Keynote

- BlackRock’s IBIT led the Bitcoin ETF recovery with an inflow of $128.9 million after adding up a $466 million outflow.

- DCC Enterprises has expanded its holdings to 1,058 BTC, targeting 10,000 coins by the end of the year since its launch in May.

- The Elliott Wave analysis suggests a potential fix to the $100,000 support despite institutional demand that provides price stability.

Bitcoin

BTC

109$636

24-hour volatility:

3.3%

Market Cap:

$2.19 t

Vol. 24H:

$70.86 b

The price, below $110,000 for the first time since early September, recorded a 5% loss on Thursday, with the global risk asset market recession escalating this week. The US-based companies are taking advantage of the fall in BTC prices to maintain their purchasing stance, which keeps their business demand for Bitcoin stable.

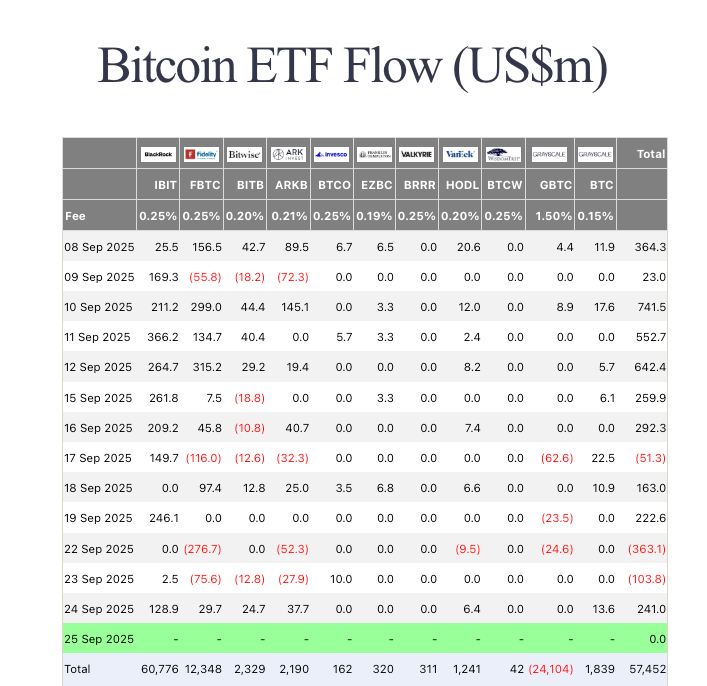

Bitcoin ETF records $241 million inflows on September 24, 2025 | Source: Farsideuk

The US spot Bitcoin ETF showed signs of resilience after the rocky start of the week. Data from far side investors revealed an inflow of $241 million on Wednesday, partially offsetting a total of $466 million on Monday and Tuesday.

BlackRock’s IBIT ETF controlled the inflow at $128.9 million, while ARK Invest’s ARKB and Fidelity’s FBTC donated $37.7 million and $29.7 million respectively, representing the second and third largest inflows.

US-based company DCC Enterprises announced another purchase of 50 btc worth $5.5 million on Thursday, September 25th, increasing its total holding to 1,058 Btc. CEO Norma Chu has doubled the company’s goal of obtaining 10,000 BTC by the end of 2025.

Disciplined accumulation in all market conditions.

₿+50 BTC added today

🟠1,058 Total BTC held

BTC yield since May is +1,556%Update full update: https://t.co/hxhfplsbov#bitcoin #BTC #corporatetreasure #bitcointreasury $ ddc pic.twitter.com/vhlwndae2f

– ddcbtc (@ddcbtc_) September 25th, 2025

DCC launched Bitcoin Treasury in May 2025 and has since achieved a BTC yield of +1,556% in its holdings.

Bitcoin Price Prediction: Elliot Wave Flag is Deepered to $100,000

Bitcoin prices are now consolidated nearly $109,600 after beating the key support level at $110,000. Technical indicators for BTCUSD Daily Chart Signals are an additional negative side risk. First, the RSI fell to 37.17, suggesting bearish momentum with more downside room before hitting a sold state.

The breakdown coincides with the Elliott wave structure on the chart, indicating the completion and correction of the five-wave cycle (a)-(b)-(c) pattern progression.

Bitcoin (BTC) Technology Price Prediction | TradingView

The next important support within the ongoing Bitcoin price correction phase is near $101,500 marked in the first expansion of Elliott Wave (C). If you don’t keep that level, deeper fixes could be triggered at $91,352.

The advantage is that Bitcoin must recover mid-bollinger band levels at $114,100 to negate the risk of immediate bearishness. If an early rebound occurs, it could last a critical break above the $118,600 level, matching Bollinger’s upper band resistance.

For now, momentum indicators show that macro headwinds dominate despite influx from US-based institutions such as BlackRock and DCC.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.

Ibrahim Ajibade is a veteran research analyst with a background in supporting a variety of Web3 startups and financial organizations. He holds a bachelor’s degree in economics and currently holds a master’s degree in blockchain and distributes ledger technology at the University of Malta.

Ibrahim Ajibade on LinkedIn