Demand for altcoin ETFs is building in the United States, with the Securities and Exchange Commission receiving at least five altcoin ETF filings in the first half of October 2025. The filings arrived during the U.S. government shutdown, so issuers remain hopeful that regulated altcoin ETF products will gain traction once reviews resume. Altcoin ETF issuers are targeting the same buyers who took advantage of the Spot Bitcoin and Spot Ether ETFs earlier this year.

Demand is the next step after Bitcoin ETF demand and Ethereum ETF demand, said Leon Weidman, head of research at Web3 analytics firm Onchain. “After Bitcoin and Ethereum ETFs prove institutional demand, an influx of altcoin ETFs is the inevitable next step,” Weidman told Cointelegraph. He said this “reflects confidence in regulation in the flow of capital”. His comments illustrate why demand for altcoin ETFs will emerge immediately after the approval of Bitcoin and Ether ETFs.

Approval of altcoin ETFs could “open the door to the next wave of institutional investors,” Weidman said. He explained that the same group of investors is moving from demand for Bitcoin ETFs to demand for Ethereum ETFs and then to demand for altcoin ETFs. This model of altcoin ETFs is not a retail product. These are regulated instruments for institutions that do not want exposure to unregulated exchanges.

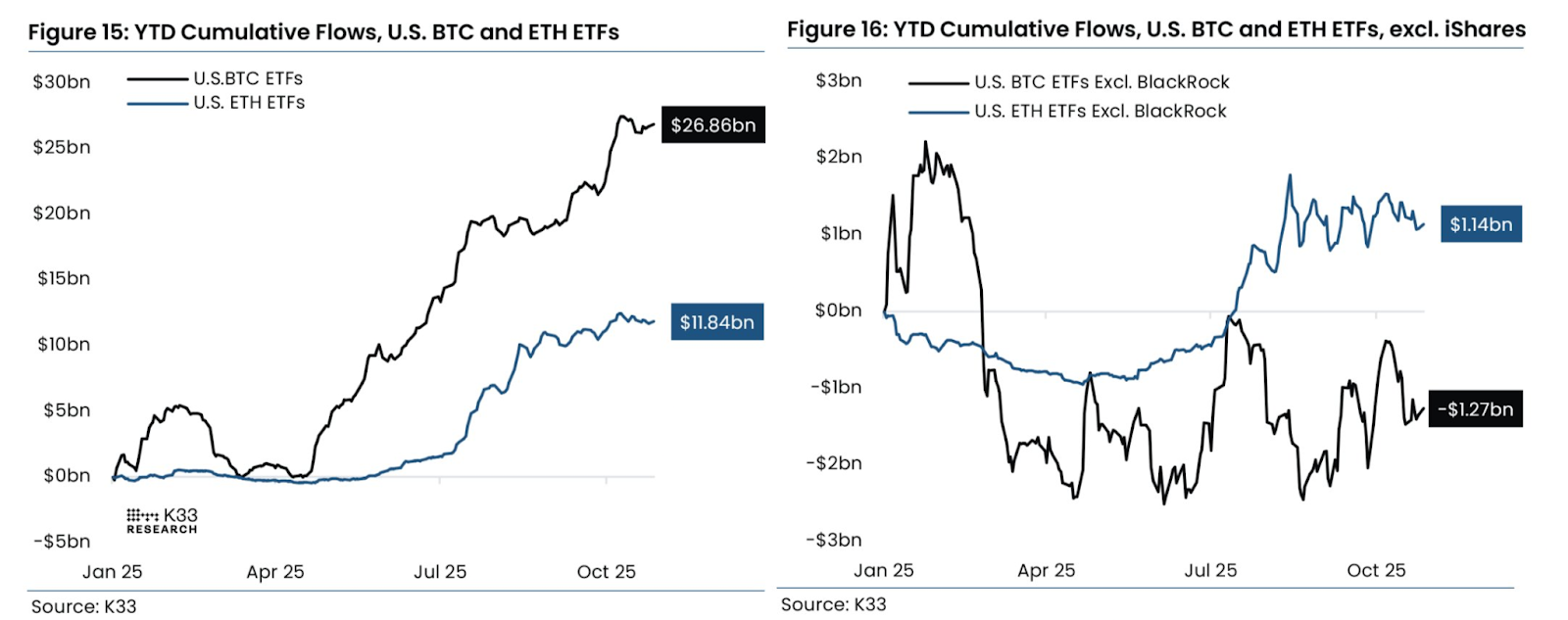

Ether ETF inflows will exceed Bitcoin ETF inflows in Q3 2025

Ethereum ETF inflows exceeded Bitcoin ETF inflows in Q3 2025. According to SosoValue, the Spot Ether (ETH) ETF attracted about $9.6 billion, while the Spot Bitcoin (BTC) ETF attracted about $8.7 billion in the third quarter of 2025. The fact that Ether ETF inflows exceed Bitcoin ETF inflows indicates that regulated investors are already accepting non-Bitcoin cryptocurrencies, given the same structure.

The demand for Ether ETFs is significant for the altcoin ETF market as Ethereum remains the second largest crypto asset and the ETF is the first non-Bitcoin asset to be widely used. For Ether ETF inflows to overtake Bitcoin ETF inflows in a given quarter, it would send a signal that there is room for more regulated crypto products in the market. “Financial institutions discovered Bitcoin through ETFs, but now they’re moving to Ethereum, and other altcoins will come next,” Weidman said.

According to SosoValue’s historical charts, Bitcoin ETFs continue to lead the market in terms of total inflows. However, changes in Q3 2025 indicate that ETF flows may become cyclical as new regulated large-cap crypto ETFs emerge. This rotation is why analysts associate Ether ETF inflows with altcoin ETF inflows. If an investor accepts Ethereum through an ETF, altcoin ETF products can also receive funds upon U.S. listing.

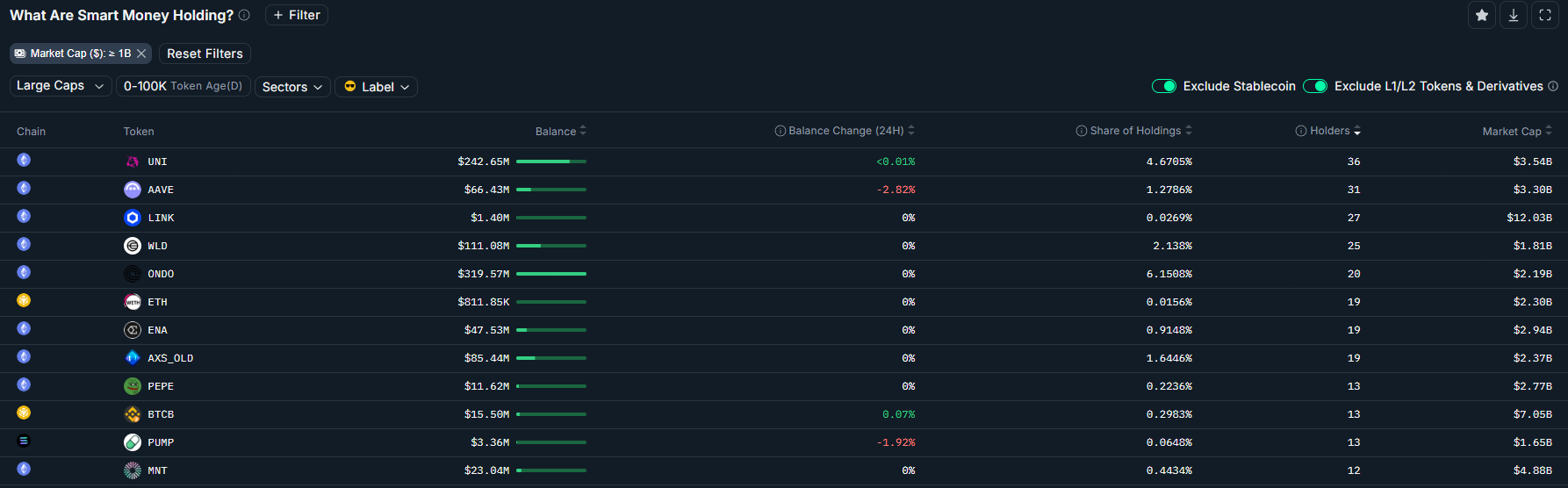

Smart money positioning for altcoin ETF listing

SmartMoney data supports the altcoin ETF story. On-chain data platform Nansen indicated on Thursday that “smart money” wallets hold Uniswap (UNI), Aave (AAVE), and Chainlink (LINK) as the top three tokens. These are DeFi and infrastructure tokens that can be used in altcoin ETF baskets because of their liquidity, history, and on-chain usage.

Smart money positioning in UNI, AAVE, and LINK means that professional crypto traders and funds aren’t just looking at Bitcoin ETF inflows and Ethereum ETF inflows. We are also preparing for demand for altcoin ETFs. These tokens are easy to explain to regulated buyers as they have distinct features: decentralized exchange (UNI), decentralized lending (AAVE), and oracles and data feeds (LINK). As such, they are reasonable candidates for early altcoin ETF products.

Issuers of altcoin ETFs will be looking at the same tokens that smart money already owns. This creates collaboration between issuers, on-chain traders, and institutional ETF buyers. This alignment is important because altcoin ETFs require underlying assets that are not only liquid but also widely recognized in both crypto-native and traditional financial circles.

BlackRock’s absence may limit altcoin ETF inflows

However, if BlackRock falls out of the first wave of altcoin ETFs, altcoin ETF inflows may not match Bitcoin ETF inflows. BlackRock’s Spot Bitcoin ETF attracted about $28.1 billion in 2025, making it the only fund with positive inflows year-to-date, according to Vettle Runde, head of research at K33. Without BlackRock, the combined Spot Bitcoin ETFs would have had net outflows of about $1.27 billion since the beginning of the year.

Altcoin ETF inflows could face the same pattern. If BlackRock does not list the altcoin ETF, cumulative inflows to the altcoin ETF may remain lower than some analysts expected. The ETF wrapper alone could not keep Bitcoin ETF inflows positive. A large, trusted publisher has done so. Runde’s data shows that both structure and issuer matter in the ETF market.

Altcoin ETF products could still come to market as the SEC has already received the application and Ethereum ETF inflows prove that regulated buyers are accepting non-Bitcoin assets. However, the size of altcoin ETF inflows may depend on which issuers participate. That’s why analysts track both the number of altcoin ETF applications and the names of the companies behind them.