Bitcoin (BTC) prices traded nearly $109,000 on September 26th, extending the losing streak that began at the beginning of the week. BTC prices fell nearly 6% on September 26, causing fear of deeper corrections to the token price.

With Ethereum (Eth), Solana (Sol) and Cardano (ADA) recording double-digit week losses, the decline deepened as sales pressure accelerated with key tokens. The wider market reflected weaknesses, while the stable ones were stable, and the high lipid hype stood out with a sharp decline.

Analysts pointed to the convergence of the triggers behind the move. Market participants highlighted the expiration dates of over $20 billion in Bitcoin and Ethereum options as a key reason for the sudden slide. Its expiration dates, strong US economic data, and the risk of severe liquidation in the position of overgrown Altcoin has made the market vulnerable. Overlapping macro stresses and differential positions set the tone of another volatile session.

Expiration and liquidation of Bitcoin options as triggers

Bitcoin’s latest drop extends the weakness outlined in the intro, with analysts agreeing to the main perpetrators. Ash Crypto highlighted the expiration dates of the $23 billion Bitcoin and Ethereum options, highlighting great resistance to emotions.

Analyst Ted reflected the same view, with options scheduled for more than $21 billion on September 26th, forcing him to rewind the position. Both Crypto analysts argued that whales often used expiration dates to push prices to “the biggest pain” levels, leaving retailers on the losing side.

Expiry’s timing coincided with stronger US economic data, reducing expectations for early speed reductions and fostering anxiety about future PCE inflation prints. The background to that macro has put pressure on the market already on the edge. The fluidity has been reduced and slipping has worsened the overall drop in the major.

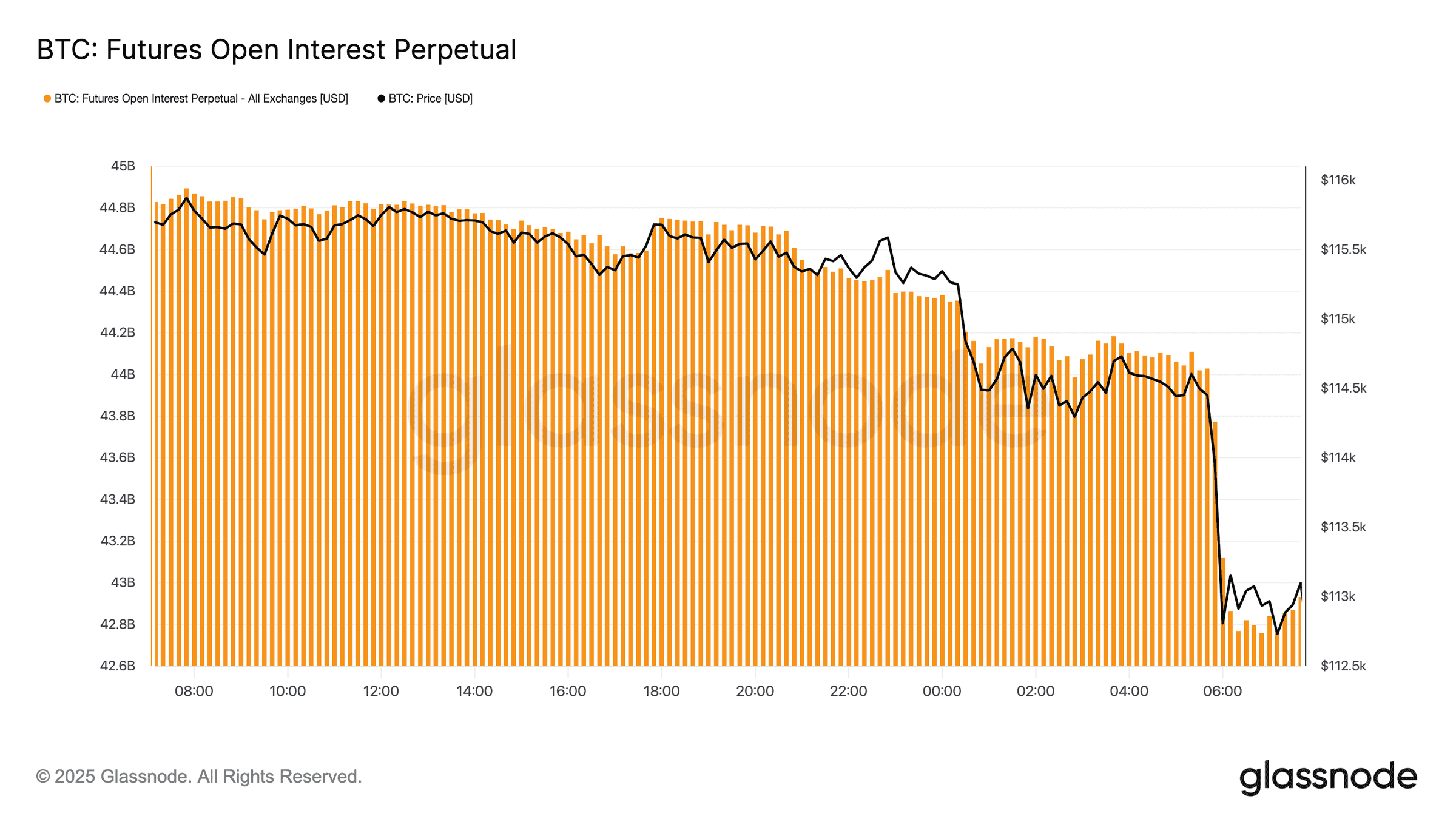

The GlassNode report framed movement as a shift.”From meetings to revisions“There was a leverage expansion during the climb in September 2025, and the market is the heaviest.

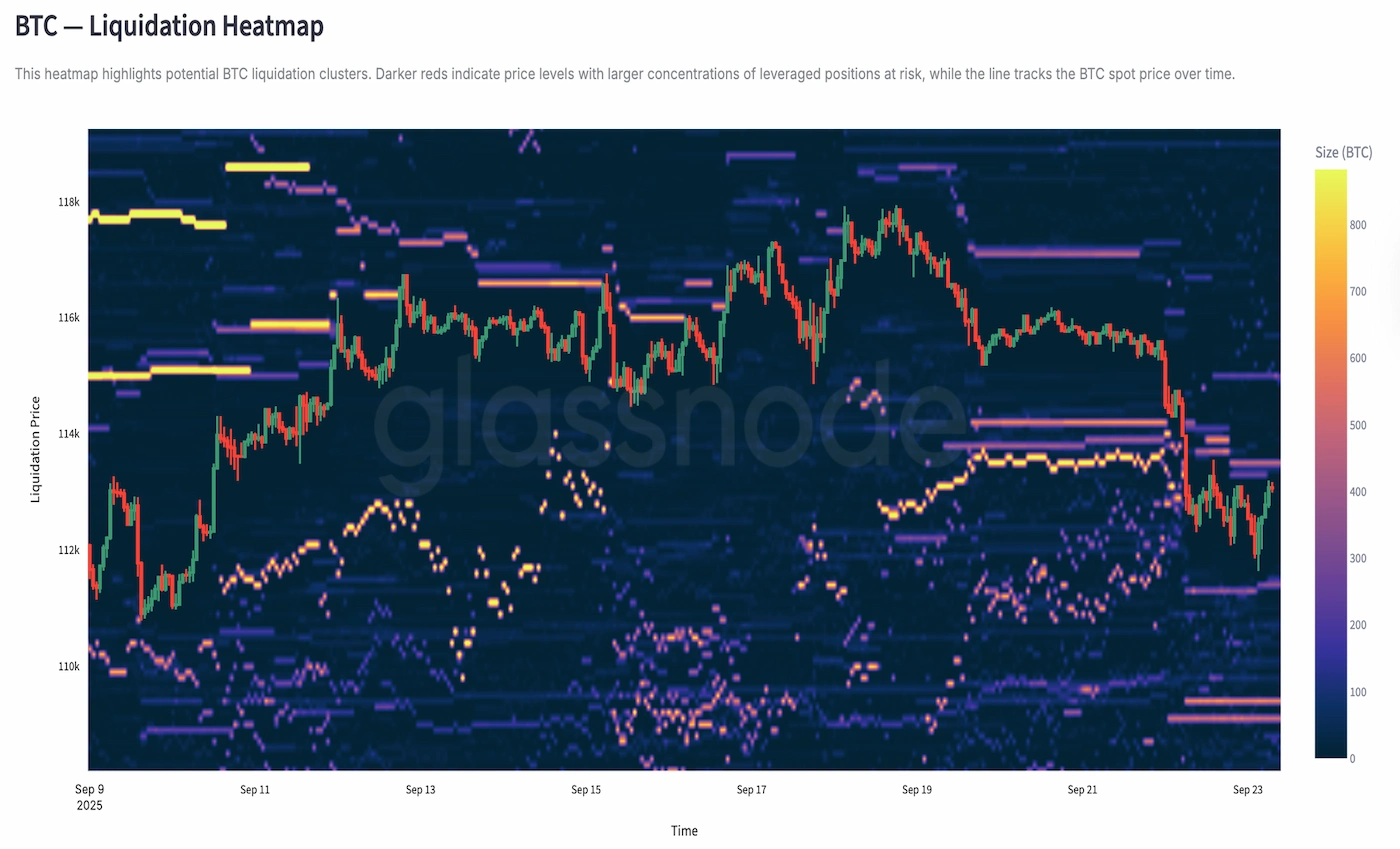

The report shows futures liquidation is rising in Lockstep along with the recession, consistent with widespread deleverage after the busy long expired. We also flagged spot-to-derivative imbalances that make prices more sensitive due to macroshocks and flow shifts.

Larger holder movements weaken BTC prices

Actions among larger holders reinforced weaknesses. GlassNode noted that it would make money after the advance in early September, reducing the cushion that long-term beliefs usually offer on sharp days.

Expiration-driven pullbacks discovered that there was less passive demand on its buffer writer, so forced sellers decided on the tape. The long settlement chain then accelerated as the token lost key level and completed the classic reset to the quarter end.

This combination explained the movement of the day. The expiration date in the direction of the pressure set. The macro headings have stripped you of confidence. The high leverage provided fuel for liquidation. GlassNode’s report gathered in derivatives rather than derivatives, showing a market that cracked when their derivatives were unleashed.

The results coincided with the core points of Ted and Ash Crypto about the role of Expiry, and on-chain lenses revealed why autumn began.

Analysts expect a flaw test before potential recovery

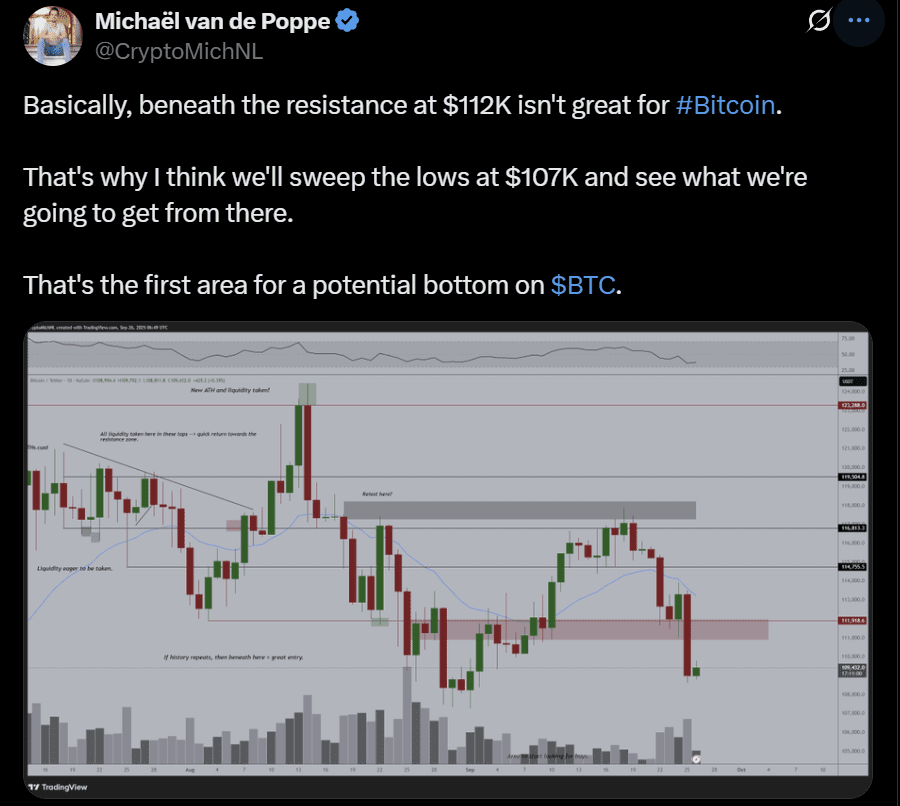

With liquidation-driven selloffs, traders discussed the next path for Bitcoin. Analyst Michael Van de Poppe claimed that a denial of less than $112,000 created the space for the deeper downside.

A market veteran said it is likely to wipe out a low of nearly $107,000 before the market attempts to form a bottom. His chart pointed to that zone as the first realistic area for buyers to retreat.

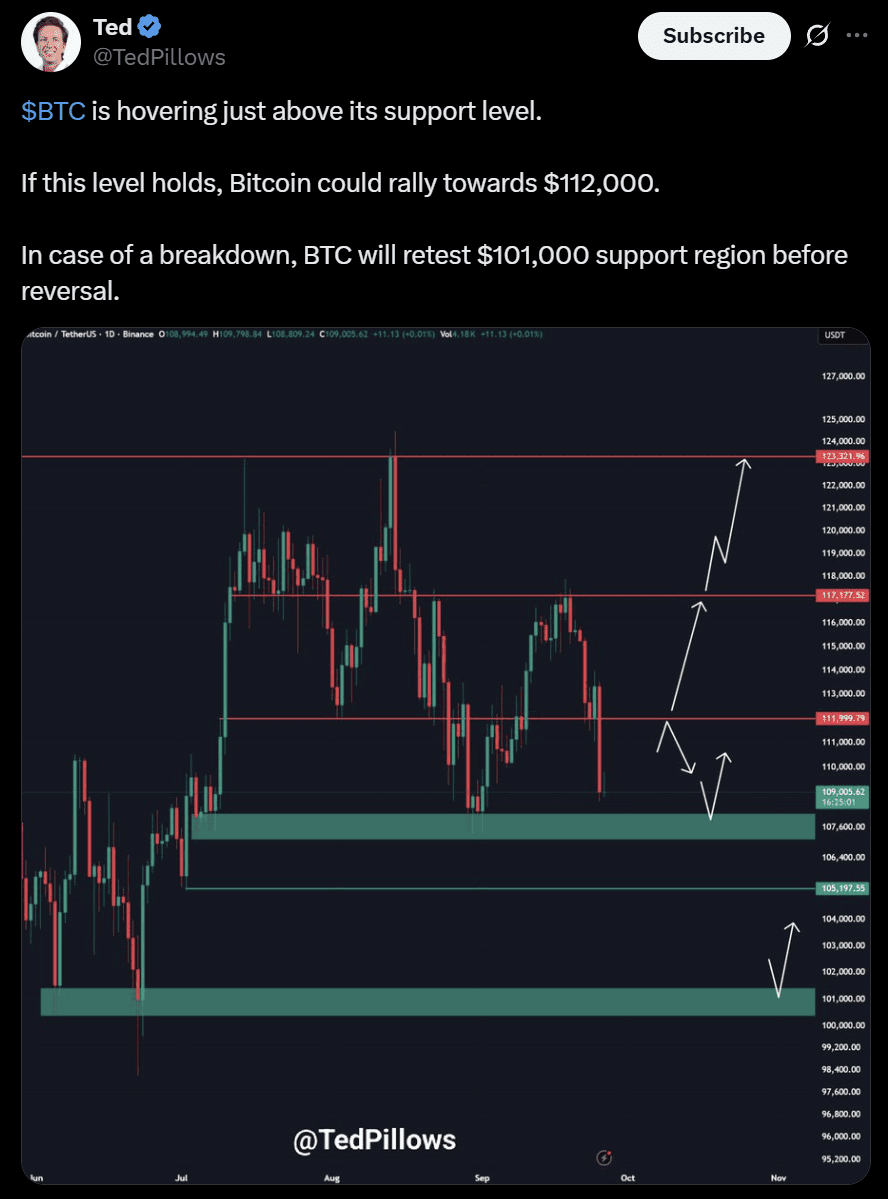

Ted emphasized more conditional structures. Analysts noted that Bitcoin prices float above support regions where the door to rebound can be opened.

If the levels were retained, analysts had expected the BTC USD pair to move to $112,000. Otherwise, Ted outlined a potential retest of nearly $101,000 and marked the bottom edge of the current structure. His view reflected the uncertainty left by severe liquidation, and attempts to recover were at risk of sales being renewed and capped.

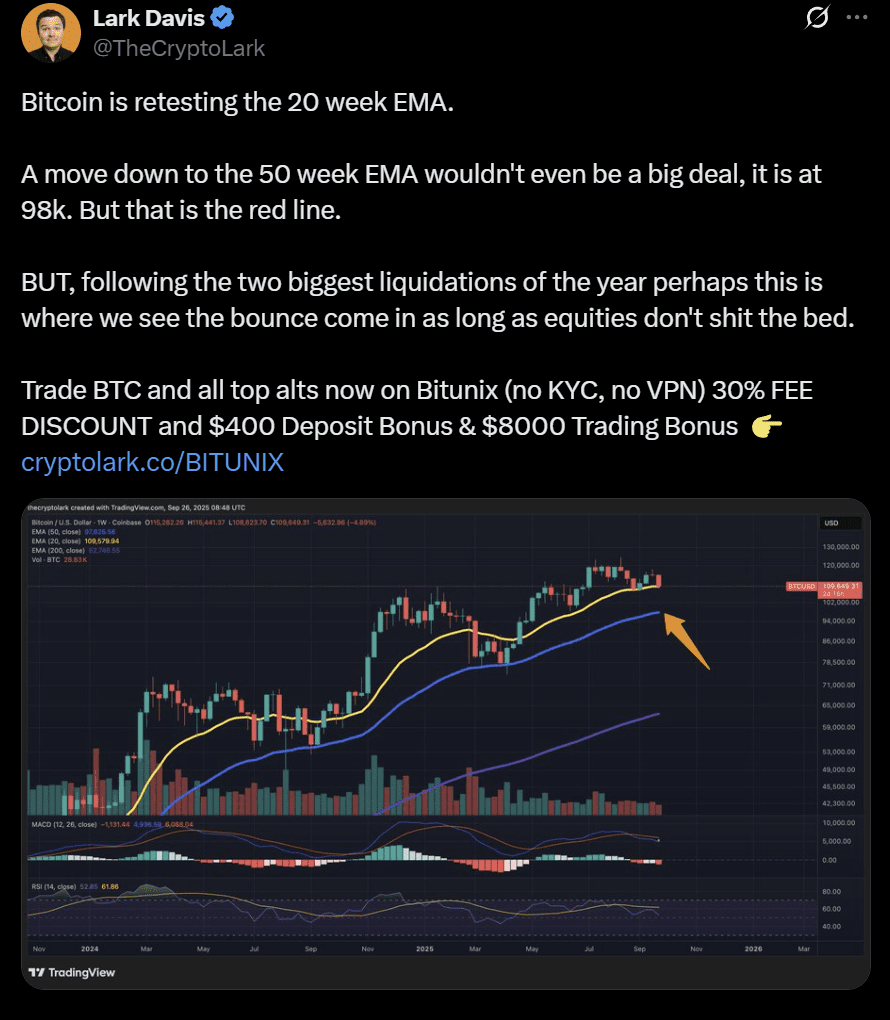

Lark Davis took a wider stance, pointing to the 20-week EMA as a pivot.

Davis said a decline towards a 50-week EMA of nearly $98,000 will not disrupt the long-term cycle. That debate brought about the latest decline within the framework of a market reset, not a breakdown.

These outlooks converged on one theme. The Bitcoin structure weakened after cascaded liquidation, but it still had not shown a complete reversal of the trend. Rejection under the resistance level confirmed the vulnerabilities flagged in previous subsections, but the support zones of around $107,000 to $101,000 have become the focus of the market.

Long-term moving averages continue to define the guardrails of the cycle, suggesting that the current phase reflects more structural shakeout than complete collapse.

Here’s why Stablecoins caused the collision in Washington: Please read here