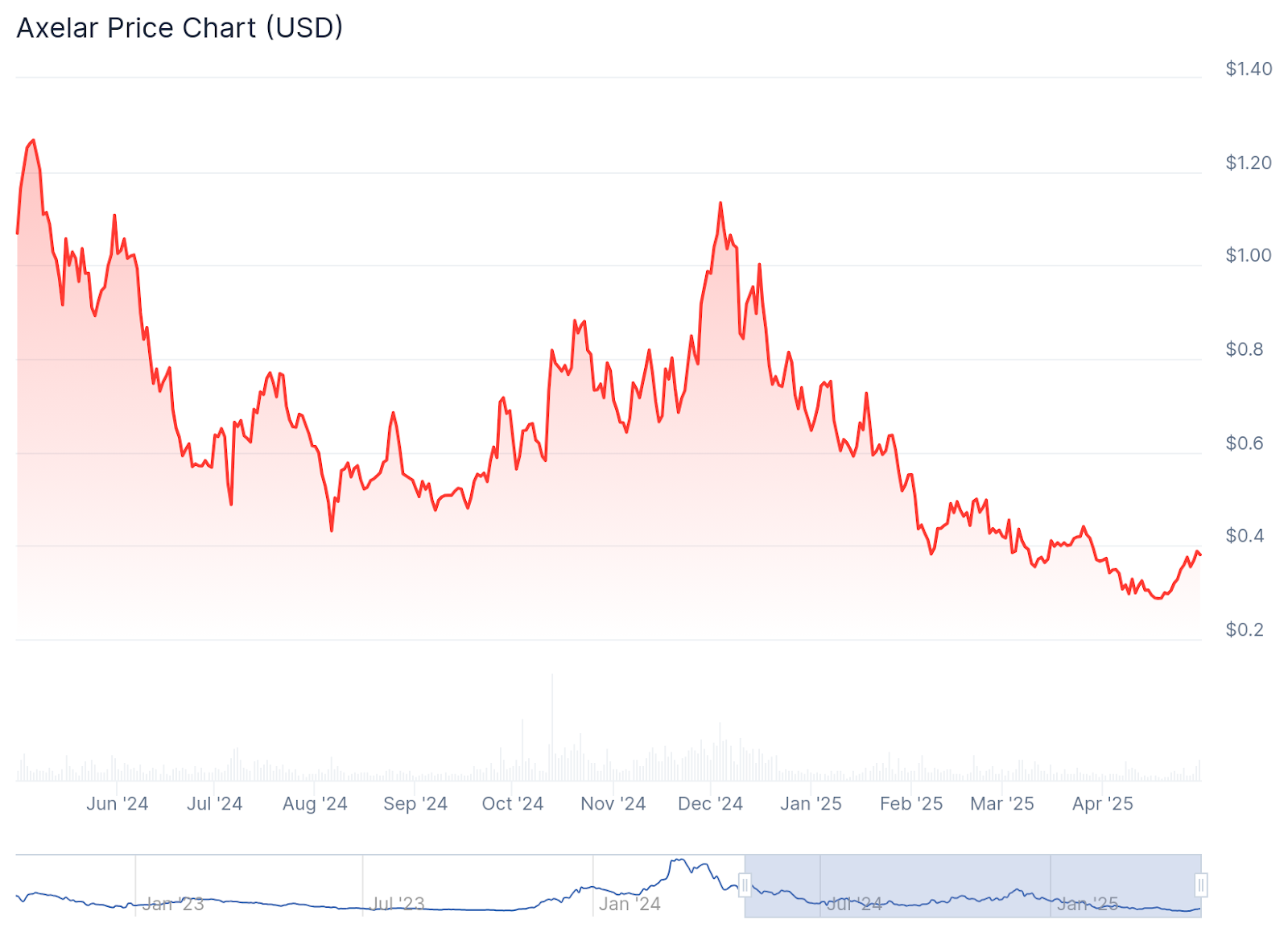

Axelar’s native token, $Axl, began to steadily recover after plunging to an all-time low of $0.2745 on April 7th.

At press time, $AXL has increased its market capitalization by nearly $370 million as trading volumes surged 246%.

Founded in 2021 by Sergey Gorbunov and Georgios Vlachos, Axelar is a Web3 interoperability protocol designed to simplify cross-chain communication and logic execution for developers.

The mainnet was released in February 2022, and then the general Message Path (GMP) protocol debuted in May of the same year.

Fluidity flows to the accelerators, but rarely

The $axl token initially gained momentum, rising to a peak of $2.66 from around $0.85 in 2022.

However, more than 85% of its value has since declined from its 2024 high, reflecting the wider market volatility and lower user activity.

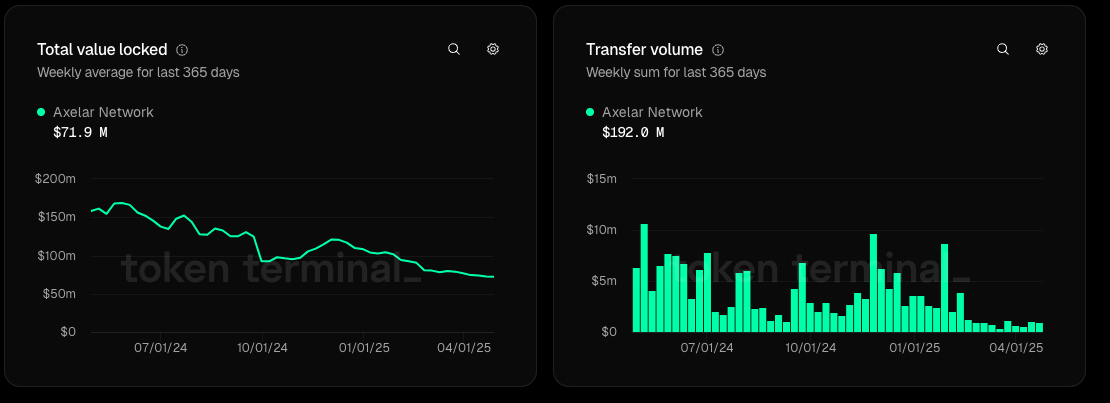

According to token devices data, Axelar’s locked total value (TVL) fell sharply from its peak in May 2024 $168 million.

This reduction can be attributed to Axelar’s utility as a routing protocol. This does not remain locked within the network, but rather passes through the network frequently.

Over the past year, the total assets over Axelar have reached just under $192 million.

Despite these numbers, Accelerators continue to attract key partnerships and industry trust.

In 2023, Axelar worked with Ondo Finance to launch Ondo Bridge, a cross-chain solution that now supports over $8 billion on diluted assets.

In March 2024, Ripple joined forces with the Axelar Foundation to integrate Axelar’s GMP protocol into the XRP ledger (XRPL) to increase interoperability of real-world assets (RWAs) tokenized over more than 55 blockchains.

Mobius Stack marks the turning point of Web3 interoperability in Axelar

Axelar, which further strengthened its role in cross-chain infrastructure, launched the Mobius Development Stack (MDS) on its mainnet in October 2024.

Considered as the first comprehensive interoperability platform, MDS bridges private chain environments with public layer 1 networks such as Solana, Stellar, and SUI.

This upgrade will be placed as the first facility-grade interoperability layer to integrate Axelar with Babylon and the Layer Proprietary, providing secure cross-chaining capabilities between Bitcoin, Ethereum and other chains.

Technical resistance first: can $axl push beyond $1?

Axelar has escaped from the downward channel, which has been limiting prices since early 2025.

This week’s Green Candle shows a clear breakout from that channel, closing around $0.3791 with a gain of about 6.9%.

Breakout candles are a bullish siege pattern on the weekly chart, indicating a reversal of potential trends. It swallows the previous red candle, indicating that the buyer has gained control.

Prices bounced back from the major support area around $0.3178, which was held multiple times in the past. If this level continues to be maintained, check the solid base.

The next important resistance is around $1.0421.

This level previously served as a great support and could now act as a resistance.

The above breaks will pave the way for the 2.20 zone, where previous highs reached.

If the price does not exceed $0.3178, the breakout could turn into a fake out and bring the price back to the downtrend.

Post after 85% crashes, facility support with eye recovery of Axelar ($axl) first appeared on Cryptonews.