What you need to know:

Akshat Vaidhya lost nearly half of his $100,000 investment in Pantera’s early-stage token fund.

He criticized early-stage crypto VC funds for their high fees, poor trading quality, and excessive size.

Co-founded with Arthur Hayes, Maelstrom is currently focused on cashflow off-chain crypto business.

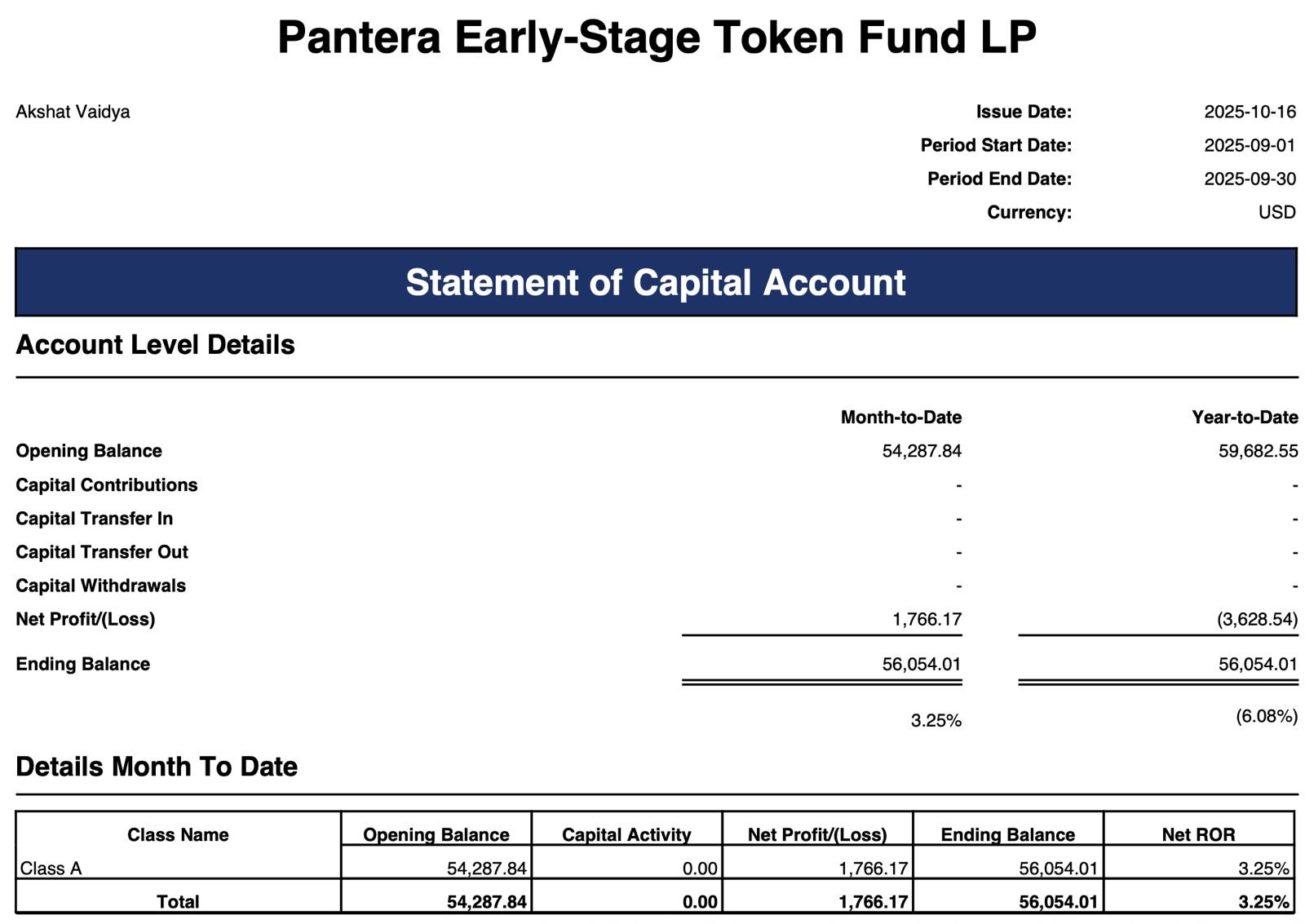

Maelstrom co-founder Akshat Vaidya’s eyebrow-raising confession reveals how investing in early-stage cryptocurrencies taught him a painful lesson in fees and fund size. Vaidya said that despite the rapid growth of the crypto market, his $100,000 personal investment in the Pantera Capital Early Stage Token Fund has dwindled to about $56,000 over four years.

In the X post, Vaidya pointed to high fees and poor scale as key issues. “My $100,000 evaporated to $56,000 (3% management + 30% carry) in less than 4 years with this early-stage token fund. In those 4 years, BTC doubled and numerous seed deals were multiplied by 20-75x. Yet this fund charged fees that wiped out half of my LP capital,” he wrote. His question was how the structure of many early-stage crypto funds, even in a virtuous cycle, left investors worse off.

Source: Akshat Maelstrom of X

What really happened?

Vaidya put money into a token fund run by Pantera. Over the next four years, the broader cryptocurrency market did well, with Bitcoin roughly doubling in that time. Many of the early-stage deals reportedly delivered returns of 20x to 75x for backers. But his slices have lost almost half of their value. He places much of the blame on the fund’s fee structure. In other words, there is an annual management fee of approximately 3% and a success fee of 30% on the upside. This combination squeezed returns, and in this case, wiped them out.

Vaidya argues that this is not just his bad luck, but indicative of broader trends in crypto venture investing. He said many early-stage crypto venture funds are getting too big, which means they have to invest in weaker deals simply because they need to deploy large pools of capital. Many VCs lose access to the most promising opportunities when they scale up too quickly. Therefore, even if some trades are successful, they charge high fees and eat into your profits. His point is how investors and LPs deserve a better opportunity to deploy their funds “at scale” without suffering from high fee resistance or losing the ability to back true breakout winners.

What’s different about Maelstrom?

Earlier last month, Vaidya explained how his company is taking a different path. Along with former BitMEX head Arthur Hayes, Maelstrom is launching a new vehicle, Maelstrom Equity Fund I, LP, focused on cash-flowing off-chain crypto businesses rather than token-only initial ventures.

According to Maelstrom, they are targeting “grab and roll” type businesses in infrastructure rather than speculative tokens. We also aim to provide a clean exit rather than locking founders into lengthy tokens and stock unlocks. They want to enable institutional investors to deploy large sums of money (amounts mentioned are in the nine figures) into crypto-native opportunities while avoiding the risks and drags of early-stage token funds. In other words, they believe that the future lies in the actual business model of cryptocurrencies, rather than just expecting their tokens to increase 20x overnight.

final thoughts

If you are an investor or someone who tracks how cryptocurrencies are evolving, there are some important lessons here.

- Even in a booming market, high fees are a problem. If a fund charges large management and performance fees, the upside would have to be very large to overcome them.

- Fund size is important. Larger funds can struggle to find enough high-quality trades, especially in niche areas like early-stage cryptocurrencies.

- Consider the type of exposure. Token funds can offer significant upside potential, but they also present significant risks and resistance. Funds that focus on real business may offer more stable returns.

- Always ask: How aligned is the fund manager with my interests? Is the fee structure fair? Is the strategy sustainable?

In the words of Akshat Vaidya: “Most early-stage crypto funds have grown too big for a small pool of true winners. LPs should be given a better opportunity to expand at scale…Early-stage crypto is just that.”

Whether you’re investing directly in crypto or considering the funds you allocate to crypto, this episode is a stark reminder that structure and scale are just as important as market timing.

Also read: After 3.5% drop in October, Bitcoin price reaches make-or-break zone