- Bitcoin price drives medium-term sideways trend due to widening channel pattern.

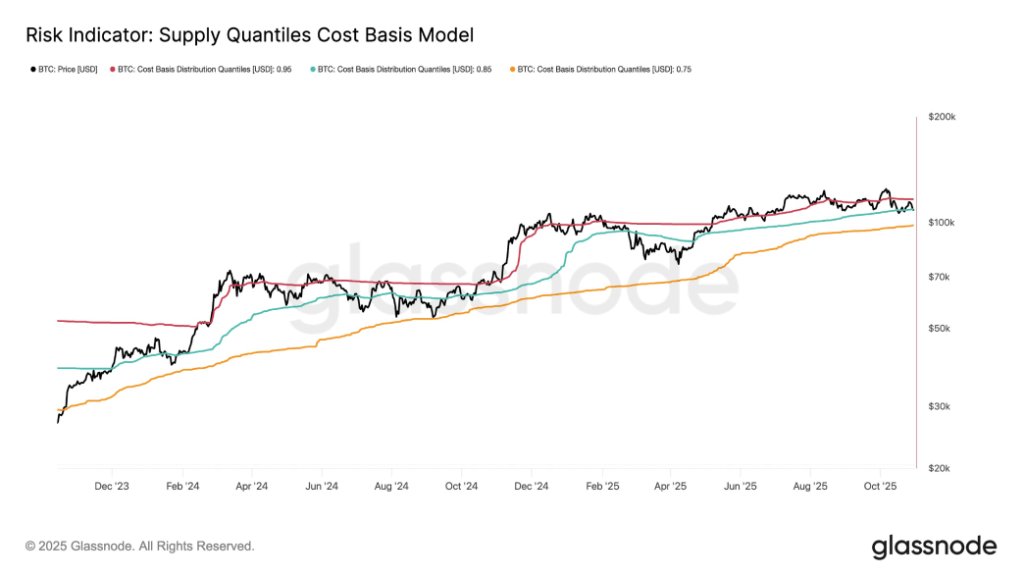

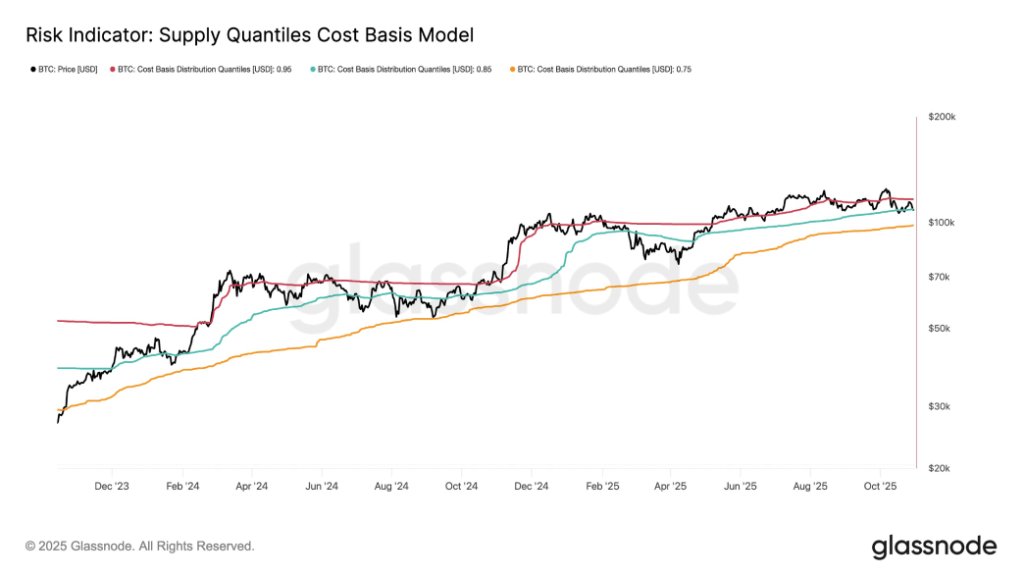

- BTC has returned to the 0.85 cost-based band around $109,000, an area that is historically considered an important pivot zone.

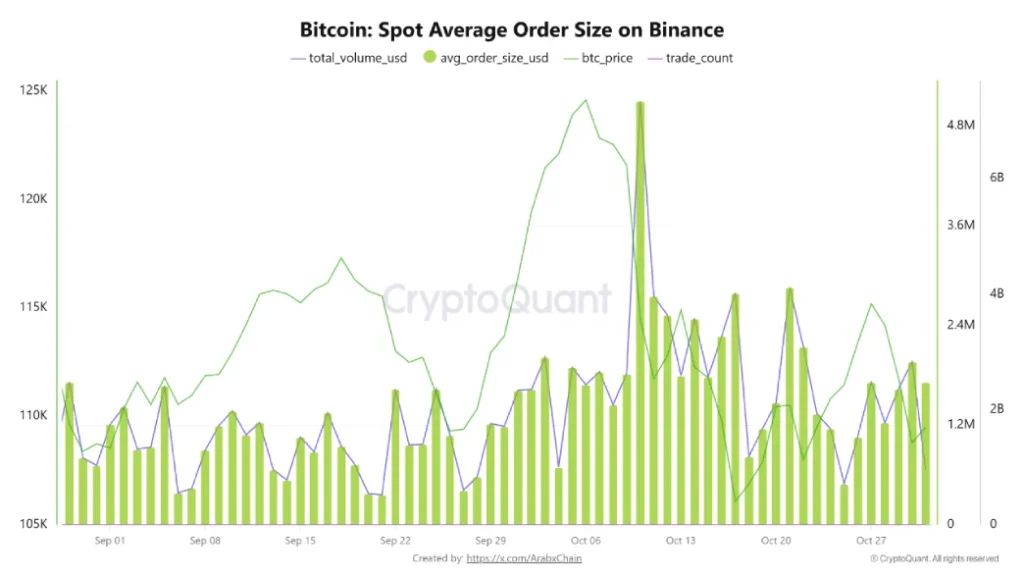

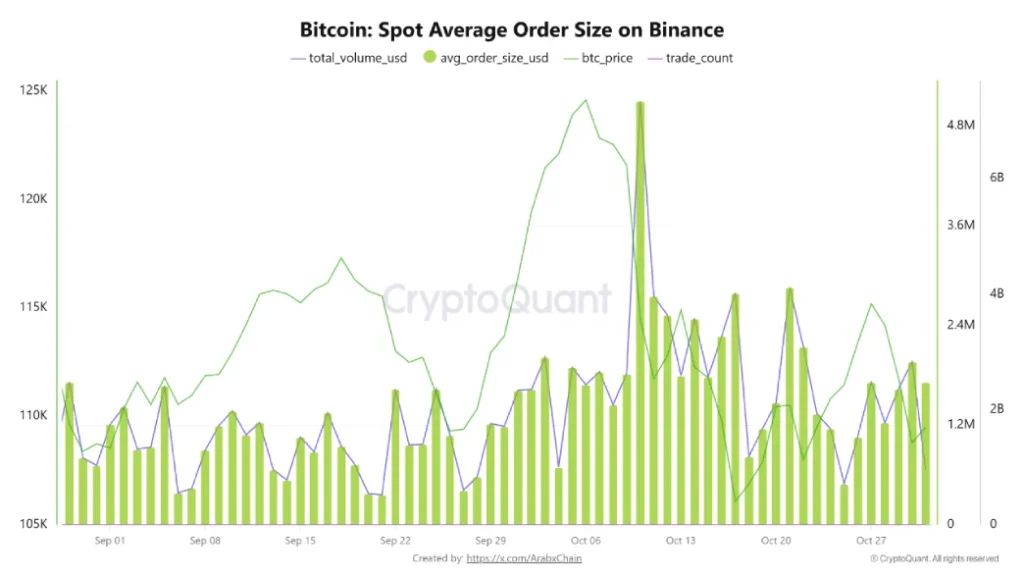

- October saw the highest average order size in recent months, indicating an increase in whale-driven trades.

Bitcoin, the pioneering cryptocurrency, rose nearly 1.5% on Friday to trade at $109,870. The buying pressure likely came as a relief rebound after a notable decline earlier this week. A long rejected wick attached to the daily candle indicates that the overhead supply is intact and the risk of further correction. While this downward trajectory is bound to cause concern among retail investors, large BTC holders continue to accumulate more coins, demonstrating confidence in a bullish rebound in the near future.

Whales step in as Bitcoin price tests $109,000 floor after October drop

October 2025 turned out to be an unexpected outlier for investors, shattering the historic optimism often associated with this month. Bitcoin price is currently trading at $109,476, with a market capitalization of $2.18 trillion, so Bitcoin price is on track to end October with a decline of 3.5%.

The price decline can be attributed to several factors, including the escalation of the geopolitical trade war, the historic crypto market deleveraging on October 10, technical failures, and the recent hawkish move by the Federal Reserve.

Following this correction, Bitcoin price retested the 0.85 cost-based band around $109,000, and this zone has repeatedly acted as a make-or-break level. If this level holds, the coin price could resume its bullish rise, as shared analysis from Glassnode data shows. However, a bearish breakdown below this floor could strengthen a prolonged correction to the 0.75 band around $98,000.

Bitcoin’s recent decline has brought it down to around $109,000, a major on-chain cost point. This area has historically been the hallmark of major changes in market cycles. According to data collected by Glassnode, this level belongs to the cost-based 0.85 band, which has historically separated periods of solid recovery from tighter corrections. There is a long history of the stock falling below the band and continuing to fall to the 0.75 level, or about $98,000.

Parallel market prices suggest increasing institutional investor participation throughout October. As measured by CryptoQuant analysts, the average spot trade size for Bitcoin on Binance spot trading pairs has increased dramatically to approximately $1.96 million. This number is one of the highest in recent months and shows that high-cap investors are taking more direct positions in the spot market.

Binance is also aware of this institutional bias, with total Bitcoin spot trading amounting to approximately $2.82 billion. An increase in both the size of trade and total flows means that larger firms are active, even though price fluctuations are suppressed.

Bitcoin price extends correction within channel pattern

This week, Bitcoin price showed a notable reversal from $116,381 to the current trading price of $109,502, marking a 5.91% loss. This decline highlights sellers’ belief in driving a long-term correction on the back of increasing red candlestick length and increasing trading volume. Even today’s green candlestick has a volume decrease of 8.86%, highlighting the weak hands of buyers.

Currently, BTC price is challenging the 200-day exponential moving average support and a potential collapse is looming. If materialized, the selling pressure will accelerate and push the price down another 5.3%, testing the lower trendline of the expansion channel at $102,560.

In theory, the chart pattern is characterized by two diverging trendlines, with greater price fluctuations from cycle to cycle, reflecting market uncertainty. A possible break below this level could further strengthen the bearish correction of prices below the $100,000 level.

On the contrary, if buyers can maintain support, Bitcoin price could recover again.

Also read: TON gains cross-chain connectivity and real-time data via Chainlink