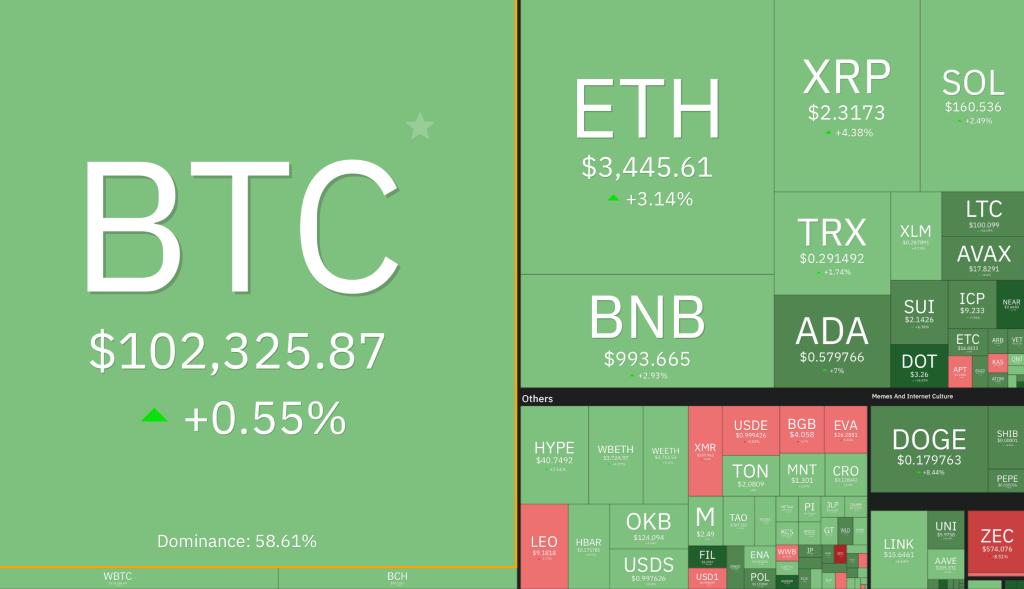

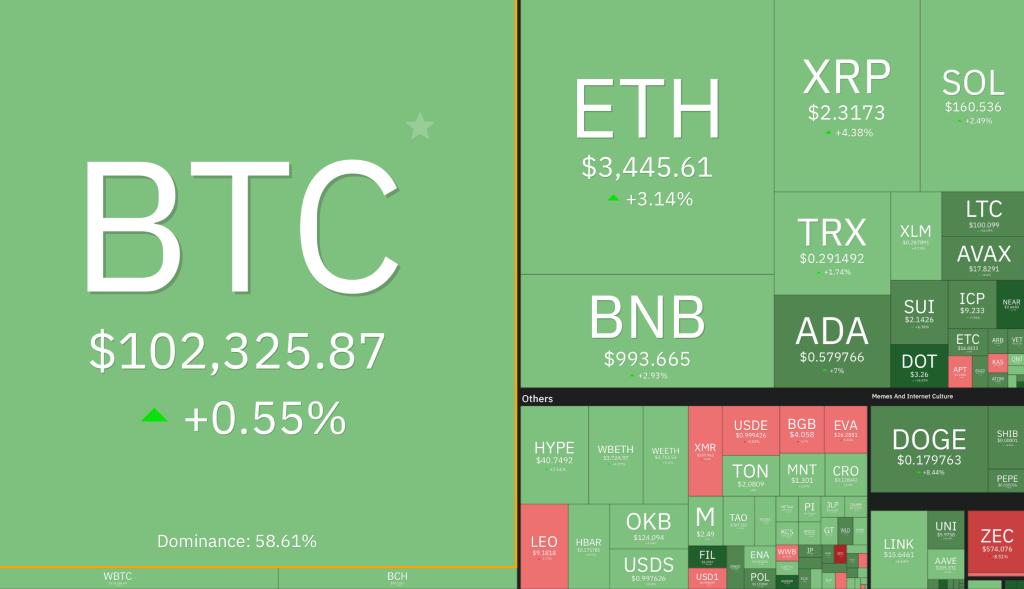

The weekend started strong for crypto markets, with Bitcoin prices hovering around $102,000 and traders keeping an eye on altcoins’ momentum. After a week of mixed ETF inflows and subdued macroeconomic triggers, the market appears to be entering a consolidation phase marked by stability in major indexes and strong activity in some gainers.

As volatility compresses across large-cap stocks, smaller tokens such as Filecoin (FIL), Artificial Super Intelligence Alliance (FET), and Internet Computer (ICP) have been outstanding performers, indicating renewed speculative interest among retail traders.

Bitcoin (BTC) traded in a narrow range between $101,500 and $102,300, while Ether (ETH) remained just above $3,450, showing early signs of stabilization from midweek pressure. The global cryptocurrency market capitalization is $3.45 trillion, down about 0.4% in the past 24 hours.

Market sentiment and technical snapshot

Market sentiment remains cautiously optimistic, with the Crypto Fear & Greed Index holding steady at 25 (Fear), suggesting confidence despite subdued price movements. On the technical side, BTC’s consolidation above the $100,000 support indicates accumulation, but the $112,000 resistance continues to cap short-term upside. Analysts say this range could be a “coil phase” that could precede a decisive move next week.

ETH is mirroring Bitcoin’s pattern, with resistance near $3,700 likely to dictate near-term momentum. Meanwhile, gainers such as FIL (+45%), FET (+37%), and ICP (+23%) have outperformed the broader market, highlighting the shift of traders’ attention to high-beta assets. This sudden rotation into smaller tokens reflects increased risk appetite as large-cap stocks become less volatile.

Broader context and outlook

Recent ETF data shows net inflows have turned positive after outflows in midweek, suggesting that institutional investor confidence remains. Macroeconomic cues are also providing modest support, with lower US Treasury yields and a weaker dollar helping to stabilize crypto assets after last week’s pullback.

Analysts say the market is entering a two-speed phase of Bitcoin and Ether consolidation, while altcoins and niche sectors are experiencing sharper movements in the short term. If BTC manages to clear the $110,500 level, the momentum could quickly spread throughout the market and set the tone for mid-November.

For now, traders are expecting a range-bound move over the weekend due to an explosion of volatility from emerging gainers, which is a common setup during a consolidation phase before a crypto rally.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.