Chartered Market Technician (CMT) Tony “The Bull” Severino argues that Bitcoin’s most reliable macro indicator, the copper-to-gold ratio, typically breaks character at the exact moment the market enters a parabolic phase, disrupting the post-halving script and leaving the altcoin without its normal rotation.

Why the copper-to-gold ratio matters for Bitcoin

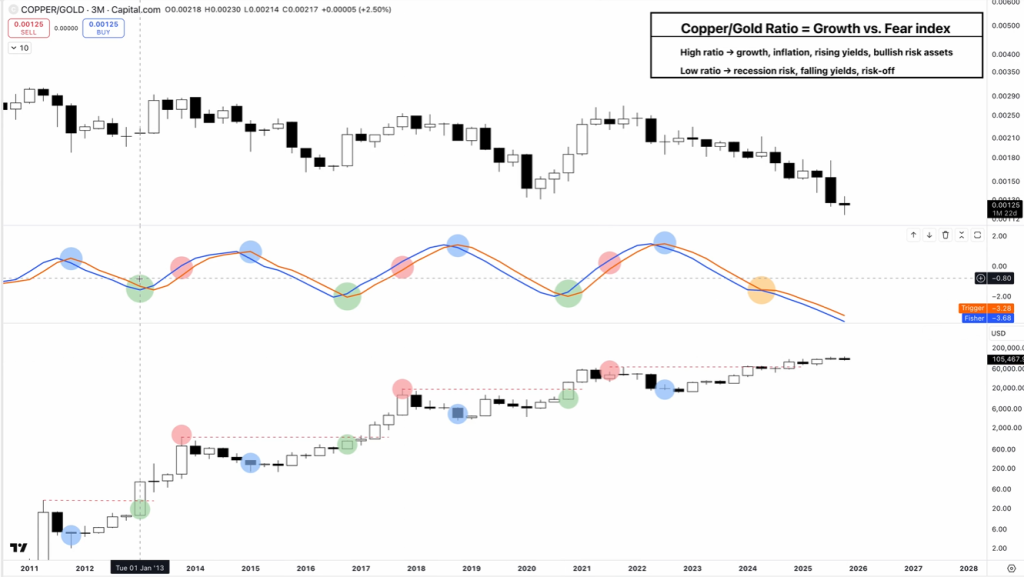

In a 16-minute video analysis published on November 10, Severino frames the copper-to-gold ratio as a “growth-versus-fear index,” with copper’s strength indicating expansion, rising yields, and risk appetite, while gold’s outperformance maps to recession risk, falling yields, and risk-off behavior.

“When gold performs better than copper, it usually means an economic slowdown [and] He added that “industrial demand for copper locks this ratio into the business cycle. The punchline is that the cyclical shift in ratios that historically coincided with Bitcoin’s vertical simply never arrived. The most dangerous thing in investing, they say, is that this time it will be different. “Well, this time it will be different. The business cycle based on the copper-to-gold ratio did not recover,” Severino said.

Severino argues that the four-year half-life myth is at best incomplete and at worst misattributed. He superimposed previous halving dates with the Fisher transformation signal of the copper/gold ratio and observed that the true inflection has historically been macro rather than supply driven. “I had no idea this was a half-life,” he says. “The NASDAQ market bull market began on the same halving date.” […] Bitcoin halving will have no real impact on tech stocks. In his view, the halving coincides with, rather than being caused by, a rising Bitcoin ratio and a risk-on impulse, which typically pushes Bitcoin past previous highs and into a final parabolic leg.

Related books

This cycle has diverged. After briefly recording a “higher high” in the ratio for the first time since approximately 2010, copper/gold failed to establish a higher low and instead recorded a “lower low,” marking, in Severino’s words, its lowest on the chart in “almost 15 years since the Great Recession.”

Fisher transformations that were historically reversed to confirm the risk-on window never achieved complete follow-through. “It was supposed to send Bitcoin into the final stages of a parabolic rally.” […] It didn’t go parabolic after breaking past all-time highs. We’re just meandering sideways. ”

Is the Bitcoin cycle at the top?

In terms of timing, failure is important. Severino measured roughly a year between the ratio’s go signal and the Bitcoin cycle top in the previous episode. By that standard, it “should really be above” already, or at least in the risk-off window if it’s anchored to the March breakout above the 2021 high. But without a decisive risk-on impulse, the markers of the cycle become vague. “We don’t know where the risk-off signals are because we don’t have complete risk-on,” he said.

Related books

The impact extends to the dominance of altcoins and Bitcoin. Historically, the green “risk-on” phase of this ratio has been aligned with the “alternative season,” but that setting did not materialize this time. “Alternative seasons typically begin with these green points […] “We didn’t get it here,” Severino said, noting that Bitcoin’s dominance holds significant support on a higher timeframe view, but also highlighting the current “very strong negative correlation” between Bitcoin and the copper/gold ratio. , added that while in past cycles the correlation has tended to trend toward zero, coinciding with altseason, “none of the conditions for altcoin season appear to be here, based on historical economic signals.”

Severino stops short of making a decisive decision. The trend structure of this ratio is ambiguous, and even if a breakout from a long downtrend fails, it will not turn into an uptrend. Fisher signals can still change direction. But until that happens, macros require caution, he argues.

“At this ratio, we’re still on the fear side. We still need to be defensive and risk-off. Once this starts to recover, we could consider becoming a bullish risk asset again.” This ambiguity is why Bitcoin’s post-ATH trend bucked the well-worn four-year narrative, he suggests. […] We are different. This time it’s really different. ”

At the time of writing, BTC was trading at $104,486.

Featured image created with DALL.E, chart on TradingView.com