Please join us telegram Channels where you can get the latest information on breaking news

French hardware cryptocurrency wallet maker Ledger is preparing to raise new capital in 2026 and considering a New York listing as demand for security devices soars.

According to some people, Financial Times coverage It said Ledger CEO Pascal Gauthier is considering both a potential U.S. listing and a private financing round for its next round of funding.

“Crypto money is in New York right now. It’s not anywhere else in the world, certainly not in Europe,” Gauthier said, adding that investor appetite for digital asset infrastructure remains strong in the United States.

Leisure records best financial year ever

If Ledger were to go public in New York, it would follow what Gauthier described as the company’s strongest year ever.

Revenues for 2025 have already reached triple-digit millions of dollars and are expected to increase further as leisure enters peak season with Black Friday sales and the holiday shopping period.

Ledger was founded in 2014 and currently secures approximately $100 billion worth of cryptocurrencies on behalf of its customers. Following a funding round in 2023 led by 10T Holdings and True Global Ventures, the cryptocurrency hardware wallet company was valued at $1.5 billion.

Multiple virtual currency companies go public as regulatory environment eases

The US’s regulatory-friendly environment has led to a series of crypto companies going public.

USDC stablecoin issuer Circle raised $1.05 billion in a New York Stock Exchange (NYSE) listing earlier this year. Blish, a digital trading company backed by former PayPal executive Peter Thiel, also raised more than $1 billion.

Cryptocurrency exchange Gemini listed on the Nasdaq in September under the ticker symbol GEMI, raising approximately $425 million at a valuation of approximately $3.33 billion.

Cryptocurrency investors turn to cold storage solutions as crypto crime surges

Ledger’s record year comes as more crypto investors turn to cold storage solutions to protect their assets amid a surge in digital theft.

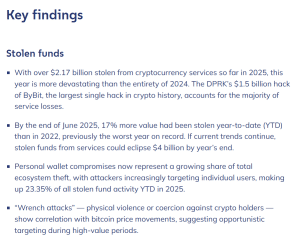

According to Chainalysis, in the first half of 2025 alone, criminals stole $2.17 billion worth of cryptocurrencies, more than the total in 2024.

More than $2.17 billion stolen from cryptocurrencies in the first half of 2025 (Source: chain analysis)

“We’re getting more and more hacked every day…bank accounts and cryptocurrencies are being hacked, and things aren’t going to get any better next year or the year after,” Gauthier told the FT.

Growing security concerns extend beyond the digital realm. Earlier this year, Ledger co-founder David Balland was kidnapped in France, his captors demanded a €10 million crypto ransom, and he was later arrested in Morocco.

As demand for cold storage solutions increases, Leisure has expanded its product line. We recently released an iOS app for enterprise users and also added native support for the TRON blockchain.

4. @ledger Enterprise is now integrated with the TRON network.

Click here for details @ledger_business 👇

— Trondao (@trondao) October 16, 2025

However, not all new leisure products have shocked the market. For example, the company’s multisig wallet feature has garnered mixed feedback from developers and longtime customers over its transaction fees.

Ledger also faced backlash earlier this year when it began phasing out support for Nano S devices, which will be discontinued in 2022.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news