Bitcoin (BTC) is in a volatile phase Psychological level below $100,000 That’s because the supply of profits has just plummeted to a new low in 2025. Amid this decline, Glassnode analysts Chris Beamish, Antoine Colpaert, and CryptoVizArt said: highlights Structural vulnerabilities, cautious investor behavior, and declining institutional demand are intertwined. Bitcoin is also oversold;However, complete surrender has not yet been reached. This suggests that prices are fragile but not broken, with a balance between recovery and the risk of further decline.

Collapse in Bitcoin supply returns signals weak demand and price

Profit from Bitcoin supply has fallen significantly, reaching its lowest level in 2025, reflecting a broader slowdown in market momentum. Glassnode analysts say this decline is indicative of a decline in demand. sustained selling pressure BTC price has stabilized around $100,000 after falling 21% from its all-time high of over $126,000.

Related books

According to the report, about 71% of Bitcoin’s supply remains profitable, near the lower end of the typical 70% to 90% range seen during mid-cycle economic slowdowns. This decline represents the lowest probability level this year; BTC price stability and recovery That could depend on whether new demand returns to the market in the coming weeks.

The analysis also revealed that Bitcoin fell below the threshold. Cost basis for short-term holders It is currently struggling to recover, confirming that the initial bullish phase is over. They say the market has not been able to regain firm footing since the war. Flash Crash and Reset on October 10ththe price remains slightly above the $88,500 realized price by active investors.

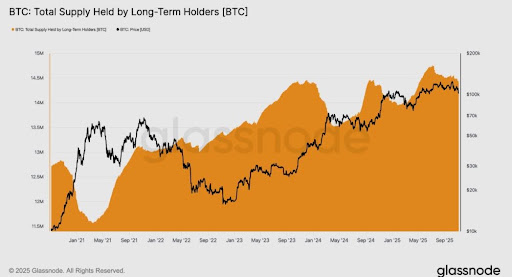

Additionally, on-chain data shows that long-term holders are contributing to profits. bearish pressure. Since July, the total supply of Bitcoin has decreased from 14.7 million BTC to 14.4 million BTC, a net decrease of about 300,000 coins. Glassnode analysts estimate that approximately 2.4 million BTC was spent during this period, which is approximately 12% of BTC. circulating supply.

Unlike earlier in the market cycle, these long-term holders are now sell one’s weaknesses Rather than strength, it shows fatigue and declining sentiment, likely due to a consistent market decline. Relative unrealized losses remain modest at 3.1%, but Glassnode analysts highlight a combination of lower profitability and stable profitability. long term distribution Bitcoin price is in a fragile situation near $100,000.

Related books

ETF outflows and volatile derivatives raise market caution

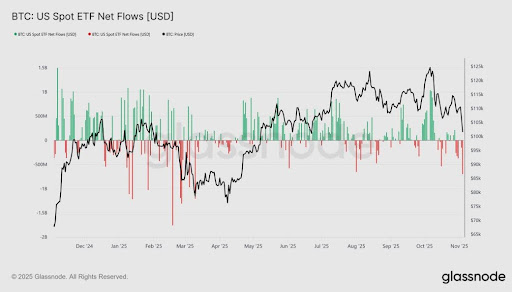

In addition to the decline in Bitcoin supply, off-chain indicators are also showing alarm. Glassnode analysts point out: US Spot Bitcoin ETF The past two weeks have seen net outflows of $150 million to $700 million per day, reversing the positive situation. Continuous inflow since September And in early October. This slowdown reflects a significant decline in institutional investor appetite, with funds flowing out of Bitcoin exposure as prices fall.

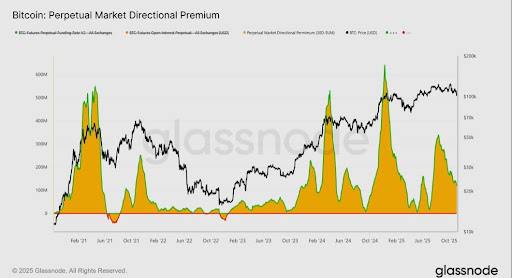

Bitcoin’s cumulative volume delta (CVD) also turned negative on Binance and major exchanges. in derivativesAnalysts noted that the permanent market-oriented premium decreased from $338 million in April to $118 million per month, indicating traders are becoming more risk-averse. Avoid aggressive long positions.

At the moment, Bitcoin is in a delicate position as it is oversold. structurally intact. Experts at Glassnode say the next key test lies at $112,000 and $113,000, and while a sustained recovery would indicate renewed demand, further declines are possible. deepen the correction.

Featured image created by Dall.E, chart on Tradingview.com