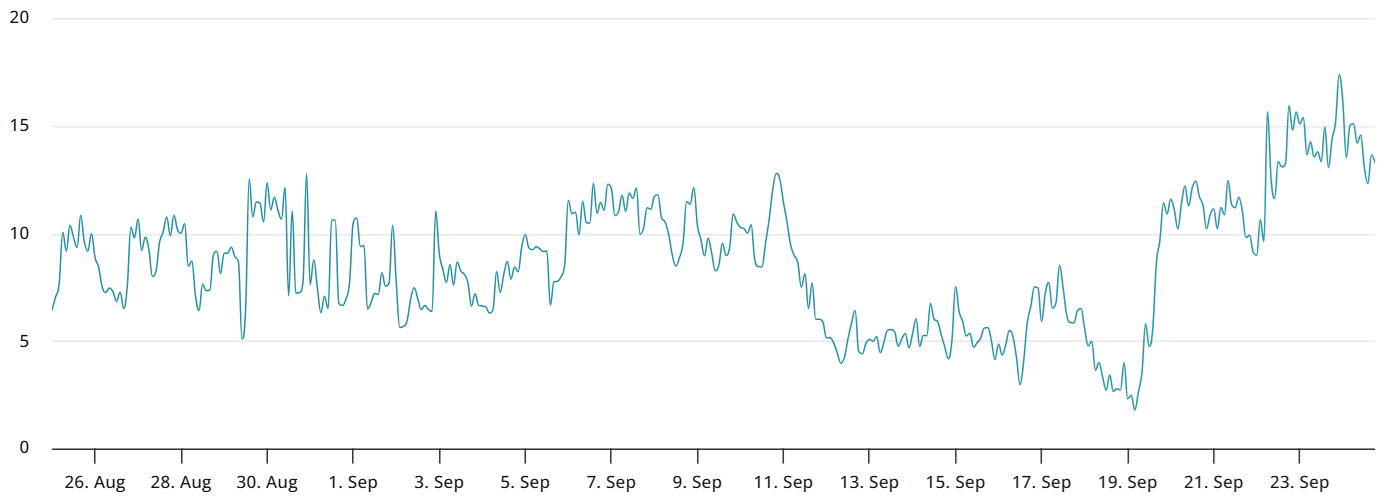

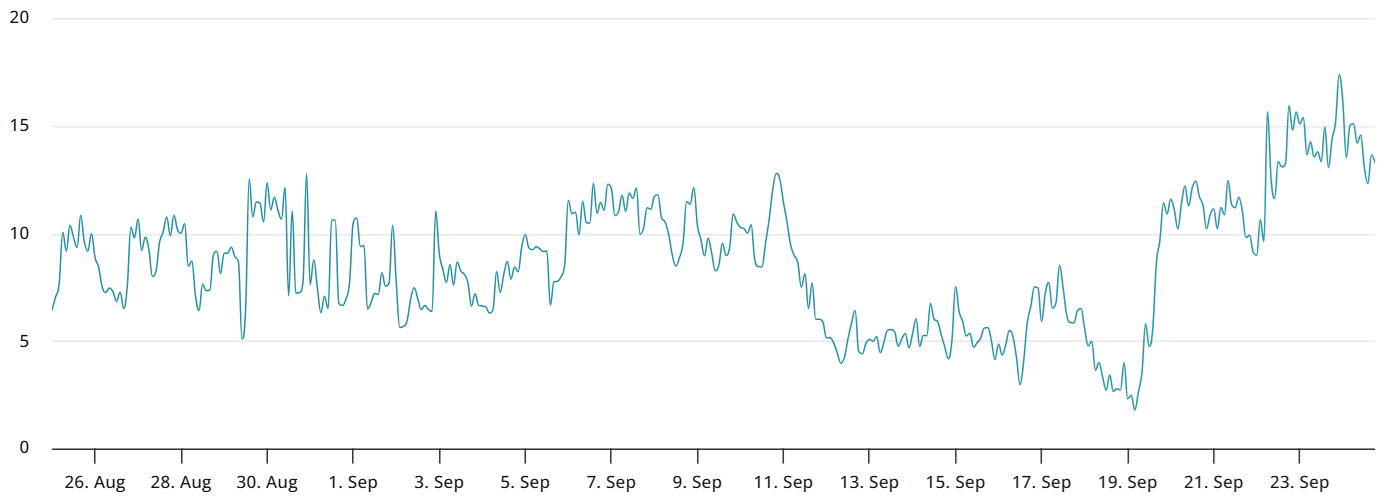

Market sentiment also reflects careful optimism, as demonstrated by options skew metrics. A 13% medium fear indicator shows that traders and market makers rely on potential negative risks at current levels despite bullish leaps.

Going forward, three scenarios based on current trading levels highlight the importance of $112,000 in support. If Bitcoin is trading between $107,000 and $110,000, traders believe they are leaning towards puts, with another $2 billion option betting even more upwards. Conversely, call options over $112,000 will be prioritized, providing a more bullish outlook. The market expects future macroeconomic data, including US GDP figures and employment reports, will affect trader sentiment and potentially change current outlook.

Despite concerns about a vulnerable economic background, measures such as potential interest rate reductions by the Federal Reserve could strengthen risky assets, including cryptocurrencies. However, lingering concerns about the labor market further increase market volatility and underscore the need for careful optimism as options closes expiration dates. The odds now support bullish results, but traders must remain vigilant about possible declines below $112,000.

This article is for informational purposes only and should not be considered financial or investment advice. The views expressed are those of the authors and do not necessarily reflect the opinions of the publication.