Please participate telegram A channel that stays up to date to break news coverage

The Crypto Industry is warning the Bank of England of impose restrictions on Stablecoin Holdings after a Financial Times report has made plans to curb them for individuals and businesses.

According to the story of September 15th, Financial Times (FT) The BOE believes it imposes a cap on individuals between £10,000 and £20,000 ($13,600 to $27,200), but said it is limiting businesses to around £10 million ($13.6 million).

Stablecoins are already widely used for payments in the UK and the adoption of these tokens is expected to grow.

Executives say the proposed rules can curb adoption, complicate enforcement, and drive the UK behind the US and the EU with digital finance.

Bank of England says it wants to prevent large-scale spills

Planned restrictions on ownership of Systemic Stablecoin are part of efforts to prevent sudden withdrawal of deposits, according to the executive director of BoE’s Financial Market Infrastructure at Sasha Mills. It also limits the scaling of alternative payment systems.

The plan to restrict ownership of Stablecoin comes as central banks and financial conduct authorities work to develop a regulatory framework for digital tokens fixed in Fiat currency.

BOE officials argue that restrictions could be transitional while the market is adapting to digital money.

Central bank’s planned stub coin rules are “bad” ideas

Crypto groups and executives in this space are urging people not to impose restrictions on BOEs. Among them is Coinbase’s Vice President of International Policy. “Imposing a cap on stubcoin is bad for UK savers, bad for cities, bad for Sterling,” Tom Duff Gordon said.

The Bank of England is putting a title cap on stubcoin, another example of how governing elites are doing stupid things that can literally do.

Trying to ban the future never works.

We have to accept that.

– Zia Yusuf (@ziayusufuk) September 15th, 2025

Payment Association Riccardo Tordera-richi also told FT that the restrictions “make no sense” as there is no limit on UK cash or bank accounts.

Others say it’s nearly impossible to impose planned rules. Simon Jennings of the UK CryptoAsset Business Council said enforcement would require a digital ID and other systems to realistically monitor Stablecoin ownership.

The BOE’s plan could also deepen tensions between the central bank and the Treasury, indicating support for digital innovation in the financial sector.

In July, Prime Minister Rachel Reeves said he wanted to push forward with advances in blockchain technology within the traditional financial sector, including efforts over tokenized securities and stubcoins.

Crypto Industry Group and executives have also warned that rules will leave that more surveillance than the US or the European Union.

The US and EU accept stubcoins

The US and the EU are signaling a stubcoin embrace, both establishing their own frameworks for digital assets.

In September 2020, the EU proposed a cryptocurrency (MICA)-regulated market as part of its “digital finance package.” The regulations are designed to provide legal clarity and regulatory framework for crypto assets and related services throughout the EU.

The MICA framework came into effect in June 2023, but stubcoin-related rules began to apply in June 2024. The broader rules for cryptographic service providers have been in effect since December 2024.

This year, the US Senate approved guidelines and establishment of national innovation for the US Stablecoins (Genius) Act, which was signed into law by US President Donald Trump in July. It aims to create a regulatory framework for the issuance and use of stubcoins in the United States.

Both the MICA framework and the act of genius do not impose a limit on the amount of stubcoins that a citizen can hold. Instead, they focus on issuance, preliminary control, anti-money laundering (AML) and counter-terrorism policy compliance.

The Stablecoin market was expected to swell to $1.2 trillion

The Stablecoin market has grown steadily since both the Mica framework and the act of genius came into effect, with the latter serving as a bigger catalyst.

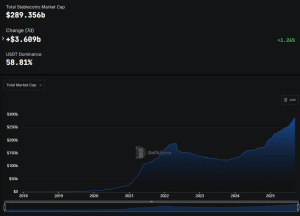

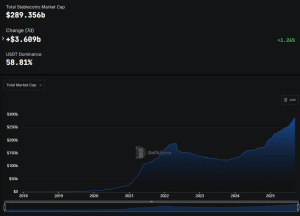

According to data from Defillama, Stablecoin’s market capitalization is approximately $28.9356 billion. This comes after an increase of more than $3.69 billion over the past seven days.

Stablecoin’s market capitalization (source: Defilama))

That growth is expected to continue, with Coinbase projecting earlier this year that the Stablecoin market will be able to exceed $1.2 trillion by 2028.

Similarly, Goldman Sachs predicts that “Summer of Stubcoin” will allow the market to reach $2 trillion in capital by the end of 2028.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage