Although Ripple-linked tokens have broken through multiple technical floors, the whale transfer has introduced new uncertainty to an already fragile market structure.

news background

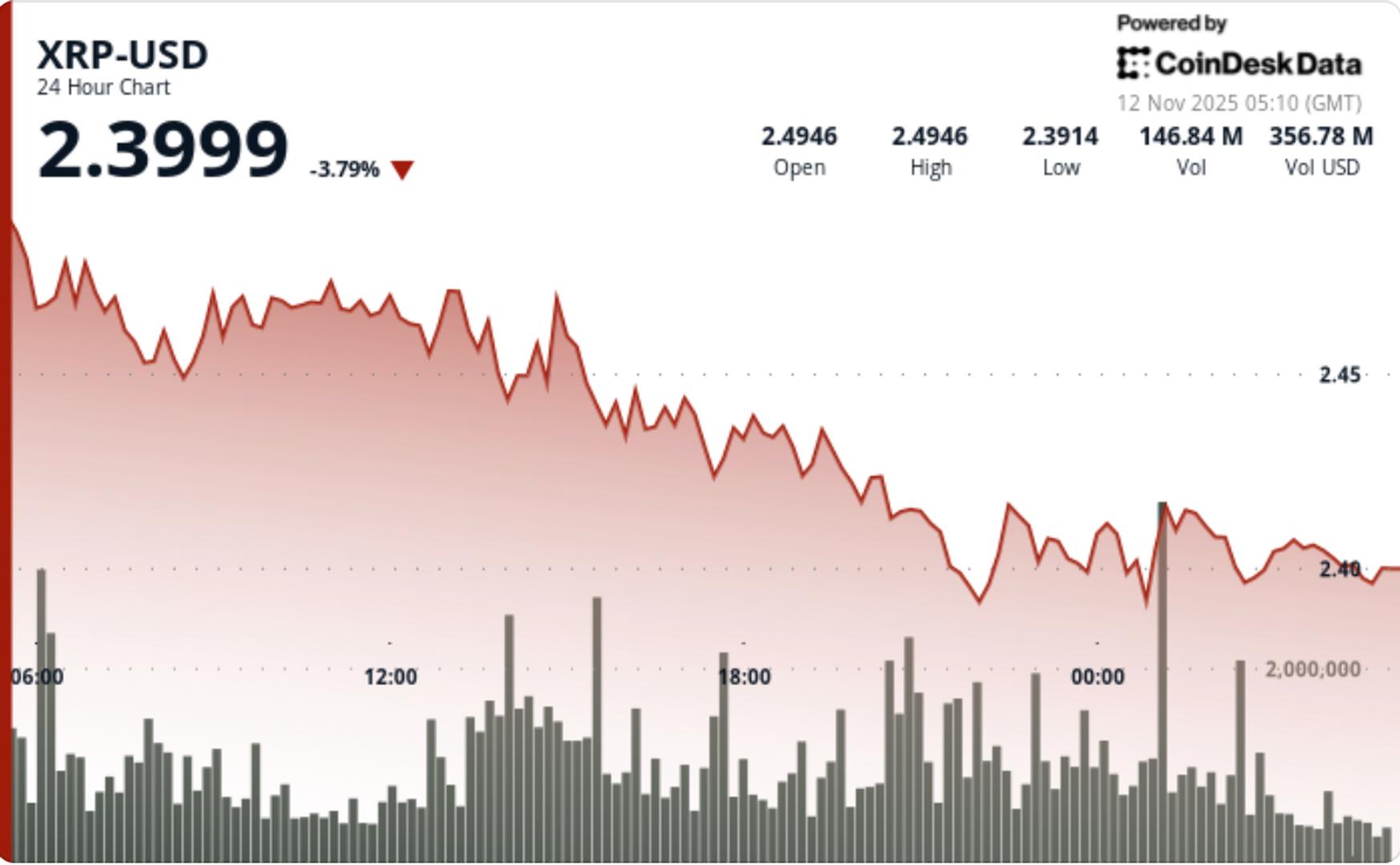

- XRP plunged 5.1% to $2.41, down from $2.54, as selling pressure overwhelmed a key support zone during Tuesday’s session.

- The move unfolded without a direct macro catalyst and instead reflected a technically-driven decline amplified by volume expansion and large-scale token movements across major wallets.

- Tennessee-based Canary Corp. on Monday filed Form 8-A, a requirement of the U.S. stock exchange for companies registering securities.

- The Canary XRP ETF tracks the spot price of the fourth-largest digital asset by market capitalization.

- Whale activity further exacerbated the volatility, with over $1 billion of XRP moving between custodial addresses linked to Ripple.

- On-chain data suggested this transfer was internal rather than exchange-related, but the timing created new uncertainty at a time of heightened technical vulnerabilities.

Overview of price fluctuations

- The decline stabilized around $2.39 to $2.41 as short-term buyers stepped in to absorb the selling pressure. The token rebounded slightly from the lows of $2.408, rising to $2.418 during overnight trading.

- Hourly data shows a 4.5% rebound from the session’s lows, with volume topping 1.1 million as of 02:01 UTC, suggesting opportunistic accumulation at discount levels.

- Despite the short-term recovery, XRP remains technically constrained. The consecutive lows from the $2.54 peak reflect a persistent distribution pattern. Failure to reclaim $2.47 or regain the broken $2.43 support will leave the broader setup vulnerable to further downside testing.

technical analysis

- The broader structure is tilting bearish as momentum indicators point to deterioration across medium-term time frames.

- The development of a death cross pattern with the 50-day moving average converging below 200 days is a cause for caution in the short term.

- The RSI reading is hovering near oversold territory, suggesting possible short-term easing, but stronger participation by institutional investors is needed to confirm the trend.

- The 38.2% Fibonacci retracement near $2.42 provides some immediate resistance, but a rally above $2.47 could restore balance in the near term. However, a break below $2.35 sharply increases the risk of a prolonged decline towards the $2.20-$2.25 zone.

What traders need to know

- XRP’s ability to defend the $2.39-$2.41 band will determine whether this move develops into a technical rebound or extends into deeper correction territory.

- The lack of panic volume on the downside of the final leg suggests controlled profit-taking rather than capitulation, although whale activity remains a sentiment wildcard.

- Institutional traders continue to monitor Ripple-related on-chain flows as a potential leading indicator of liquidity-driven changes.

- With broad cryptocurrency sentiment mixed, the next decisive move will depend on whether XRP can regain $2.47. This is the short-term pivot point that separates stabilization from sustained decline.