Please participate telegram A channel that stays up to date to break news coverage

Bitcoin prices fell 1% to trade in the last 24 hours $114,437.94 Daily trading volume increased by 33% to $309.6 billion.

This fall in BTC prices comes despite Japan-based Metaplanet purchasing an additional 5,419 Bitcoin worth $632 million.

The buy pushed its total holdings to 25,500 BTC worth around $2.71 billion, and was bullish as Crypto’s fifth largest corporate holder.

Despite the recent market dip, Metaplanet says it is confident in the long-term potential of Bitcoin.

Metaplanet acquired 5419 BTC for ~$116,724 per Bitcoin for ~$632.53 million, achieving a BTC yield of 395.1% YTD 2025. $ BTC It was acquired for ~$106,065 per Bitcoin for ~$27.1 billion. $ mtplf pic.twitter.com/cbhzi2x9le

– Simon Gerovich (@gerovich) September 22, 2025

Meanwhile, strategy executive director Michael Saylor suggested that the company plans to buy more Bitcoin.

Despite facing challenges in the stock market, Saylor said buying DIPS in Bitcoin remains MicroStrategy’s main strategy.

Just In: Michael Saylor Posts Saylor Bitcoin Tracker, hinting at buying more BTC

“The orange dot is rising and it’s up to the right.” pic.twitter.com/ggzlkwgbh3

– Bitcoin Magazine (@bitcoinmagazine) September 21, 2025

Bitcoin Price: On-Chain Data Shows Strength Despite DIP

The decline in Bitcoin prices has led to increased activity on the blockchain. transaction As investors moved coins, the volume increased, some purchased dips, others sold to reduce risk after price increases. More Bitcoin left the exchange.

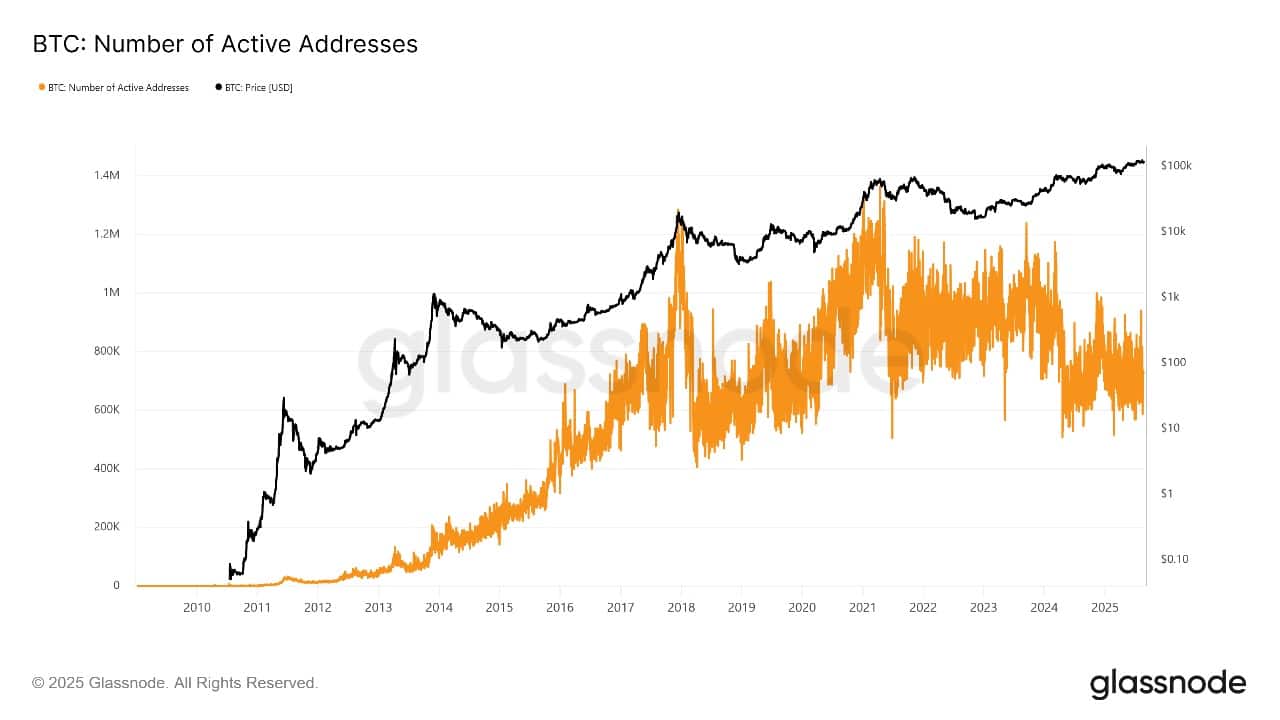

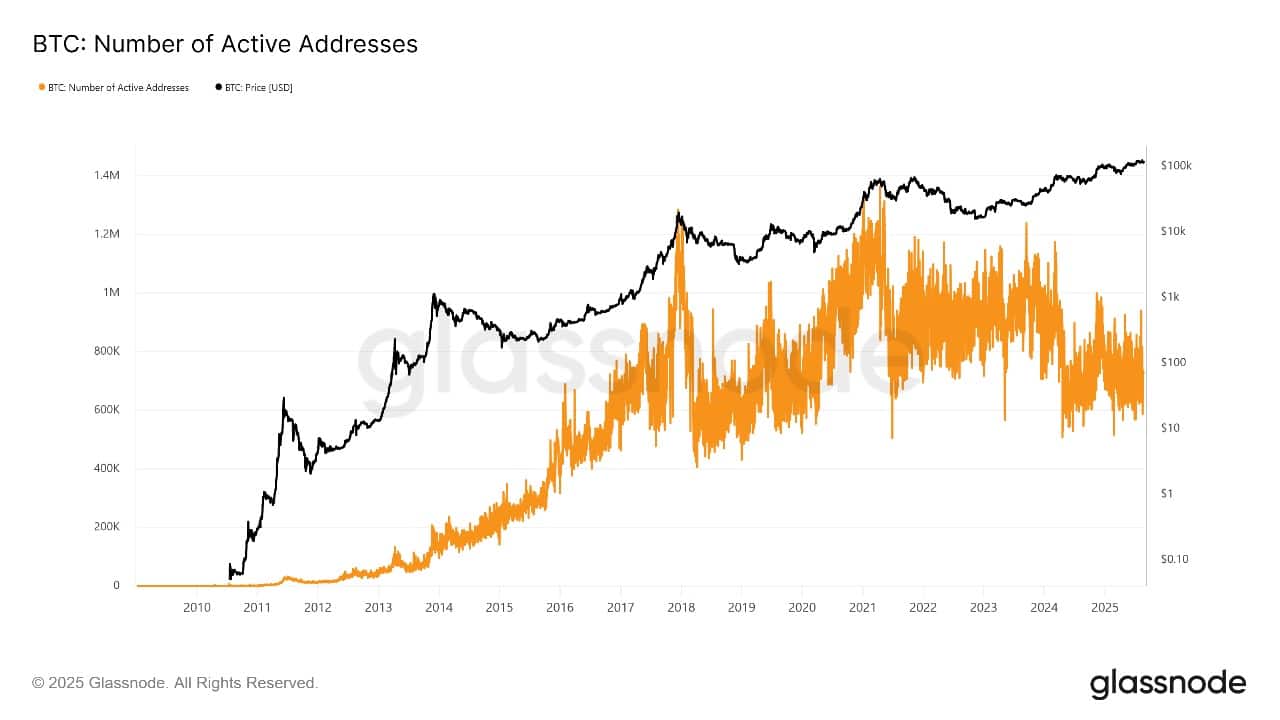

active Despite the price reductions, wallet count and network activity remained stable. The facility’s wallets were not reduced significantly. It suggests that if companies such as Metaplanet and Strategies continue to accumulate, the decline could be limited.

Bitcoin Active Address Source: GlassNode

Experts say the amount of Bitcoin stored from the exchange is close to the height of the cycle. This will reduce sales pressure and may prepare the market for gatherings when conditions improve. Sentiment data shows careful optimism, a typical pattern during price pullbacks.

Bitcoin pricing technology analysis shows support and recovery

On September 22, 2025, Bitcoin traded at nearly $114,546, falling about 0.67% in the past day. It has kept the important 50-day moving average (SMA) at $110,408, serving as support. The 200-day SMA, close to $83,398, is the next major support level for long-term buyers.

BTCUSD Analysis Source: TradingView

Bitcoin prices remain within the upward channel. Resistance is seen at close to $123,731. This is a key target if the Bulls regain their strength. The Relative Strength Index (RSI) covers about 52.3, showing neutral momentum and is not over-acquired or sold.

The MACD indicator shows the MACD line under the signal line with a negative histogram bar. This suggests that short-term bearish momentum could continue unless you buy a pressure shift.

If Bitcoin is held above the 50-day SMA, we expect a recovery. However, if you fall below this, you could potentially find your support at nearly $100,000. Traders look for signs of a reversal, such as a positive MACD cross-over or an increase in RSI.

In summary, the decline in Bitcoin is below $114,000. There are tips on major in-house purchases from Metaplanet and more purchases from Michael Saylor. On-chain data shows that the holders are almost stable, but technical indicators suggest that the market is seeking a bottom before a possible gathering.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage