Bitcoin holds a dear life near the $110,000 level and is currently trading at $109,786. After an immense week of sales pressure, market-leading cryptocurrencies are stuck at current levels among what appears to be the beginning of the bear market.

However, this is far from BTC. In fact, Altcoins was hit even more harder as investors left the market. Ethereum is down more than 10% a week, but assets like Solana and Dogecoin can see up to 14% losses over the same time frame.

This sharp market correction has surprised many investors. Over the past four days, they witnessed more than $4.6 billion in liquidation, prompting hundreds of thousands of traders to be defeated and fill their positions.

The overwhelming majority of traders who were “shipwrecked” during that period were those who were betting on the market.

The overwhelming majority of traders who were “shipwrecked” during that period were those who were betting on the market.

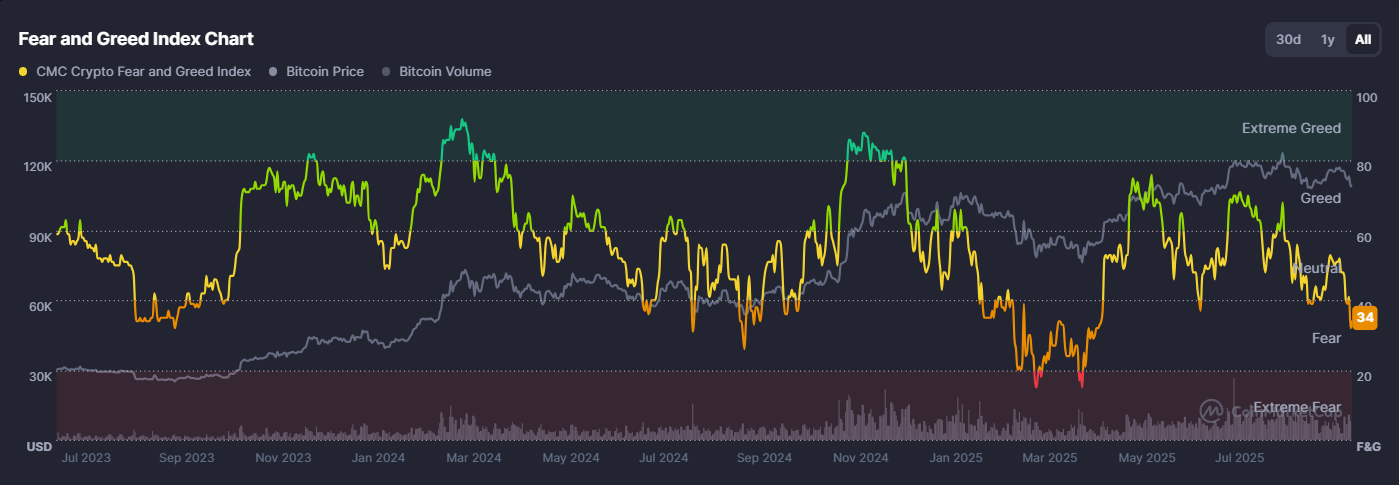

CoinMarketCap’s “Fear & Greed Index” is a metric that analyses the overall sentiment of the cryptocurrency market, reinforces the idea that it could reach its lowest point in 20 weeks and face more than just a market correction.

Market sentiment can say a lot, but in many cases it also raises the wrong flag. So are we at the beginning of a change in the direction of the market? Or is Crypto’s Bull Run above expectations heading into the last quarter of the year?

Market sentiment can say a lot, but in many cases it also raises the wrong flag. So are we at the beginning of a change in the direction of the market? Or is Crypto’s Bull Run above expectations heading into the last quarter of the year?

Who is afraid of bears? (Most people)

In traditional finance, many analysts turn to the “20% decline rule” to determine whether the market is changing in a different direction. Although a somewhat arbitrary number, the 20% mark helps you understand whether investors are dealing with volatility and prices or corrections, or whether the market is actually inverted.

Bitcoin/USD -1d

Bitcoin/USD -1d

As of September 26th, Bitcoin is “just 12% below its height as of August 14th.” With this metric, performance these days isn’t that great, but the recovery potential has not yet been out of the table.

Join now: $50 bonus, 100 USDT, iPhone 15 & More 🎁

Start trading

50 and 200 days SMA

Looking at the total cryptocurrency market capitalization chart, the overall trends are still visible A bit strongdespite the short-term trends, it is beginning to show signs of downward pressure.

Crypto Market Cap -1d

Crypto Market Cap -1d

Cryptocurrency’s market capitalization fell below the 50-day simple moving average (SMA) for the first time since June. However, Crypto is still trading comfortably above the 200-day SMA. The Bitcoin chart also shows very similar scenarios.

Simple Disclaimer: This does not mean that current sales pressure will be drained anytime soon. The 50-day SMA just started dipping this week, and while there’s still room for buyers to control, Crypto could continue to slump over the next few days.

So, what is causing the confusion?

The cryptocurrency market has fallen by $319 billion since September 17th. That same day, the Federal Reserve announced new interest rates, down 25 basis points.

So, yeah. Everyone at Crypto was excited about the interest rate cuts and wanted to inject more liquidity into the financial markets. And a week later… here we’re talking about bears.

A few days after the FOMC meeting, the final revision of GDP for the second quarter was announced, with an impressive 3.8% growth. And today, Bea has released a Core PCE report, showing steady but sticky inflation.

The thing is, we went through a series of developments that could have been Too positive For US dollars. In addition to that concept, the Ministry of Finance has been suspended for 10 years since the announcement of low interest rates. As of today, 10-y yields have increased by 0.17% in just 10 days.

Chart by CNBC

Chart by CNBC

With this extraordinary combination of low interest rates and GDP growth, risky assets such as crypto and stocks are far less attractive to investors. This explains why digital assets face set-offs.

So, because of the question of whether we are in the bear market. At least not so for now. So, investors should continue to watch SMA for 200 days, but future macro reports will determine what they can expect from crypto performance for the last quarter of this year.

In addition to trading opportunities, certain platforms add additional incentives. BrophinFor example, we’re running a September event where users can move from cash-equivalent bonuses to premium rewards such as the iPhone 15, Apple Vision Pro and the gorgeous Omega Watch for top tier participants.