Bitcoin (BTC)’s bearish start to November is not necessarily the end of a bull market. LMAX strategist Joel Krueger says Bitcoin prices could rebound after a six-year bearish close in October.

Krueger noted that the ongoing decline in Bitcoin prices is likely a pause, not a reversal. Additionally, Krueger noted that Bitcoin has been accumulating solid fundamentals amid a historically bullish fourth quarter.

Why is Krueger bullish on Bitcoin price when whale demand is low?

Bitcoin price slumps due to weak demand from whale investors

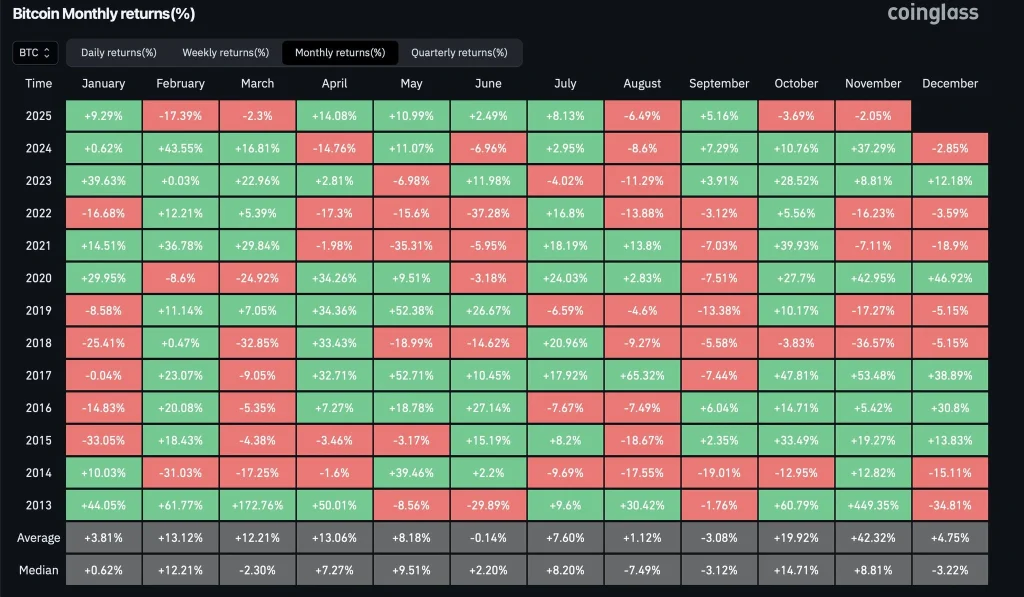

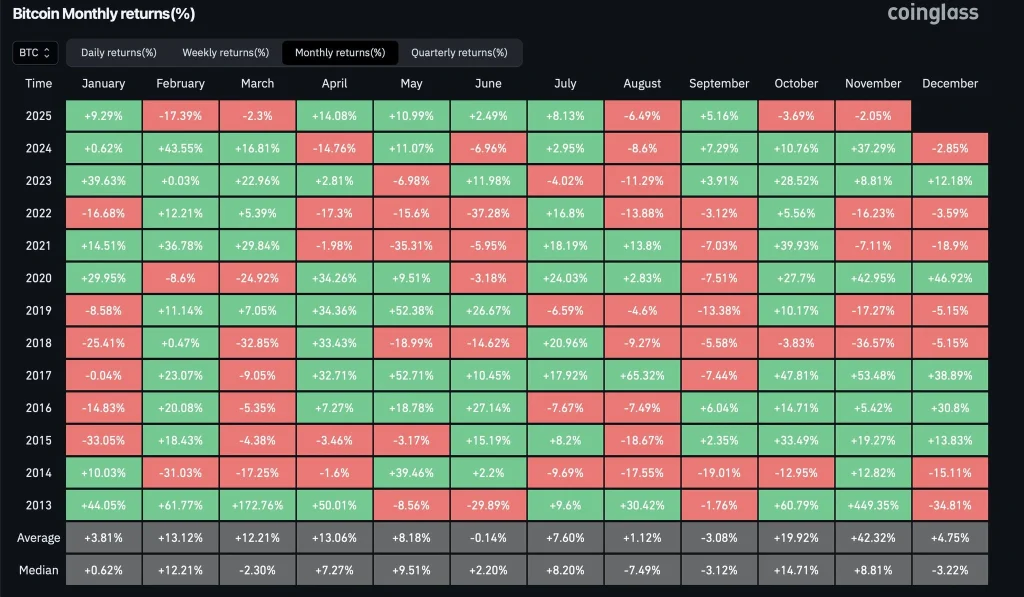

Bitcoin prices have been volatile amid growing concerns that the cryptocurrency will fall further after a bearish closing price in October. Bitcoin prices fell in October for the first time in six years.

Medium-term bearish sentiment is exaggerated by weak demand from investors. For example, CryptoQuant’s on-chain data analysis shows that long-term holders have offloaded over 400,000 BTC in the past 30 days.

Meanwhile, Bitcoin investment products recorded a net cash outflow of $946 million last week, according to CoinShares’ weekly report.

Technical tailwinds blow amidst strong fundamentals

Macro BTC price upward trend remains strong

From a technical analysis perspective, the BTC/USD pair is retesting the rising logarithmic support trend line. On a weekly time frame, the BTC/USD pair has not experienced the euphoria of previous bull markets since the bear market reversal.

So, as long as the BTC/USD pair stays above the weekly rising logarithmic support trend line, it is very likely that it will reverse towards new all-time highs by the end of this year.

Cumulative basics to consider

The Bitcoin market has accumulated solid fundamentals over the last year amidst a volatile consolidation. For example, this flagship coin has been adopted as a financial management tool by dozens of companies led by Michael Saylor’s strategy.

Bitcoin’s mainstream adoption has been strengthened by supportive regulatory frameworks in several major jurisdictions, led by the United States.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.