Please participate telegram A channel that stays up to date to break news coverage

Bitcoin prices have fallen in percentage over the last 24 hours, trading at $111,561 as of 12:20am.

But it did nothing to suppress the spirit of strategy Michael Saylor.

“Bitcoin is a technology version of gold and will be 10 times bigger than gold,” he said in an interview with CNBC.

today @morganlbrennandiscussed differences between Bitcoin, Gold and other crypto networks, as well as the rise of digital financing companies, digital credit and digital finance. pic.twitter.com/sdbwweiq0e

– Michael Saylor (@saylor) September 23, 2025

Meanwhile, Coinbase CEO Brian Armstrong believes Bitcoin can reach $1 million by 2030.

I think Bitcoin could reach $1 million by 2030, based on current conditions and progress.

Think about it in the long term. pic.twitter.com/6mkqrjojap

– Brian Armstrong (@brian_armstrong) September 24, 2025

Social Media Sentiment Monitor Santiment says it will “buy DIP.” It surged to the highest level on the 25th, but warns that it doesn’t mean that a quick rebound is coming.

“Prices usually move the opposite direction of crowd expectations,” it said. “So, if retailers believe that $112.2K is time to finally buy, then you need to feel a little more pain. If the crowd stops being optimistic and they start losing their bags, this is usually the time to hit with your dip purchase.”

Bitcoin Price: Despite the drop, it’s still on the upward channel

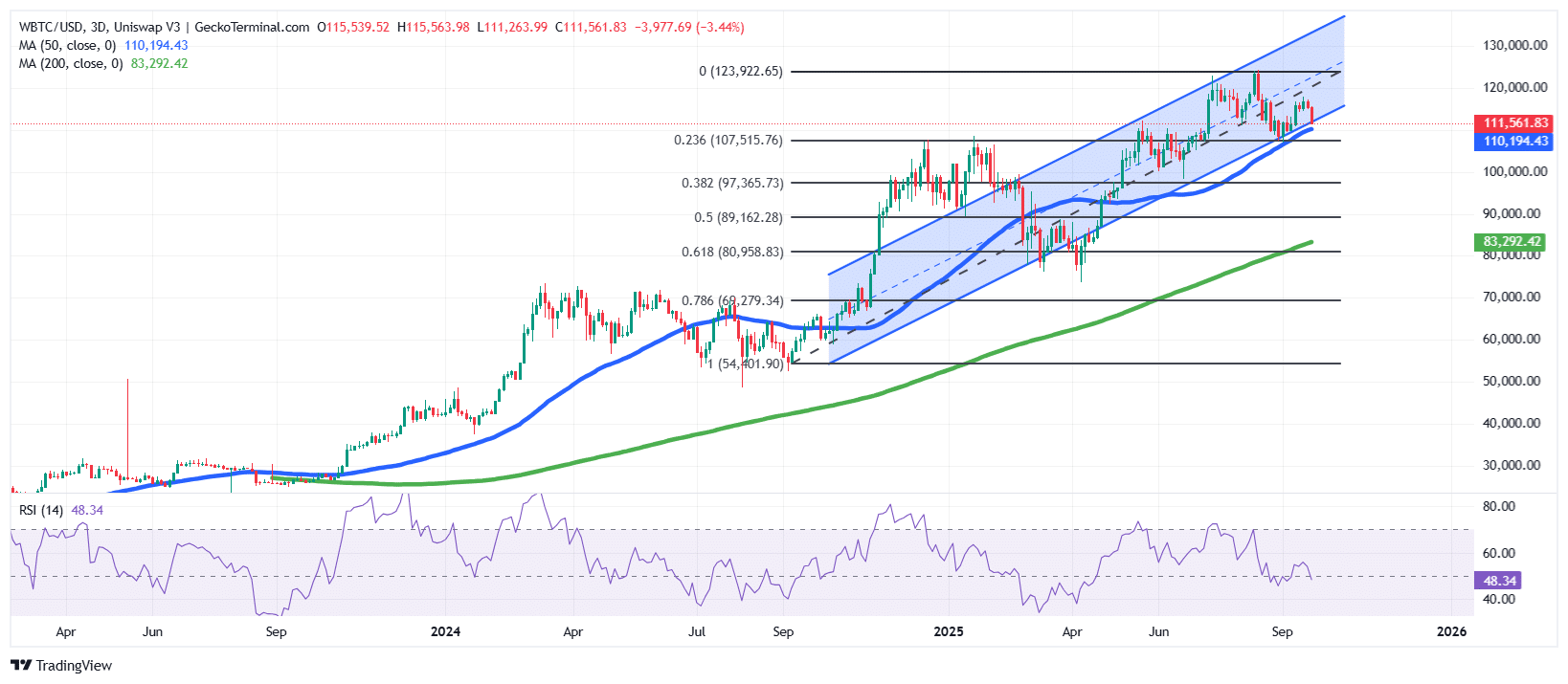

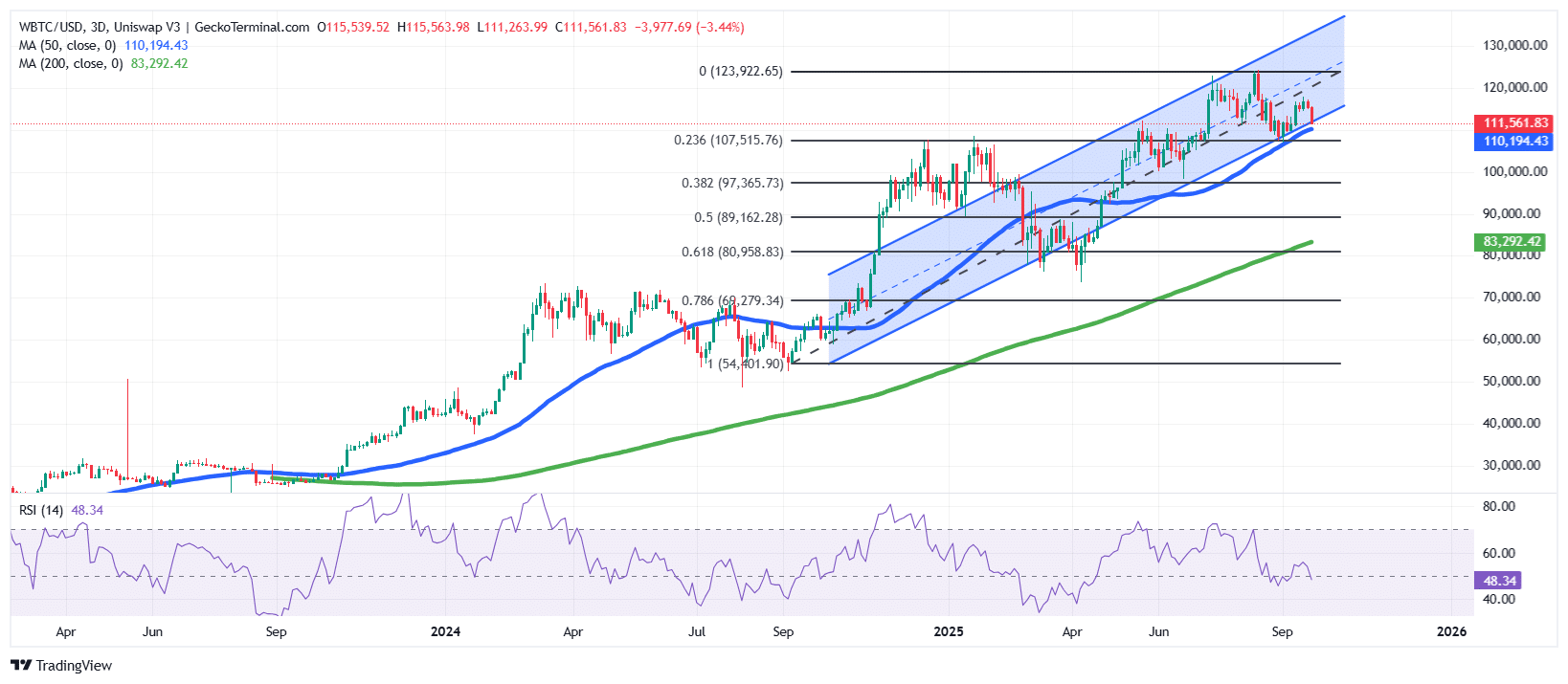

BTC prices for the three-day time frame indicate that assets are moving on established uptrends within rising channel patterns.

Since the second half of 2023, Bitcoin prices have steadily moved forward, respecting both the upper and lower boundaries of this channel. However, recently, BTC prices have been pulled back from the local high of nearly $123,922 and are currently trading at around $111,561.

This retracement shows the BTC hovering near the lower boundary of the channel, which has historically served as a strong dynamic support.

Failure to maintain this level could open doors to the further downsides, but as long as the channel structure remains intact, the broader bullish trend remains playful.

Meanwhile, according to Fibonacci’s retracement level, the 0.236 level is $107,515, while the 0.382 level acts as a key support of $97,365, while the $0.5 retracement acts as a deep safety net if sales pressure is strong.

BTC price momentum indicators support uptrends

A simple moving average (SMA) on a chart checks the general strength of a trend. The 50-day SMA is located at $110,194 and offers short-term dynamic support that closely matches current BTC price action. Meanwhile, the $83,292 200-day SMA is far below the market, highlighting a long-term bullish bias.

The relative strength index (RSI) is located at 48.34, showing neutral momentum and leaning towards debilitating. This suggests that purchases have cooled down, and the market could be further consolidated before resuming the critical trend.

If Bitcoin prices exceed 50 days of SMA and channel support, there is likely a rebound to a height of $123,922, which could break out in the $125,000-$130,000 range.

Conversely, if Bitcoin prices fall below $107,500, a more likely scenario would result in a drop to the Fibonacci range of $97,000-89,000.

BTC could surge beyond $115,000 resistance, according to Michaël Van De Poppe, a crypto analyst at X, with over 808K followers.

I want to know $ BTC Keep these important levels for support.

In that case, more than $115,000 will be the next clear point of resistance.

What if not? Probably another cascade from 106-108K to > Maximum Purchase Zone. pic.twitter.com/1bylicyukd

– Michael Van de Poppe (@cryptomichnl) September 23, 2025

Related News:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage