crypto news

Key points:

- Bitcoin is coming off a red October for the first time in seven years and is gearing up for a green November.

- Key catalysts for the fourth quarter bull market include the FOMC’s recent tax rate cuts, increased implementation rates, and SEC approval of the ETF listing.

- Arthur Hayes announced that QT could end after Chairman Jerome Powell said the central bank could “stop shrinking its balance sheet”.

- Presale for Bitcoin Hyper ($HYPER) reaches $25.5 million as it promises a faster, cheaper, and more scalable Bitcoin network.

Bitcoin ended October in the red heading into November, the richest month in history.

DollarBitcoin has already defied expectations by acquiring the red color for October, making this the third time in history, excluding 2014 and 2018. The 2025 performance would end a six-year rally that saw Bitcoin rise between 5.56% and 39.93% in October since 2019.

Red October will reset the entire market and force a clean outlook into the fourth quarter of 2025.

So what should you expect?

Based on Bitcoin’s monthly returns, November will likely turn green and could lead to big gains if momentum pushes BTC$ above $120,000.

All the catalysts seem to be in place. The race for gold is taking on new dimensions this year as the Fed cuts taxes by another 25 points and adoption rates increase.

Then there is Bitcoin Hyper ($HYPER). This is Bitcoin’s next layer 2 solution to the network’s most pressing problem: performance limitations.

Bitcoin price prediction for November

The most realistic price prediction for Bitcoin is that the token is expected to exceed $130,000 by the end of November. This is likely a price target given Bitcoin’s performance over the past four quarters, especially over the past two years when both October and November were green.

But so far, all bullish predictions seem to have come true when it comes to Bitcoin, but what are the chances of this prediction happening?

Analysts at TD Cowen follow the same line of thinking, citing Bitcoin’s resilience after the October 10 market crash as the main driver. In their view, Bitcoin is likely to reach $141,000 by December, which will set a new ATH.

The circumstances also seem to support this result. After Chairman Powell signaled an end to quantitative tightening (QT) in the banking sector, Arthur Hayes made this very point with the unambiguous “buy everything” phrase.

Conversely, quantitative easing (QE) causes banks to pump more cash into the economy, directly benefiting the crypto space. More available capital equals more purchases.

Ending QT would dovetail very well with ending the Senate filibuster rule to overturn government shutdowns. This is a necessary step for the SEC to greenlight many crypto ETFs currently on standby. Trump himself called this out in a recent Truth Social Post.

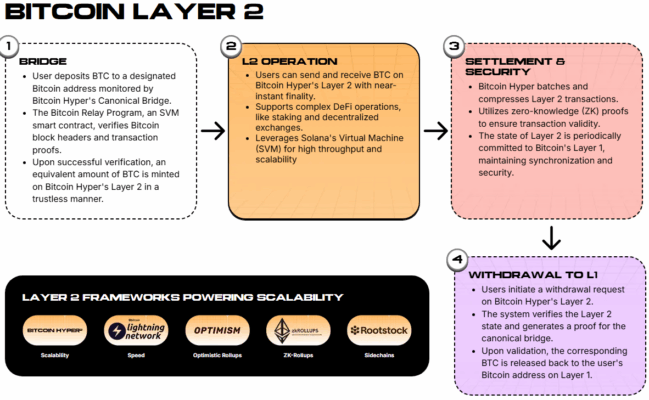

Finally, there is the Bitcoin Hyper ($HYPER) presale. It promises to make the Bitcoin network faster, cheaper, and more scalable using tools such as SVM and Canonical Bridge.

How Bitcoin Hyper plans to lift Bitcoin’s performance limits

The Bitcoin network is natively limited to 7 transactions per second (TTS), which impacts finality time, cost, and scalability. Bitcoin Hyper ($HYPER) aims to change this with tools such as Solana Virtual Machine (SVM) and Canonical Bridge.

SVM brings Solana’s performance to the Bitcoin ecosystem, enabling ultra-fast execution of smart contracts and DeFi apps. This upgrades your network’s performance to Solana-grade numbers.

Canonical Bridge addresses Bitcoin’s limited TPS, which currently ranks 26th on the list of fastest blockchains. Bridges create hyper-ecosystems

The Bitcoin network tracks incoming transactions and mints users’ $BTC into the hyperlayer.

The Bitcoin Relay program verifies transaction details almost instantly, so the entire process is completed in seconds. Wrapped Bitcoins can be used immediately and remain in the hyper layer until you decide to withdraw them to the Bitcoin network.

These tools allow the hyper layer to transform Bitcoin in terms of performance, transaction costs, and overall scalability. That means finality times of seconds instead of hours, significantly lower transaction fees, and the virtually infinite scalability of Bitcoin that is institutionally possible.

Presale increased by $25.5 million and $HYPER remained at $0.013205.

The project has attracted a lot of attention, with investors flocking to it, drawn by Hyper’s promise, extensive whitepaper detailing its roadmap, and $HYPER’s long-term potential.

Hyper’s release window is planned from Q4 2025 to Q1 2026, so the window of opportunity is closing quickly. If you want to invest, the sooner the better.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this page. Readers are encouraged to conduct their own research before taking any cryptocurrency-related action. Coindoo shall not be responsible or liable, directly or indirectly, for any damage or loss arising from use of or reliance on any content, goods or services mentioned. Always do your own research.