Keynote

- Lawmakers face a midnight deadline with a $1.7 trillion spending bill in a forecast market that offers 87% shutdown probability.

- Bitcoin Short Traders rolled out a $1.4 billion leverage at $115,000 as the market supports its potential funding for US government funding.

- BTC trades in a rising wedge pattern near $113,871 and has a critical resistance at $115K, which determines the next directional movement.

US VP JD Vance suggests the first US government closure in seven years at an oval office press briefing on September 30, causing fresh risk signals across the global market.

Lawmakers remain stuck at $1.7 trillion “discretionary” spending for key agency businesses, Reuters said.

If Republican and Democrats fail to reach a timely agreement on spending bills, or extensions by midnight, the closure could cut off funding for major federal projects from October 1st to October 1st. This is expected to have a significant economic impact as important bureaucratic services will be put on hold as government offices approach and non-essential workers may suffer redundancy.

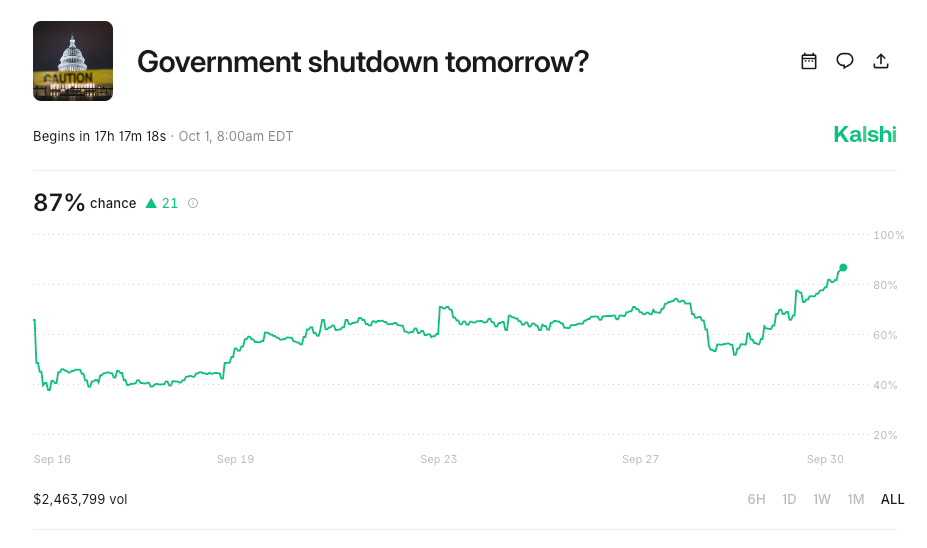

Forecast Market Shows 87% Probability of US Government Shutdown | Source: Kalshi, September 30

Real-time data from the forecast market platform shows 87% expectations for shutdowns, with total bets approaching $2.5 million at the time of this report.

The immediate impact was seen in key markets where the price of gold (XAU) rose 0.6% to $3,843, and the Tech Heavy S&P 500 was up 0.1%. Meanwhile, the Dow Jones Industrial Average (DJI) fell 0.022%, reflecting active capital turnover when investors responded.

President Donald Trump is threatening irreversible job cuts for federal workers, amplifying uncertainty across key markets, according to BBC News. Bitcoin

BTC

$114 415

24-hour volatility:

0.1%

Market Cap:

$2.28 t

Vol. 24H:

$57.43 b

Prices consolidate around $114,000 near the weekly frame peak, allowing traders to maintain a cautious attitude when exposed to US financial markets.

How does Bitcoin price respond to US government closures?

Before it rebounded to $114,200 on September 30, Bitcoin prices were initially retold for under $113,500, and Bear immediately rolled out $1.4 billion as the market was supported due to the imminent impact of the US government closure talks.

The BTC is often gathered on safe bets during periods of proof political crisis. However, Bitcoin’s volatile price action and derivative trading metrics seen on September 30th hold hopes from exposure to the US market.

Since the last government shut down on December 22, 2018, cryptocurrencies have been increasingly intertwined with US financial markets and political landscapes.

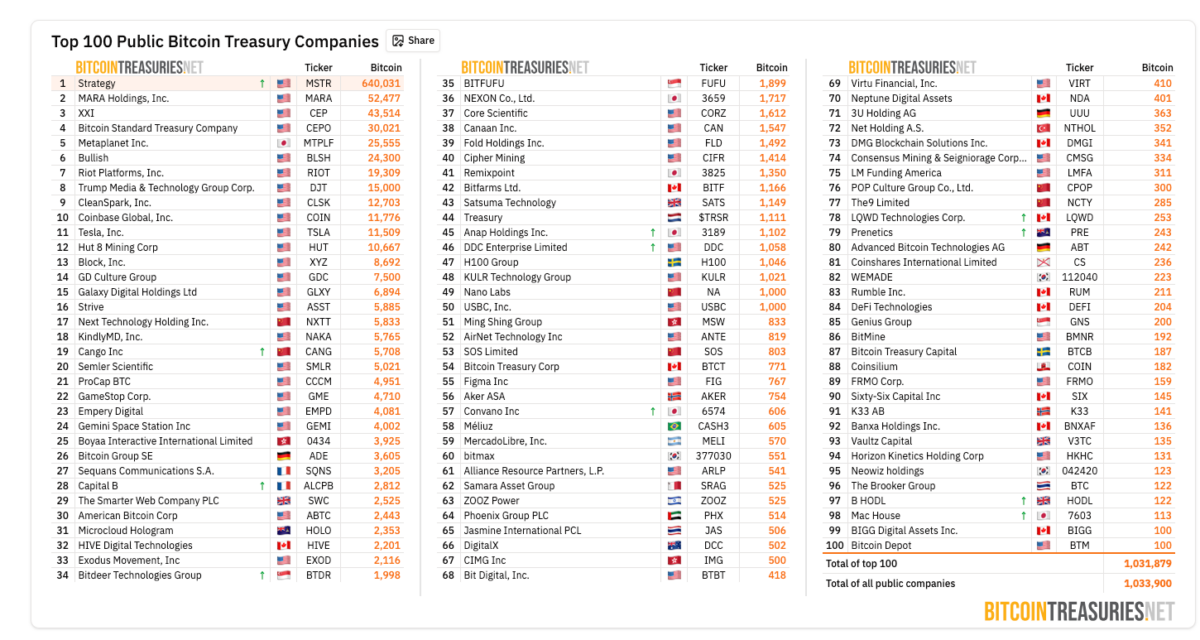

Top 100 US listed companies holding Bitcoin as of September 30, 2025 | Source: Bitcointreasuries

Corporate origins like Coinbase and Robinhood are included in the S&P 500 due to a positive change in US crypto regulations under the current Trump administration, which took over in January 2025.

Additionally, Bitcointreasuries lists more than 100 US corporations carrying a cumulative 1,031,879 BTC on their balance sheet, including BlackRock, the world’s largest asset manager, which currently holds nearly $100 billion across BTC and ETH’s active ETF offerings.

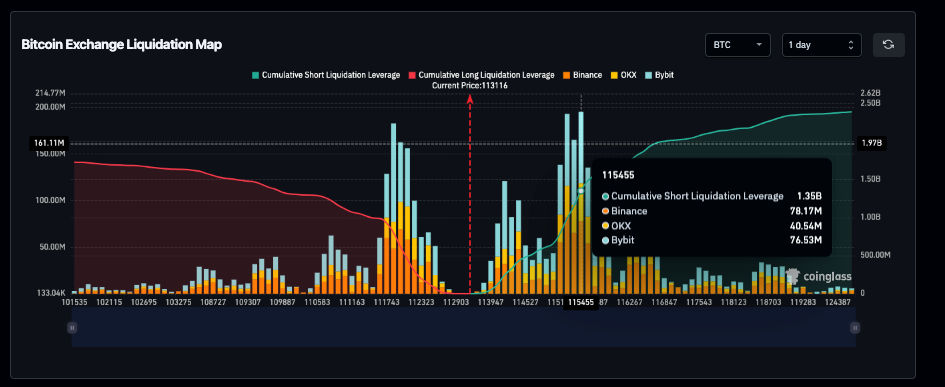

Bitcoin Short Trader rolls out $1.4 billion total leverage to 115.3K | Source: Coinglass

Coinglass liquidation map data captures the reactions of BTC short traders to the US government shutdown report. As shown below, active BTC short positions have risen to $2.4 billion, with long distances being limited to $1.73 billion over the last 24 hours, reflecting dominant bearish expectations.

Looking closer to the charts, BTC short traders cluster $1.4 billion leverage at a price level of around $115,000, accounting for 58% of all active positions.

As US government closures remain unconfirmed, the looming short leveraged cluster could limit the outlook for Bitcoin rebound at $115,000 as traders squeeze their options.

Bitcoin price forecast: Will BTC get back $115,000 or succumb to the correction signal?

Bitcoin prices trade within the rising wedge formations of the weekly chart. This is a structure that often precedes sharp movements. At the current level, close to $113,871, BTC pushes midrange, with bulls and bears evenly matching.

In an advantage, the rise in price-to-weight ratio (PVT) supports a BTC level of around 725,550, supporting an optimistic Bitcoin price outlook, suggesting that long-term capital inflows remain unchanged. If the shutdown is afraid of safe hull demand for fuel as seen in the money entering the purchased territory, the Bitcoin Bulls could trigger a breakout above the rising wedge cap nearly $120,000.

Bitcoin (BTC) Technology Price Analysis | Source: TradingView

Conversely, the 4,861 trending MACD line, which falls below the signal at a moment that fades 5,859 signals, reflects the negative pressure of constructing weakness in the histogram. A breakdown of wedge support below $105,000 can confirm bearish divergence and drive losses to $95,000.

Currently, the largest leveraged cluster is $115,000, so this level is important for Bitcoin’s next move. Rejection there can confirm bearish domination, but the critical closeness in the coming days could lead to a frenzy-inducing short cover that could raise the price of BTC to $120,000.

Best Wallet Presale is approaching $162 million and packed with BTC prices

With Bitcoin traders weighing the headwinds from the imminent US government closure, investors are turning to early-stage projects like Best Wallet (Best) for the best momentum.

Best Wallet (Best) is a multi-chain storage solution built with agency-grade security to disrupt the $11 billion non-mandatory wallet sector.

Best Wallet (Best) Pre-Sale

At the time of press, the highest wallet pressure exceeded $16.1 million. With less than 24 hours to the next price tier, investors can get tokens for $0.0257 via the best wallet website and unlock early entrant perks ahead of official launch.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.

Ibrahim Ajibade is a veteran research analyst with a background in supporting a variety of Web3 startups and financial organizations. He holds a bachelor’s degree in economics and currently holds a master’s degree in blockchain and distributes ledger technology at the University of Malta.

Ibrahim Ajibade on LinkedIn