Keynote

- Mining companies leverage over 12,000 BTC Treasury ministry to secure institutional funding at competitive rates.

- Bitcoin-backed lending gains momentum as miners prefer less dilute funds than traditional stock offerings.

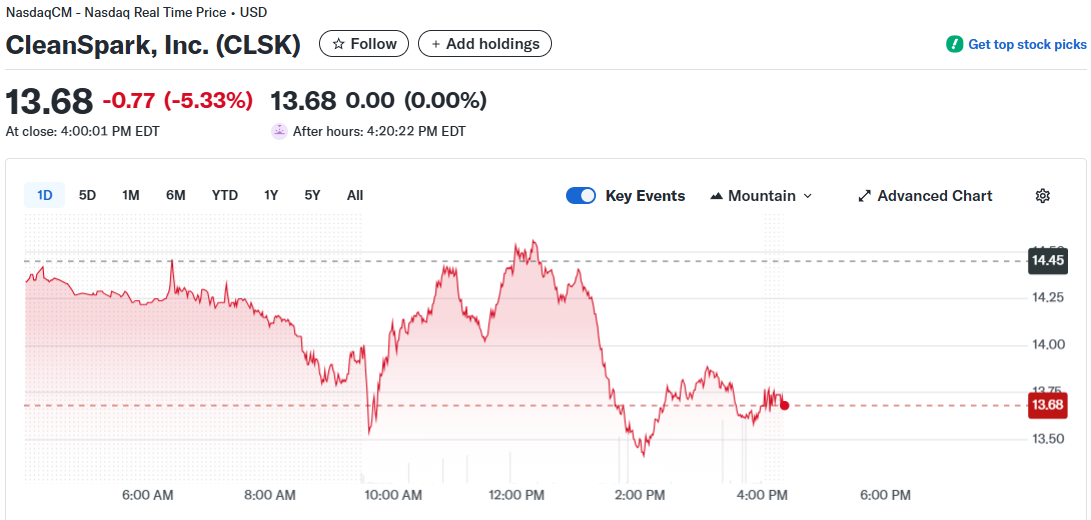

- CLSK’s stock remains stable at $13.68 despite securing major credit facilities for operational growth.

CleanSpark, Inc. is a leading player in the US Bitcoin mining sector. (NASDAQ:CLSK) has established a new $100 million Bitcoin-assisted credit facility with two primes, institutional lenders. The agreement, announced on September 25th, boosts CleanSpark’s total collateral lending capacity to $400 million, marking a key step in its capital growth strategy.

The credits will accelerate data center expansion, strengthen high-performance computing (HPC) initiatives and support the company’s digital asset management team in optimizing the Bitcoin Ministry of Finance. Currently they have over 12,000 BTC in the Treasury.

“We are pleased to announce that Gary A. Vecchialelli, Clean Spark’s Chief Financial Officer and President, said:

Bitcoin support funding gains traction among major miners

The two major facilities represent CleanSpark’s second most important Bitcoin support fund this week. Previously, the company announced an additional $100 million credit line arranged alongside Coinbase Prime. This trend reflects the growing interest among miners who use digital assets to fund and maintain shareholder value, rather than relying on stock offerings to raise capital. According to a press release, the strategy supports operational growth while maintaining exposure to Bitcoin price movements.

– CleanSpark Inc. (@cleanspark_inc) September 25, 2025

Two leading CEOs Alexander Bloom welcomed the Clean Spark move and said the partnership shows increased confidence in Bitcoin use

BTC

109$487

24-hour volatility:

3.6%

Market Cap:

$2.18 t

Vol. 24H:

$73.11 b

As collateral for institutional loans. Other large miners, such as the Riot Platform, have tapped similar credit options, highlighting Bitcoin’s evolving role in corporate finance.

CLSK stocks show minimal response despite heavy funding news

CleanSpark’s financial news was filled with a calm response in the stock market. As of September 25th, CLSK shares were trading at $13.68, falling from $14.85 at the beginning of the week, not far from $14.44 from its recent out-of-hours peak following the announcement of its credit feature with Coinbase Prime. According to Yahoo Finance, trading volumes have tripled the daily average since early September, exceeding 36 million shares.

CLSK stock price graphics. Source: Yahoo Finance

The stock has climbed dramatically since mid-September, reflecting investors’ optimism regarding Clean Spark’s ability to expand without dilution of shareholders. Over the past month, CLSK has just over 52%. The company’s market capitalization remains at nearly $3.9 billion.

The move to secure more dilute funding for CleanSpark has seen public miners continue to increase their share of Bitcoin’s total network hashrate, enjoying a high rating in the market recently, and companies’ Bitcoin reserves remained rising. The company’s decision is expected to accelerate infrastructure growth and strengthen financial management, supporting a wide range of industry trends of diversification and capital-efficient expansion.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with nine years of experience in the industry. He writes for top outlets such as Criptonoticias, Beincrypto, and Coindesk. Specializing in Bitcoin, Blockchain and Web3, he creates news, analytics and educational content for global audiences in both Spanish and English.

José Rafael Peña Gholam on LinkedIn