avalanche(avax) is a high-performance layer 1 blockchain platform known for its instant near-reach transaction finality and architecture that supports the creation of customizable subnets.

To make short-term price forecasts for Avax, it is essential to consider both recent pricing movements and fundamental factors such as strategic partnerships, ecosystem development, updates from the Avalanche/AVA Labs team, institutional capital flows, and overall market trends.

Below is an overview of the latest information on these factors.

Avax Price Performance Overview

Avax has experienced a significant recovery since the beginning of 2025. As of May, tokens are trading in the $24-25 range, reflecting an increase of 25% to 50% compared to early May. This rebounds as the previous peak in March 2024 fell to about $60, followed by the beginning of the year when Avax fell to about $19-20.

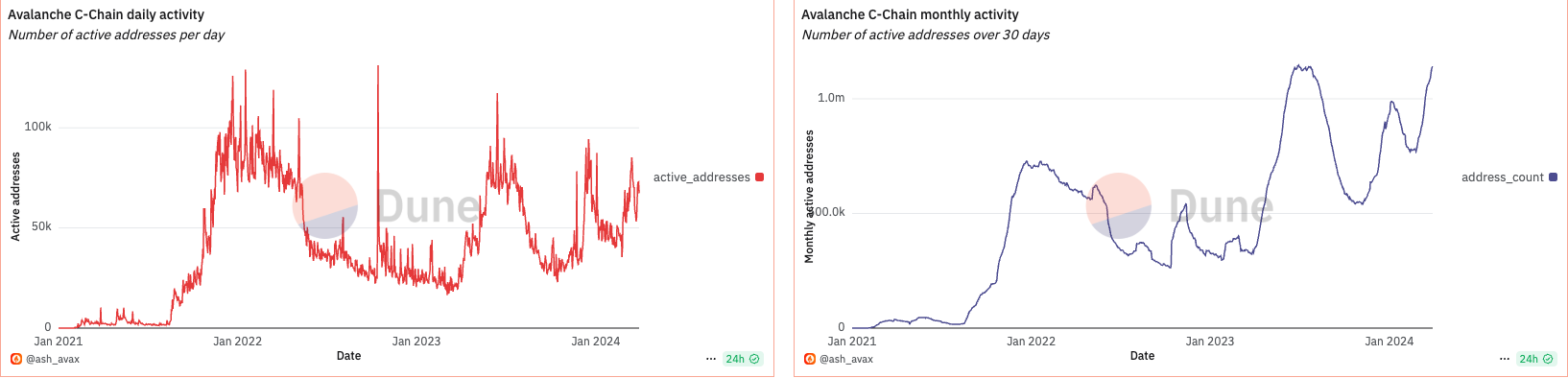

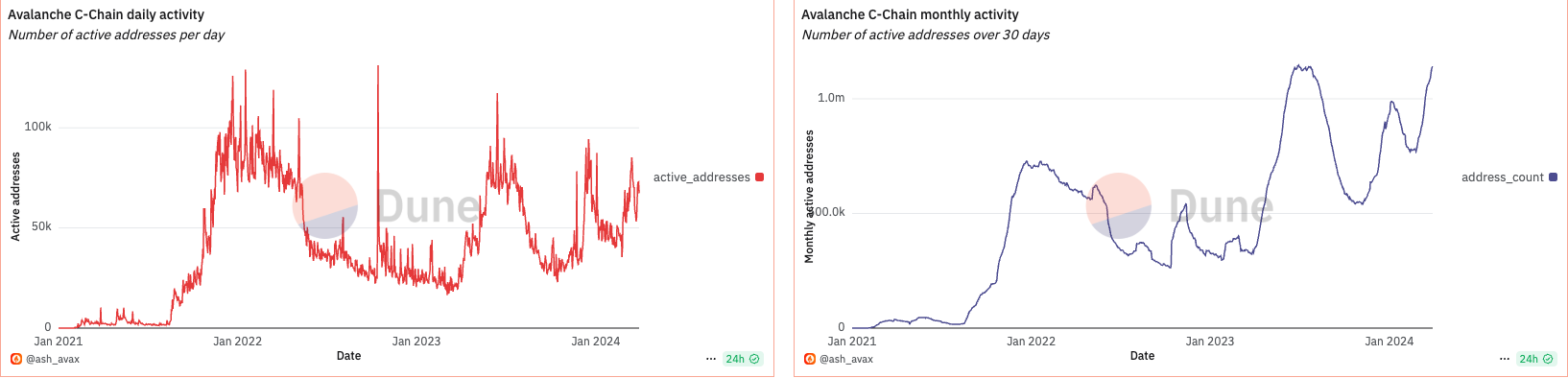

Network indicators also show enhancements to the ecosystem. The number of active addresses in the avalanche is over 2 million, setting a new all-time high. The volume of transactions on the network increased by more than 185%, but wallet activity increased by 700% in the first half of 2025. It highlights user engagement updates and growth of activities on the chain.

Source: Dune

Strategic Partnerships and Famous Collaborations

Avalanche continues to attract well-known partners across a diverse range of industries, enhancing its position as a multi-purpose layer 1 blockchain.

In Sports, FIFA (the global authority on football) is partnering with Avalanches to publish digital collectibles and develop dedicated blockchain networks to enhance fan engagement.

In the entertainment sector, J. Even music platforms featuring artists like Cole and 6lack have launched their own Layer 1 blockchain with Avalanche using Avacloud service from AVA Labs.

Meanwhile, the launch of the Avalanche card (with Rain and Meta) allows users in Latin America and other emerging markets to spend crypto as they do with traditional Visa cards.

Additionally, traditional finance is increasingly becoming an avalanche infrastructure. Japan’s SMBC Bank, together with Fireblocks and TIS, has signed an agreement to consider issuing Stablecoin for B2B payments on the Avalanche network.

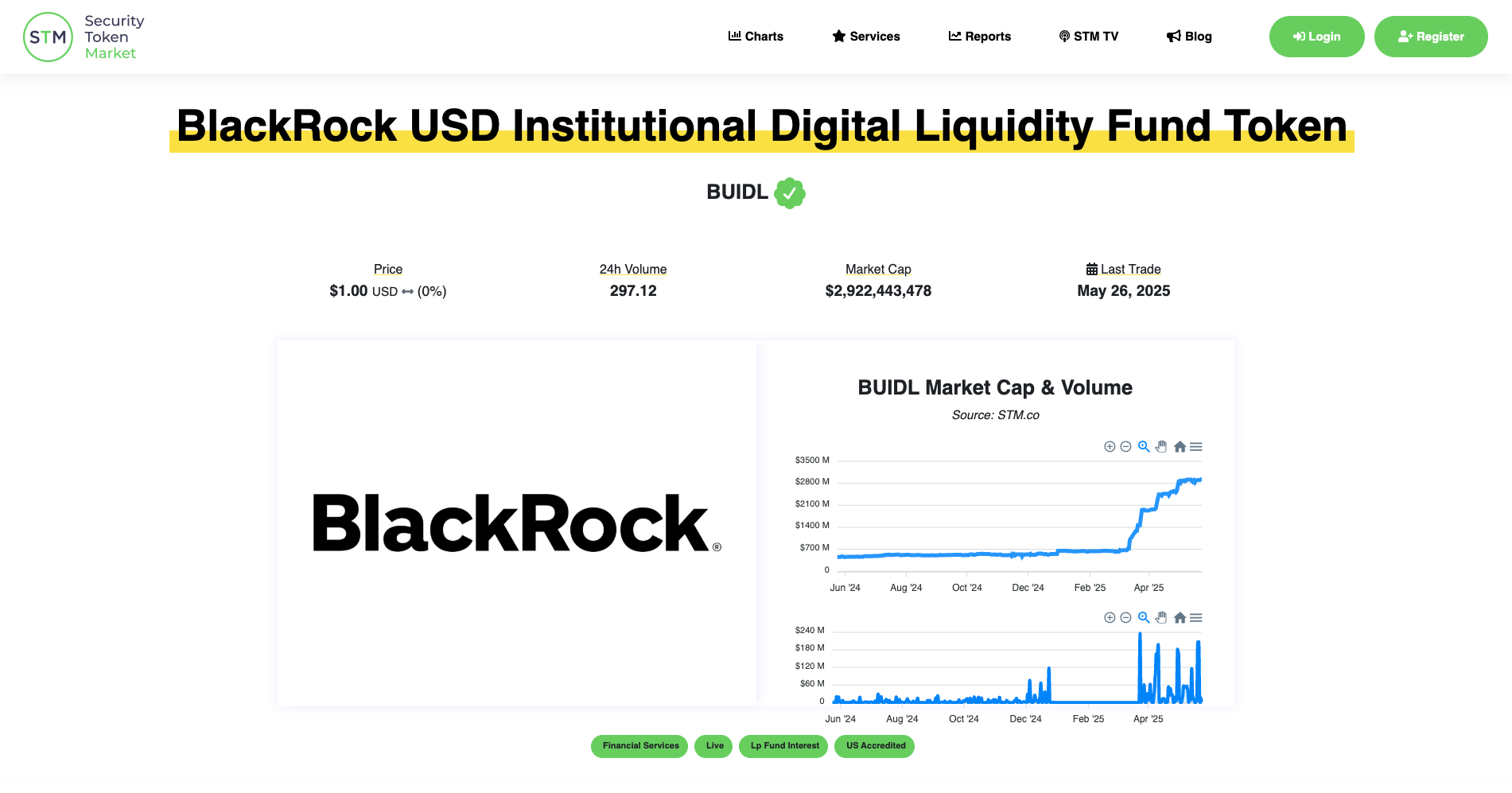

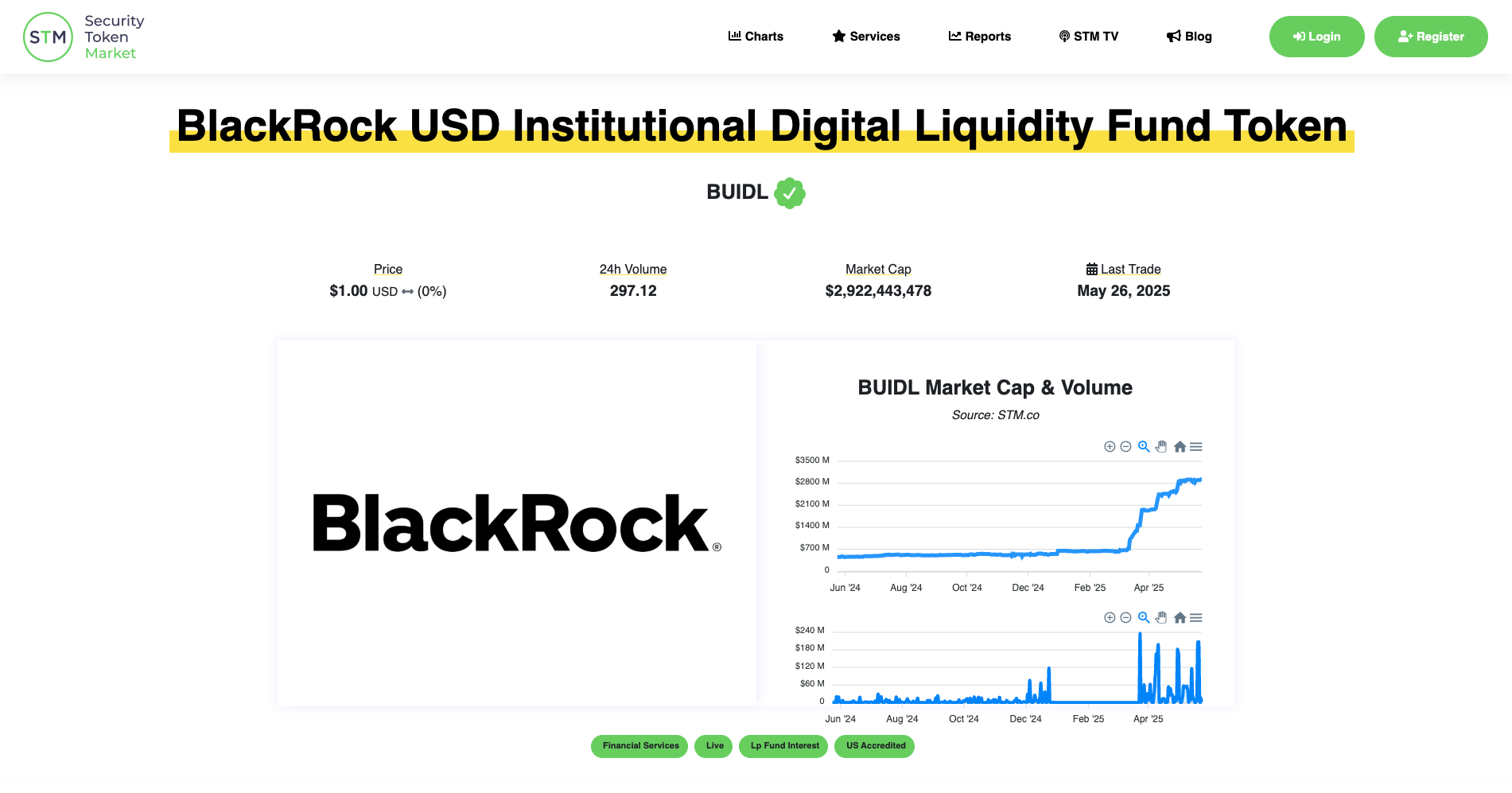

Buidl, BlackRock’s tokenized assets fund, is currently valued at over $2 billion and has expanded into an avalanche via Securitize, making it the world’s largest tokenized financial fund. Additionally, asset management company Vaneck is planning to launch a dedicated Web3 fund in June 2025, focusing on the Avalanche ecosystem.

Another notable development: Vaneck’s tokenized financial product VBill (US short-term T-bill sediment), has been launched in the avalanche along with other networks. The move highlights the growing institutional interest in avalanches as a platform for real-world asset tokenization.

Expansion of the avalanche ecosystem

Avalanche is actively building multiple vertically, including Defi, GameFi, NFTS and core infrastructure. In the gaming space, several large titles have chosen avalanches for deployment.

In particular, Maplestory N- has moved over 180 million players worldwide to the avalanche Henesys subnet, while Pixelmon has announced plans to develop mobile games on the Avalanche network.

The 2024 rollout of Avalanche’s Avalanche 9000 (ETNA) upgrade has significantly reduced subnet launch costs by 90%. This reduction created over 100 new subnets, each tailored to specific applications, such as high-performance gaming, enterprise solutions, and private networks.

Read more: Free Crypto Signals and Trading on Evening Trader Channel

At Defi, Avalanche is expanding its support for Bitcoin-related assets. For example, on May 16, 2025, Solv Protocol launched SolvBTC.Avax, a synthetic BTC asset native to Avalanche. At NFT Front, FIFA Collect – FIFA’s official Digital Collectible Platform (NFT) aims to move to a Layer 1 chain of avalanches and improve the global fan experience through strengthening digital ownership.

To further include new users, Avalanche partnered with Stripe to enable Fiat Onramps. This integration allows users to purchase Avax directly via credit card or bank transfer. Stripe’s functionality is also built into a core wallet developed by AVA Labs, providing seamless access to users involved in the Avalanche network.

On-chain metrics highlight this momentum. The total Avalanche value is locked (TVL) has surged to the multi-billion dollar range, but since March 2024, native steady-state formulas (such as USDC and USDT) supply has risen 1.7 times.

Source: Defilama

Latest developments from AVA Labs

Avalanche Foundation and AVA Labs- The core development team behind Avalanche continues to deploy new initiatives aimed at accelerating recruitment and developer engagement across ecosystems.

One of the major highlights is the launch of CodeBase Season 4, an incubation program designed to support Web3 startups built on Avalanche. The program highlights the avalanche’s commitment to foster early-stage innovation.

Recent announcements on Avalanche’s official blog reflect an active and strategic roadmap.

- May 15, 2025 – A new Layer 2 Utah built for unification by Xsy has been released.

- May 20, 2025 – Music Platform has launched its own Avalanche Layer 1 chain.

- May 22, 2025 – The FIFA Blockchain Initiative has been officially confirmed to be hosted in an avalanche.

Avalanche also expands its reach through an enterprise-friendly infrastructure. First announced in 2023, a long-standing collaboration with Amazon Web Services (AWS) allows businesses to launch an avalanche node with a few clicks. Additionally, there are plans to provide subnet deployments as a service through the AWS Marketplace.

Avacloud by Avalanche – launched in 2024 also helped democratize access to blockchain infrastructure. This allows developers and businesses to launch custom blockchains without the need to manage complex backend operations.

Institutional capital is increasingly flowing into avalanche ecosystems. In particular, Vaneck is preparing to launch the Pleantbuilt Avalanche Fund, a dedicated vehicle for investment in the Avalanche-Native project managed by the Vaneck Digital Assets Alpha Fund.

Vaneck has also introduced an Avax-based leveraged Exchange-Traded Note (ETN) to make it easy to access avalanche exposures for European investors, but ETNs are now down by around 36%.

In summary, there is an increase in institutional investment in avalanches. It targets major sectors such as Defi, GameFi and Real World Asset Tokenization (RWA). This sustained interest will help lay a solid foundation for Avax’s long-term value and short-term price stability.

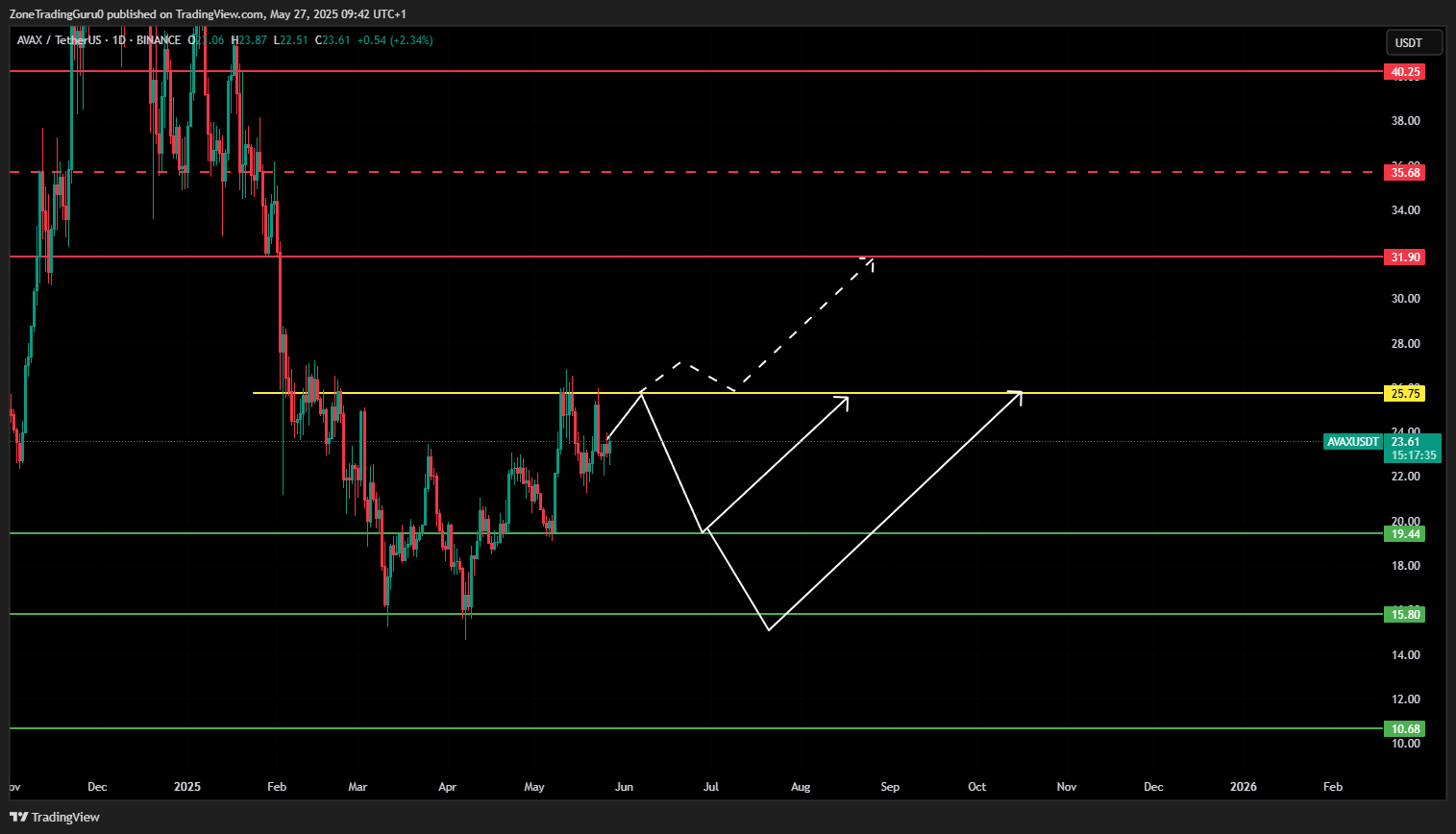

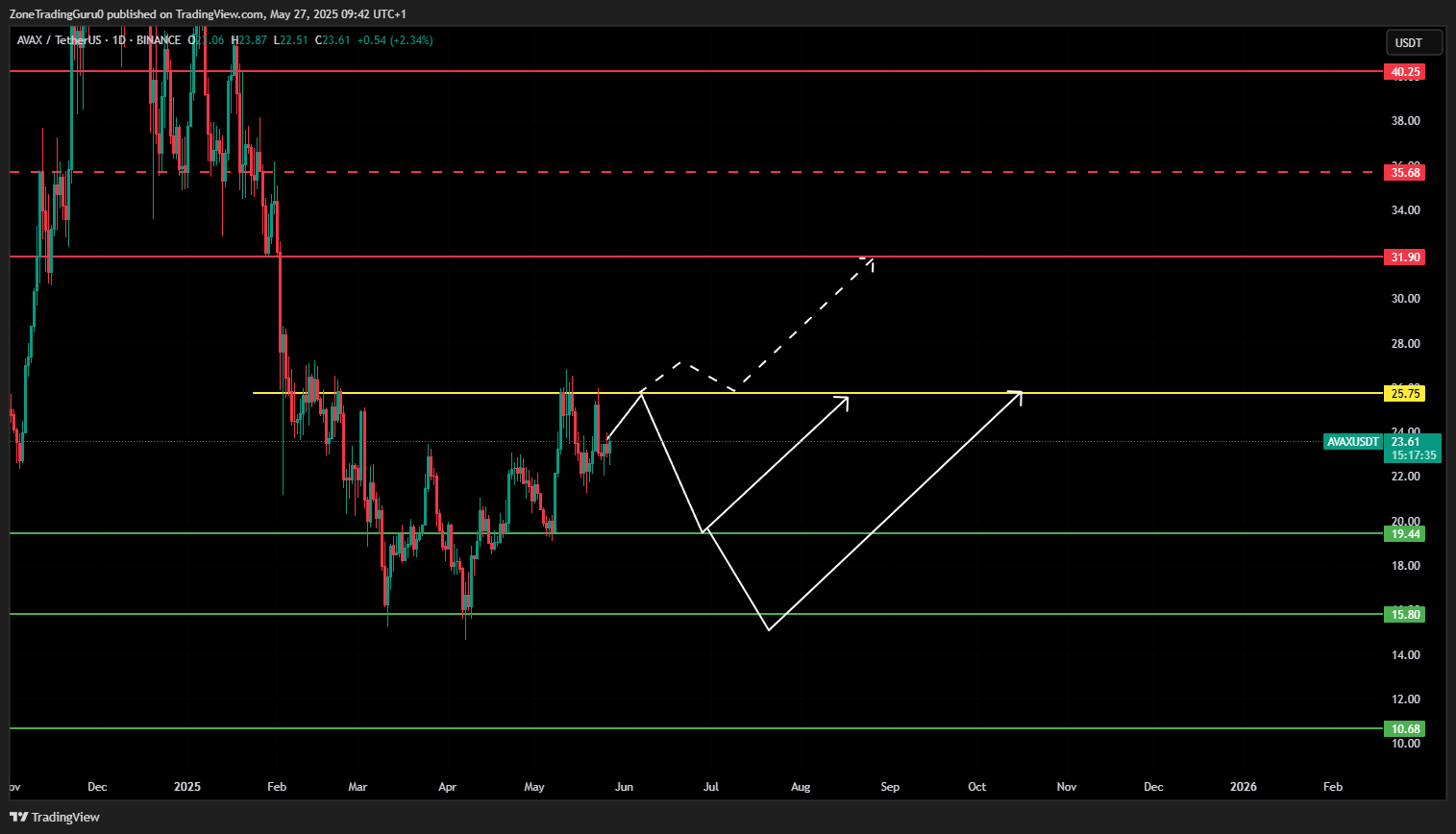

Technical Analysis: Waiting for breakout confirmation

Currently, Avax is sandwiched between a critical resistance of $25.75 and a wide range of support zones ranging from $19.44 to $14.77. The $25.75 level is the most important threshold to watch.

When Avax prints a daily (D1) candle that closes decisively beyond this level, the price could quickly move to $31.90. Confirmed breakouts above $31.90 can open paths to higher resistance levels at $35.70, $40.25, and even $44.13.

On the other hand, if Avax fails to break past $25.75, there is a risk of downward movement towards the support range between $19.44 and $15.80.

If the $15.80 support is not possible, the price could revisit its previous low at around $10.68. These support zones can provide the opportunity to buy scalp, but traders need to strictly control risk due to their proximity to important resistance.

Source: TradingView

Avax price forecast: Short-term Oulook

As positive developments continue to emerge, including ecosystem-wide initiatives, infrastructure upgrades, and new institutional partnerships, Avax can maintain upward momentum. In the near future, tokens may test key resistance zones in the $27-30 range.

Future, the possibility of US Federal Reserve reductions could serve as a broader catalyst for risky assets, particularly when confirmed at the June 2025 FOMC meeting. If this happened, Avax was able to see a major upward revaluation, supported by increased market liquidity and new investors’ trust, along with key Altcoins such as Sol and ETH.

Historically, Avax has tended to reflect broader market trends. As a high beta asset, its prices often follow the performance of flagship cryptocurrencies, particularly Bitcoin. When BTC experiences keen gatherings and revisions, capital in and out of Altcoins, including avalanches, is often triggered.

Analysts like Andre Dragosch (Wharton) highlight this dynamic, noting that past Fed rate cuts (typically considered a liquidity event) are fuelled by a short-term surge in Bitcoin and Ethereum. In such a scenario, Avax can benefit as they take part in a wider Altcoin Rally cycle.

Read more: DogeCoin Price Forecast for June 2025