Bitmine bought Ethereum (ETH) on the downtrend amid growing concerns of further capitulation. Amid the recent market correction, Bitmine has purchased $300 million worth of Ether since last week, according to Arcam’s on-chain data analysis.

BitMine leads Ethereum’s high demand

After its latest acquisition, BitMine currently holds approximately $12.4 billion worth of Ether as of this writing. The company’s ether accumulation coincides with increasing demand for altcoins by institutional investors.

According to CoinShares’ weekly report, Ethereum investment products recorded a net cash flow of approximately $57.6 million. Meanwhile, at least 15 entities hold 4.75 million ETH in treasury management led by BitMine and SharpLink.

Is ETH Price Ready for a Bull Market Rise in 2025?

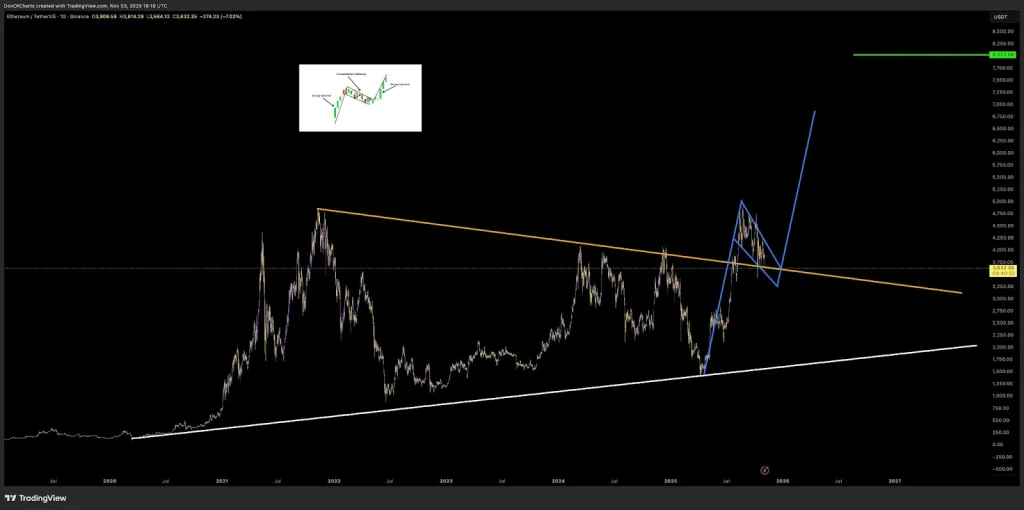

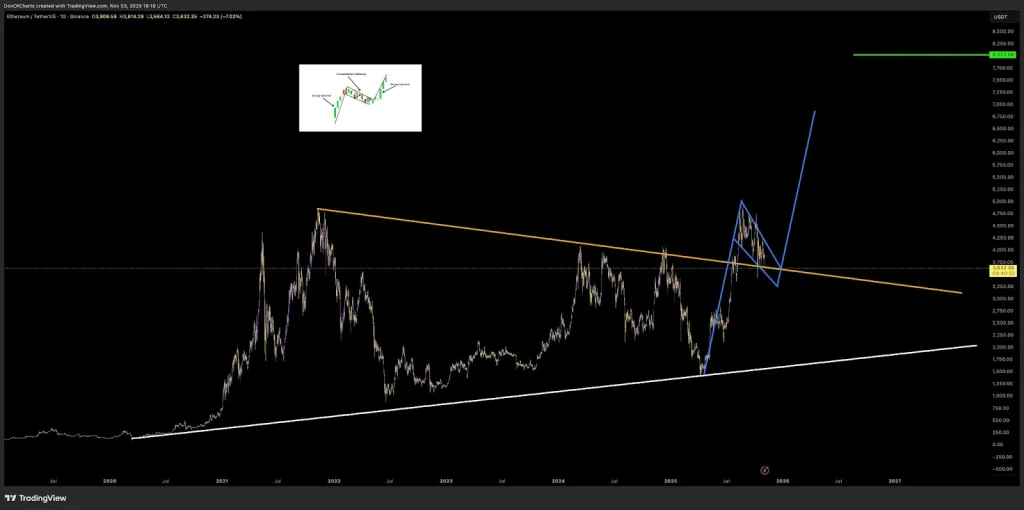

From a technical analysis perspective, it is clear that Ether price is in the early stages of a macro bull market. The large-cap altcoin has a fully diluted valuation of approximately $434 billion and is retesting a bullish breakout from a key multi-year resistance level near $3.6 million.

Source:X

As long as Ether price remains above the $3,000 support level, it could potentially reverse towards new all-time highs in the coming days. The bullish outlook over the medium term is fueled by growing concerns about a decline in cryptocurrencies amid notable deleveraging among long traders.

Additionally, crypto markets often tend to move in the opposite direction of crowd sentiment. Meanwhile, Bitcoin OG whales, which have been successful in recent trades including the recent crypto crash, have snapped up BTC and Ether for $37 million and $18 million, respectively.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.