Simply put

- Crypto Market is poised to close the greens in September as Bitcoin gathers over $114,000.

- However, Altcoins like Ada and Doge are barely apart.

- Technical indicators and forecast market data diverge in near and long term market views.

The crypto market nurses another day of modest losses, but is modest enough to escape the seasonal curse of September.

Despite today’s Red Sea, despite 82% of the top 100 coins registered losses by market capitalization, they are poised to close in Green in September, with an average monthly gain of 2.7%. For those who are curious, removing Bitcoin from the equation: altcoin The market is still up about 0.7% that month. Not bad, everything is considered.

According to Coingecko, global cryptocurrencies currently have a market capitalization of $4 trillion, less than 1% in the last 24 hours. Bitcoin manages modest rebounds and currently trades over $114,400. Meanwhile, Ethereum itself climbed to about 1%, costing around $4,200. However, other well-known altcoins, such as Cardano and Dogecoins, are not as far apart.

As you zoom out, traditional markets show today’s mixed signals. The S&P 500 and NASDAQ recorded conservative profits as investors consume revenue reports from tech giants. However, actual behavior is happening in the commodity market. Gold is trading at $3,822 per ounce after climbing 0.07% of the day. The strength of precious metals reflects on continuing concerns about Middle Eastern inflation, tariff policies and tensions that raise oil prices.

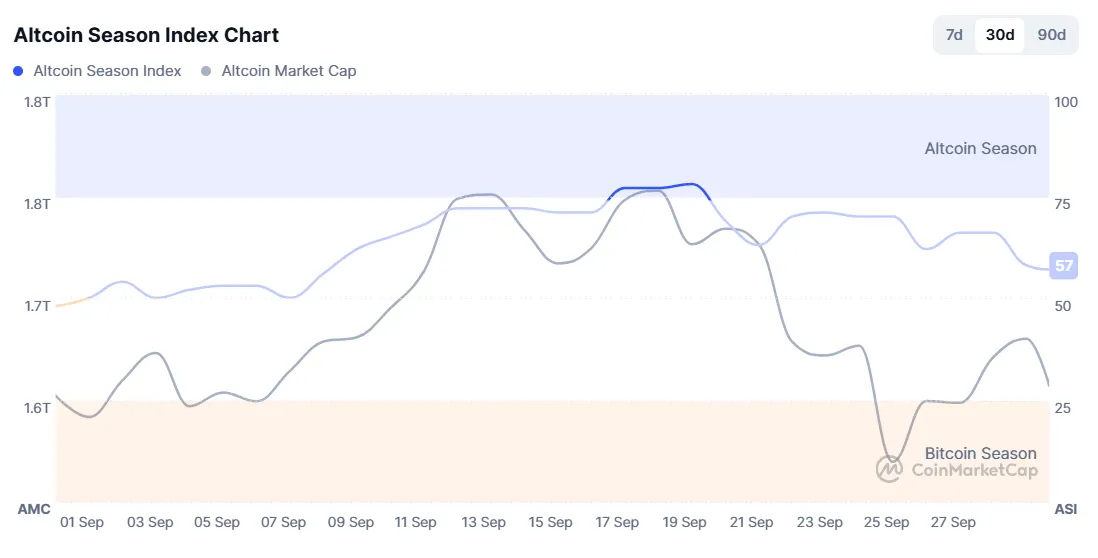

The correlation between Crypto Market and traditional risk assets remains the same, but it has a twist. Bitcoin works more and more like digital gold during market stress, but Altcoins are spinning to relative safety. The Altcoin Season Index, which measures the strength of crypto assets against Bitcoin, has plummeted from 77 to 58 points in the past week, indicating that traders are either fleeing to Bitcoin or leaving the market for good.

Bitcoin (BTC) Price: Market Leader Holds Line

Bitcoin continues to show significant resilience, trading above $114,000, nearly 1% in nearly a day despite the weaker markets in the wider market. The flagship cryptocurrency was entered as what Bitfinex analysts describe as the “cooling stage.”

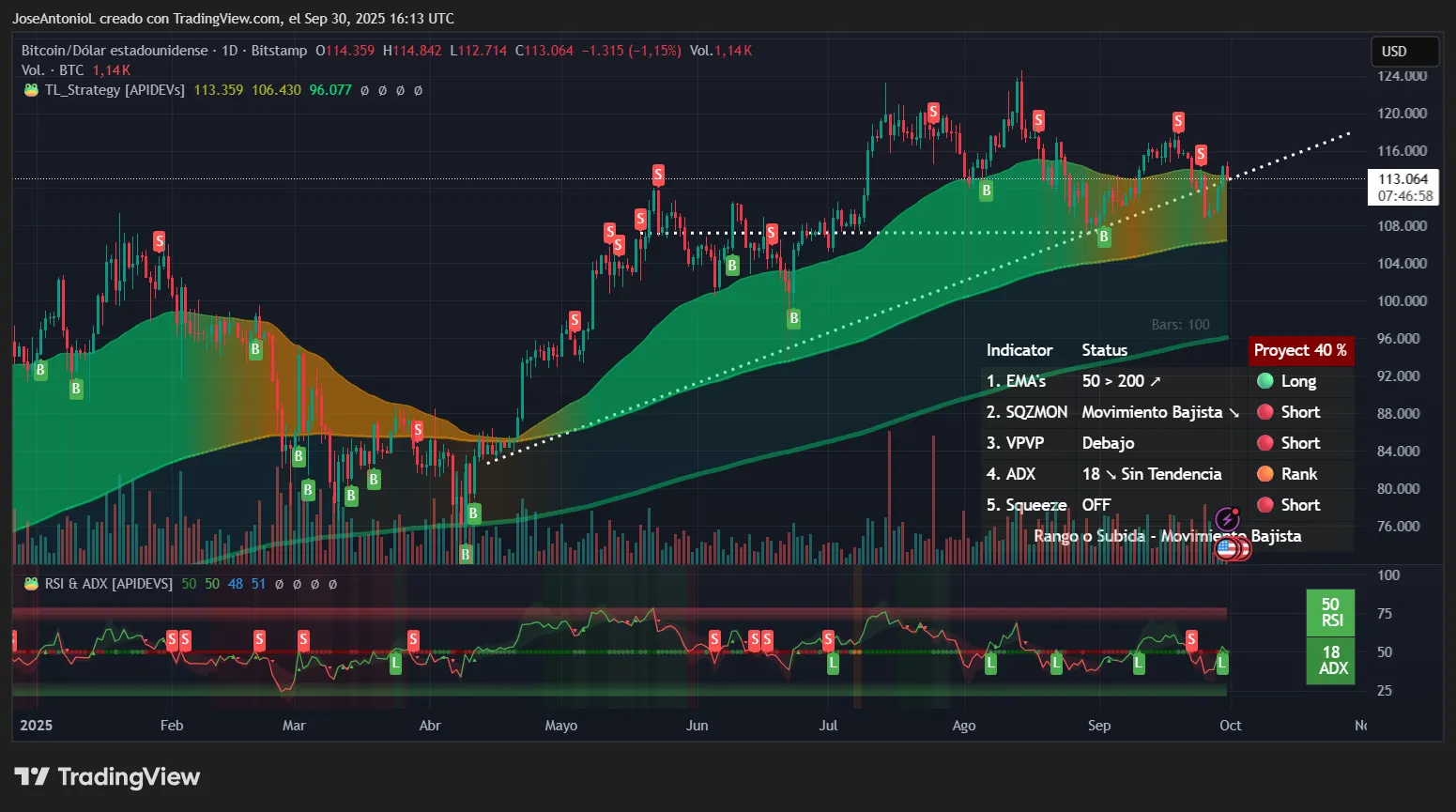

The technical photos show that Bitcoin maintains a golden cross-formation. There, the 50-day moving average (EMA50) is comfortable on the 200-day line (EMA200). In other words, the average price of Bitcoin for the short term is trading higher than the average price in the long term. It is a traditionally bullish composition, suggesting that medium-term trends remain intact.

However, momentum indicators tell a more nuanced story. Traders use squeeze momentum indicators to indicate the type of market stage in which the current asset is currently trading. This indicator flips the bearish and, when combined with other weak signals, marks a short-term shift that often precedes deeper corrections.

Bitcoin’s average directional index (ADX) is well below the 25 threshold that traders use to confirm a strong trend establishment. Think of ADX as a trend intensity meter: measurements below 20 readings indicate directional trades that are uncontrollable, neither the bull nor the bear. Bitcoin’s weak ADX reading means lacking the belief that the market will be critically high or low, and is vulnerable to external shocks from macroeconomic events and regulatory developments.

At these moments, traders often choose to set up take probit or stop loss calculations in for-profit jobs, as markets under these conditions tend to have many bounces within certain levels of support and resistance. For Bitcoin, the range is currently within $100,000 to $118,000.

Bitcoin’s relative strength index (RSI) is currently around 50. RSI measures momentum on a scale of 0 to 100. A score of 50 indicates a balanced market that seeks to digest just how powerful this multi-month correction is. But the combination of weak trend strength and bearish squeeze momentum creates a waiting environment where traders are content to consolidate profits from the start of the year before Bitcoin commits to fresh capital.

From an emotional perspective, forecast market data reflects the short-term bearish found on the charts. Traders at Myriad, a forecast market run by Decrypt’s parent company Dastan, are hoping for even more red candles on the Bitcoin chart by tomorrow afternoon, bringing their odds to 74%.

Myriad traders are currently split in the next direction of Bitcoin, with a 53% odds upwards towards $125,000 (a new all-time high) and a 47% odds back to $105,000. For the sake of context, countless traders are far more bullish on gold at the moment, with precious metals putting their odds at 70% for the rest of 2025, with the digital counterparts.

Key level:

- Immediate Support: $109,000 (Recent Integrated Zones)

- Strong support: $106,000 (Psychological level and concentration of options)

- Immediate Resistance: $116,000 (Recent Rejection Points)

- Strong resistance: $120,000 (the best ever approach to territory)

Cardano (ADA) Price: Long-term bull meets short-term bears

According to Charts, Cardano, an ETH competitor developed by Ethereum co-founder Charles Hoskinson, finds himself in an interesting position today.

Tokens as Traders as ADA are down around 1% today, just above $0.80. This alone is enough for a market capitalization of $29 billion, but it’s down about 74% from the all-time high of $3.09 four years ago.

Still, for Ada Bulls, long-term structure continues to be encouraging.

Cardano’s 50-day EMA is on top of the 200-day EMA and is in the formation of the “golden triangle” that traders love so much. However, the short-term momentum is soft and the gap between moving averages is closed, referring to the possibility of a future “mutual death.”

The Cross of Death is basically the opposite of Golden Cross. If your EMA50 is traded below EMA200, it usually means that the longer you hold, the more you lose. This is usually seen as a solid indicator of bearish trends, just as golden crosses are considered bullish for the same reasons.

The ADA’s RSI is 40 years old and is located in the bearish to neutral to neutral territory, and is consistent (if not panic). The 22 ADX is consistent with trades bound to a choppy range, highlighting the lack of a critical trend. The “off” status squeeze moment indicator shows bearish momentum, suggesting that a downward movement is already in progress, rather than wrapping it for a breakout.

The ADA prices were below the psychologically significant $0.80 today. The market appears to be bound to range between about $0.75 (support near the EMA200) and $0.85 (resistance near the EMA50). The Bulls must collect and hold over $0.80-$0.82 to bounce momentum. Otherwise, the tests remain on the table for between $0.75 and $0.76.

At the moment, countless traders are bullish, with the market set at 55%, with the ADA pumping up to $1 rather than dumping it to $0.60.

Key level:

- Immediate Support: $0.750 (under range)

- Immediate resistance: $0.809 (Today’s High)

- Strong resistance: $0.850 (range top)

Dogecoin (Doge) Price: Channel Support Testing During Play

OG meme coin Dogecoin also dropped to $0.227 today after opening at $0.235, and tested critical support within an otherwise constructive long-term setup. The daily range ($0.236 to $0.227 lower in height) is a clear indication of short-term debilitating after a major revision from mid-September.

Like the ADA, Doge enjoys 50 days of EMA on top of 200 days of EMA. Price Action tracks rising channels, and prices are currently hovering near the channel’s lower limit and EMA band. It’s plausible to hold that level and rebound to $0.24-0.26. Losing it will allow for a breakdown to $0.21-$0.22.

The RSI of 43 is neutral to barish, while the ADX of 17 indicates “no clear trends.” Conditions that punish breakout attempts and prefer tactics of range (purchases of support, selling of resistance). The squeeze momentum indicator reflects the ADA: embraces bearish momentum with the “off” of the aperture, meaning that a down move is in progress rather than a download.

Despite the short-term weakness, the basic background of Dogecoin has been greatly improved. Bloomberg analyst Eric Baltunas is confident that Dogcoin ETFs are approved by the end of the year, and has repeatedly opened the doors to pension funds and institutional portfolios to gain dog exposure through regulated investment vehicles.

We all know what the ETF did for Bitcoin and Ethereum. It is the new capital of billions of fresh capitals that played a key role in the multi-year bull market of crypto. Dogecoin owners will certainly wonder if they have enough left too.

Key level:

- Immediate Support: $0.227 (Psychological Channel Low Boundary and EMA200)

- Immediate resistance: $0.236 (Today’s High and EMA50)

- Next resistance: $0.25 (apparent zone, not strong, but still playing)

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.

Daily report Newsletter

Start daily with top news articles now. Plus original features, podcasts, videos and more.