Bitcoin remains in a critical period, with traders waiting for the week’s close. A key support level is looming, and market sentiment is divided on whether the cryptocurrency can maintain its current bullish momentum. As macroeconomic factors and technological signals intertwine, renewed optimism hinges on progress in US political negotiations and positive developments in global trade policy.

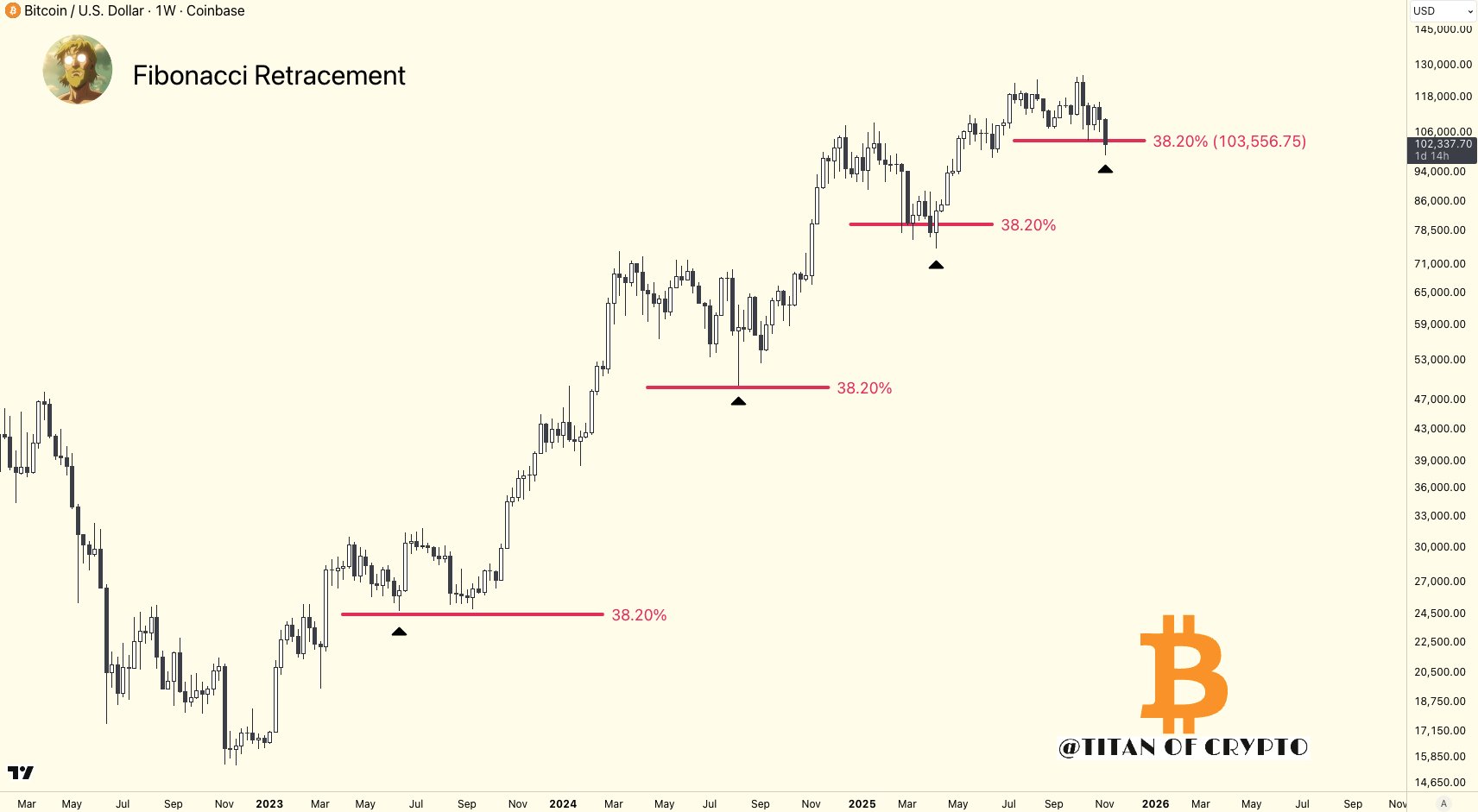

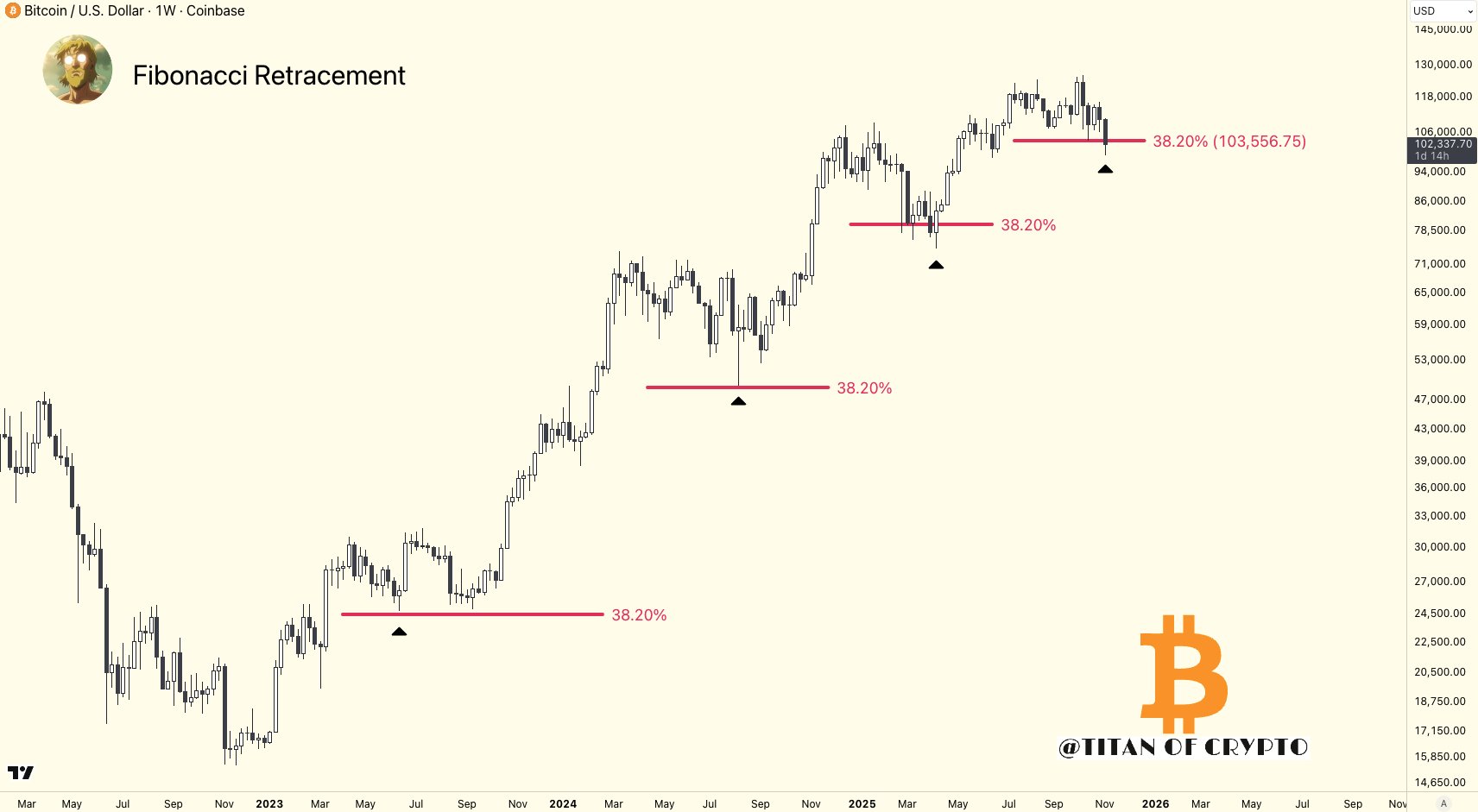

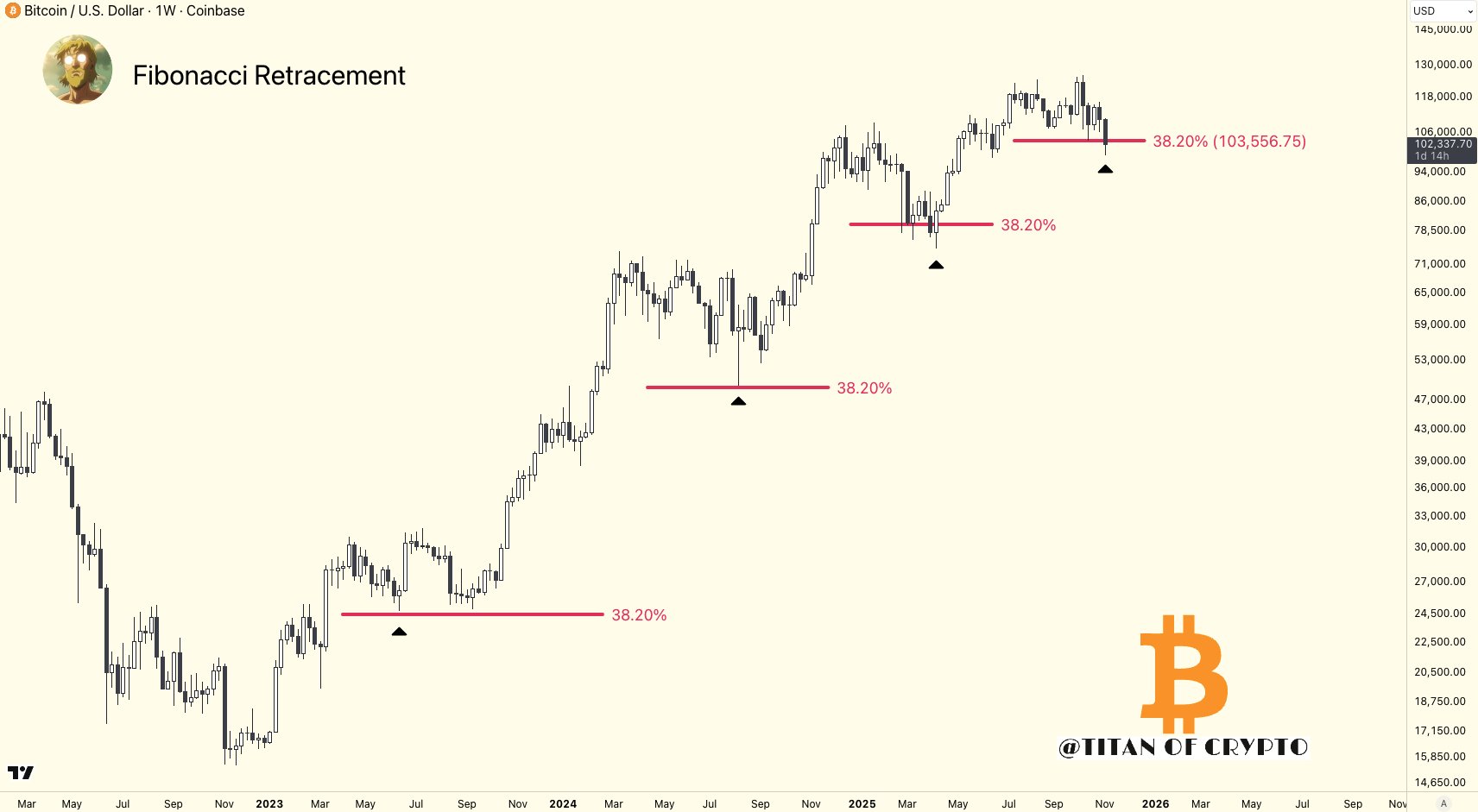

- Bitcoin is nearing an important weekly close, with an important threshold based on the Fibonacci retracement level at $103,500.

- Market experts warn that while the outlook remains optimistic, a weekly close below key support could signal the end of the recent bull run.

- Hopes for a market boost are tied to a possible resolution to the U.S. government shutdown and possible easing of international trade tariffs.

Bitcoin (BTC) is trading within a tight range as traders focus on the key weekly close, with $100,000 acting as a psychological and technical support level. Market volatility has been low over the weekend, with investors watching closely to see how the weekly candlesticks shape over the next few days.

BTC Price Countdown to Key Weekly Close

Data from Markets Pro and TradingView reveals subdued price movements ahead of the weekly important settlement. The key focus remains whether Bitcoin can close above the $103,500 level, a mark rooted in Fibonacci retracement analysis, which could sustain the ongoing bullish cycle.

Crypto trader Titan emphasized the importance of the $103,500 threshold, posting on X, “This week’s key level: $103,500,” emphasizing that its basis is the Fibonacci level. A weekly close below this could signal the end of the current bull market, he said, but “next week’s breakdown would indicate the bull market is likely over. We’re not there yet.”

Meanwhile, the 50-week exponential moving average (EMA) located at $100,940 is considered a key indicator of strength. Traders have warned that a close below this level could undermine the current bullish outlook, with Max Crypto noting: “We absolutely do not want the week to close below this level.”

On the technical side, we are approaching a “death cross” where the 50-day SMA falls below the 200-day SMA, raising concerns among analysts like Superbro, who recall past instances of this pattern leading to market bottoms.

“We are approaching the fourth ‘death cross’ of the bull cycle. Each time we see a reversion to the mean and a sustained bottom,” he said. “So far, however, the response at the 365 SMA has been lukewarm. Let’s see if the bulls can rebound and reclaim Q3 lows towards the week’s close.”

Market outlook depends on US political developments

Beyond technical analysis, broader market sentiment is influenced by potential macroeconomic developments. Expectations are high over a resolution to the ongoing U.S. government shutdown, with hopes that the deal could spark broader market expansion.

Additionally, many believe that the upcoming Supreme Court ruling could eliminate international trade tariffs, which could immediately boost stock prices and, in turn, benefit the crypto market.

Cryptocurrency analyst Kass Abbe suggested in X that the phase of market manipulation may be nearing an end, suggesting that Bitcoin could skyrocket once the shutdown ends.

However, some analysts remain cautious. Cryptocurrency investor Ted Pillows warns that if market expectations don’t materialize soon, Bitcoin could test low levels again, especially as large whales and institutional investors continue to outflow.

“Bitcoin continues to consolidate around $102,000. The market expected the shutdown to end this weekend, but that didn’t happen,” he said, adding, “Given the decline in institutional demand and the selling off of OG whales, we still think Bitcoin could fall a little further.”

As whale activity continues, overall sentiment suggests continued volatility, highlighting the importance of macroeconomic factors and political developments in shaping the future of crypto markets.

This article does not contain investment advice or recommendations. All investment and trading moves involve risk and readers should conduct their own research before making any decisions.