Please participate telegram A channel that stays up to date to break news coverage

Bitcoin prices traded at $113,437.94 at the time of EST, as daily trading volumes rose 1% in the last 24 hours, increasing by 45% to around $59 billion.

This jump at BTC prices comes after Bitcoin mining company Cleanspark was responsible for raising $100 million with Coinbase Prime and used some of its 13,000 BTC holdings as collateral. The company plans to use the funds to expand its Bitcoin mining, HPC and energy operations.

With $300 million in BTC-backed funding so far, CleanSpark has recently recorded record revenue of $198.6 million, mining 657 BTC in August, up 37.5% from last year. The company says the versatility of mining and computing overall will drive future growth.

CleanSpark $ clsk and $ COIN Sign a $100 million deal. 👀 pic.twitter.com/hnxgx4wwhz

– Cole Grinde (@grindeoptions) September 22, 2025

Meanwhile, Bitmex co-founder Arthur Hayes has reaffirmed its $250,000 Bitcoin price target and argues that institutional adoption, ETF momentum and central bank policies will encourage BTC’s next major gathering.

With Bitcoin trading exceeding $1.13 million, Hayes believes the market is on track due to his ambitious forecasts.

Bitcoin futures open interest hits record high

Open interest in Bitcoin futures has reached new highs, indicating strong growth in market activity. Coinglass data shows that open interest is over $100 billion as Bitcoin price trading exceeds $120,000. Both have been steadily rising since the second half of the third quarter, indicating a growing confidence among traders.

This surge in open interest means that more traders are entering the futures market, betting on the price movement of Bitcoin. It also reflects deeper liquidity and greater participation from both retail and institutional investors.

Open interest rates rise with prices often show stronger momentum, but sudden revisions can also lead to higher volatility.

Exchange BTC futures open interest: Coinglass

This trend underscores how important futures trading has become in shaping the price of Bitcoin. With more money flowing into derivatives, the futures market plays a bigger role than ever in fostering overall sentiment.

If this upward trend continues, Bitcoin can maintain its strong momentum. However, traders should be aware of potential risks, particularly big liquidation during sharp pullbacks.

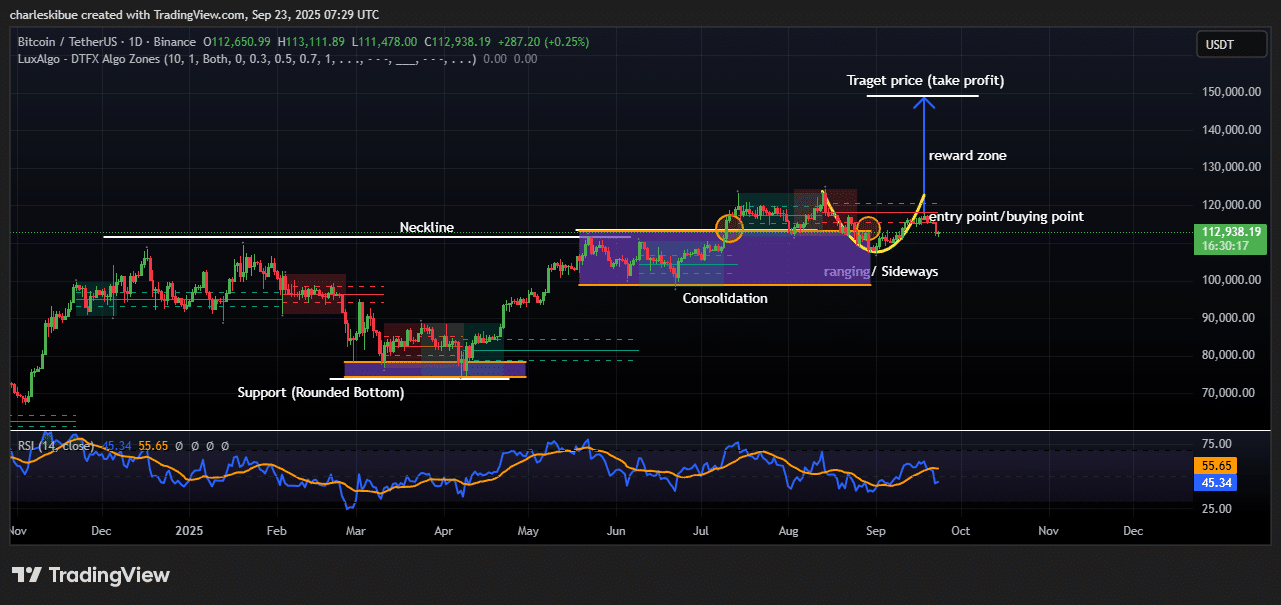

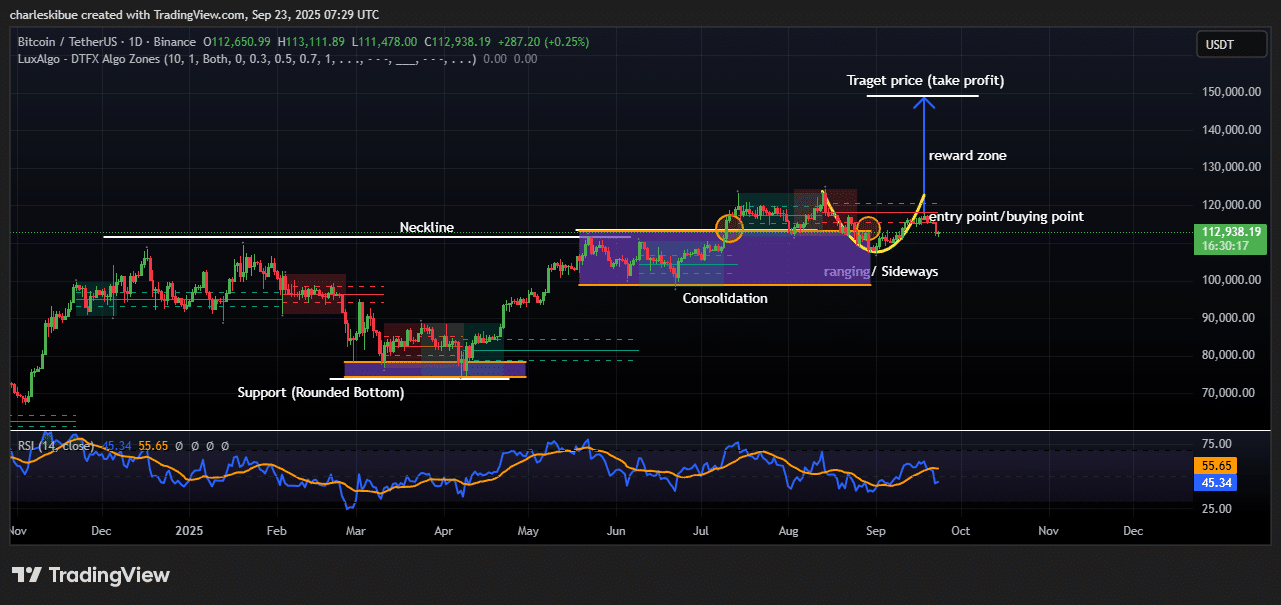

Bitcoin prices are targeted at $150K as the chart signals a break breakout

Bitcoin (BTC) is trading at around $113,025 after a small profit, with traders looking closely at the potential for a major breakout. The chart shows that Bitcoin is building strong support and could be preparing to move to $150,000 if the trend holds.

Earlier this year, Bitcoin formed a round bottom pattern of nearly $90,000. This served as a strong level of support. From there, the price moved into a long integration phase, then over $113,000 above the neckline. This breakout is important as it shows that buyers are regaining strength and could far outweigh the prices.

Currently, Bitcoin is moving sideways, testing the $113,000 area as a new level of support. Many traders see this as a healthy retest after a breakout. If Bitcoin can stay above this zone and build momentum, your next goal could be in the $130,000 to $150,000 range.

BTCUSDT Analysis Source: TradingView

The relative strength index (RSI) sits near 55. This means there is still room for prices to climb without causing massive sales pressure. However, RSI also warns that Bitcoin could face a short-term pullback before making the next big move.

For traders, the key entry point is at the $113,000 level, and it is expected that the purchase pressure will return. Once Bitcoin exceeds $120,000, it will be able to see bullish outlook and bring more buyers to the market. On the downside, if you can’t keep the above support, you can return Bitcoin to the $100,000-105,000 range.

Overall, the technical outlook for Bitcoin appears positive. Rounded bottom patterns, integrated breakouts and stable RSI all point to higher prices. Traders are aiming for a potential reward zone of up to $150,000, but in the case of pullbacks they also pay attention to the level of support.

If the current breakout applies, the market will be able to see strong gatherings in the coming weeks. However, if support fails, lateral trading could last for a long time before the next big move.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage