With September 2025 closing in Green, the cryptocurrency market will enter October with cautionary optimism. Historically, October has been one of the strongest months for Bitcoin (BTC) and Ethereum (ETH), but XRP is facing potentially transformative ETF decisions that could reshape the future. October proves to be a pivotal month for the digital asset market, as macroeconomic uncertainty, institutional influx and investor sentiment is rampant.

Bitcoin (BTC) Price Prediction October 2025

Bitcoin traders are looking closely at October after BTC won in September. Analyses of the last 15 Bitcoin Octobers show that there is a 73% chance of a positive monthly end, with 11 of those ending on the green.

All six consecutive Octobers in the past six times have been positively closed, offering a median return of +27% and +28.3%. Some octobers have even greater strength, with meetings exceeding 30% and over 40% in a year.

Negative octobars are rare, and the last time Bitcoin slipped 3.3% during the US government shutdown in 2018. Historically, however, losing Octobers tends to get a sharper drawdown of about 30% on average. If such a pattern is repeated today, Bitcoin can see the modifications up to the $80,000 range.

Current indicators point to potential early debilitating. The four-day moving average cross suggests a modified target of nearly $105,000, but the bearish five-day signal could extend moving to $102,500. Still, if Bitcoin follows historic fourth quarter performance, a new surge to a new all-time high remains a strong possibility.

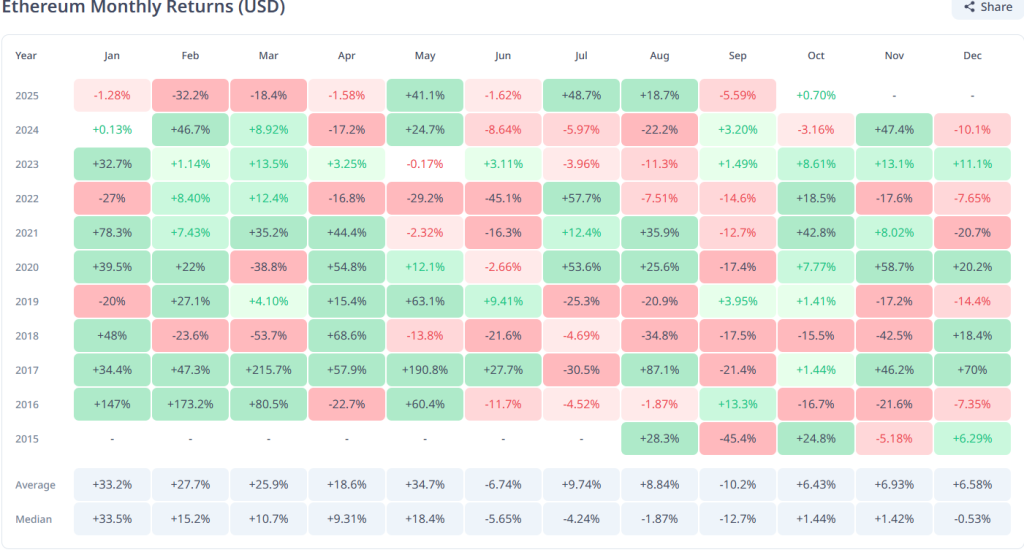

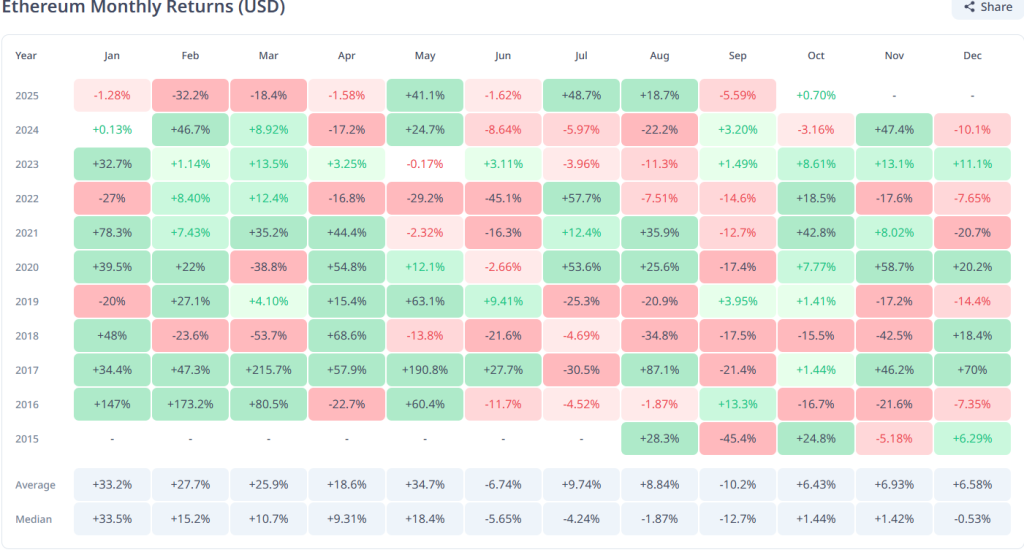

Ethereum (ETH) Price Prediction October 2025

Ethereum entered October after a volatile September and held its key support zone of $3,900 after hitting a low of $3,825 below $4,000. Currently, market participants are focusing on whether Ethereum can break through key resistance levels. The most direct barrier is around $4,260.

A strong breakout above this level will allow ETH to test $4,670, and if that range is exceeded by conviction, a $5,000 milestone will be your next target. In a more cautious scenario, Ethereum may consolidate between $4,000 and $4,600 before deciding on the next direction.

From a technical standpoint, Ethereum’s RSI has been the best-selling read since April 2025, a rare condition that has preceded a powerful gathering historically. The last time ETH was sold oversold, set at a 134% rally within just two months. This adds weight to the discussion as there is a possibility of rebound in the coming weeks.

Historic Q4 data further supports this outlook, with Ethereum being +104% over the past few years, +142% in the fourth quarter of 2017, +36% in the fourth quarter of 2023, and +28% on average. If ETH can regain and hold $4,000 with weekly closures, analysts could set up a strong bull run in early 2026, as they think a rally between $7,000 and $8,000 remains in play.

XRP Price Prediction October 2025

XRP could be the biggest story of October 2025, with eight XRP ETF applications from key asset managers such as Grayscale, Wisdomtree and Franklin Templeton likely to have a final decision scheduled between October 18th and 25th. These companies oversee more than $8 trillion in assets under management and hope that Modest Instituatial Inflows will have an out-impact on XRP.

Analysts estimate that inflows of between $300 million in the first year would be enough to double the XRP market capitalization and boost the token to $5. A sustained influx could drive XRP prices to double-digit territory for the first time in history, creating a transformative moment for cryptocurrency.

Technically, the XRP is consolidating the level of around $3 after being pulled back from its all-time high of $3.66 in July. The $3 price range has become an important battlefield for bulls and bears. Holding it on top of it could trigger a breakout towards $3.65 initially and potentially $4.50. This opens the door to new price discoveries.

However, if XRP is unable to weaken momentum and volume, the token risks returning to its main support level of $2.75, which has been held for several months. Analysts also point out that XRP displays similar chart patterns to the 2017 Bull Run, suggesting that assets may be preparing for parabolic movements.

A combination of potential ETF approval, a simplified SEC process, and institutional interests can create one of the most important moments in XRP history.

Conclusion

Bitcoin starts with a bullish historic track record in October, but risks like the US government shutdown can cause short-term volatility. Ethereum is oversold, ready for a potential fourth quarter rebound, and has strong historic benefits in favor of a recovery rally. XRP could be the biggest initiator as future ETF decisions could trigger a major institutional influx.

Overall, the fourth quarter of 2025 was able to set the stage for a transformative crypto rally towards 2026.