Good morning, Asia. This is what makes news in the market:

Welcome to Asian morning briefings, daily summary of top stories throughout the US time, and an overview of market movements and analysis. For a detailed overview of the US market, see Coindesk’s Crypto Daybook Americas.

Telegram’s blockbuster is a deal with Xai, which confirms that Elon Musk’s AI company will be integrated into Telegram and that the two companies will share revenues, is still a work in progress despite an announcement from US Pavel Durov.

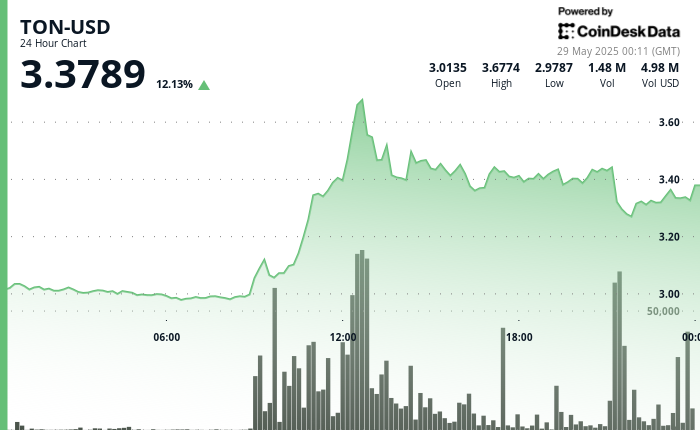

Ton, a token belonging to Tonegram’s ecosystem, trades for $3.30 and will gather there from $3 after the first (now rebuttal) partnership announcement. The token has fallen from its previous high of $3.68 after Elon Musk posted on X and then posted that no contracts had been signed between the two companies. According to data from the Coindesk Market, Ton is up 11% that day.

Although Durov has now confirmed that the deal is not signed, the founder of Telegram said it is “in principle agreement” that Ton still has important support for $3.30.

As Asian business days begin to see if more clarification comes from either side, all eyes are on the telegram and Xai.

According to the CEO, Bluesky’s decentralized Bluesky is not a web3 company

Vancouver – Jay Graber, CEO of the fast-growing decentralized social media platform BlueSky, started on Web3 as the developer of Privacy Coin Zcash, but wants to keep X’s competitors firmly on Web2.

Speaking at the Web Summit in Vancouver on Wednesday, Graber argued that the persistence of blockchain technology and resource-intensive design make content unsuitable for fleeting and personal consumer social networks.

“Why do I need a photo of what I post for lunch that is maintained forever in this digital archive?” she asked on stage, highlighting the inherent scalability and cost limitations that have driven her decision to avoid blockchain in blue skis.

Certainly, grabbers are not against ciphers. She says that technology, such as payments and digital identity, still has real value, even if Web3 tends to seek problems and present solutions and be drawn to centralization.

“There was a time when everyone was creating blockchains like this hammer, and we were trying to try blockchains for everything,” Glover said. “All the systems that are trying to do it are easy and ultimately convenience will ultimately win at the end of the day.”

For her, Bluesky’s future lies in combining ideals of decentralization, such as user autonomy and portability, with a practical Web2 infrastructure that creates platforms that prioritize user needs.

“Blockchain will probably find it somewhere in the technology world, but Bluesky is just making the best choice for its users, so it’s not on the blockchain,” she concluded.

Nvidia’s revenue beat boost inventory offers a modest lift to AI tokens

Nvidia’s shares rose about 4% in trading Wednesday after reporting first-quarter earnings stronger than expected. This was highlighted by a 73% jump in the data center business driven by a 69% revenue increase from last year and a robust demand for AI chips. Net profit rose 26% to $18.8 billion, conservatively increasing Nvidia’s age-type performance, Coindesk previously reported.

The revenue report provided a modest lift to AI-related crypto tokens such as Bittensor (TAO), nearby protocols, and Internet computers (ICPs), although the gains were modest.

However, Nvidia has eased future expectations and warned that second quarter revenues may not reach market estimates due to tariff-related trade tensions between the US and China.

Market movements:

- BTC: While Nydig has more room for profit, Bitcoin has soaked 1.2% in $107,800. At the same time, Crypto Markets is shrugging from US courts blocking Trump’s widespread tariffs as unconstitutional, and BTC’s deal remains stifled.

- ETH: When Asia opens business days, ether is trading above $2,700. Previously, Coindesk analyst Omkar Godbole wrote that ETH has repeatedly had breakouts over $3,000.

- gold: Amidst safe demand for cooling, gold reduced 1% to $3,267.47 to $3,267.47, but tariffs and geopolitical uncertainty remain.

- Nikkei 225: Nikkei 225 is up 1% as export-dependent Japanese investors see recent announcements that the Supreme Court blocked Trump tariffs with cautious optimism, even if the code shrugs.

- S&P 500: The S&P 500 was closed in red, but the future is up 1% as traders become more clear about the court’s move to block Trump’s tariffs.