important notes

- Bitwise BSOL options began trading on November 11th, with strike prices ranging from $16 to $26, and expiration dates until May 2026.

- The fund manages $497.2 million in assets and has captured 98% of total inflows into the Solana ETF market since its inception.

- BSOL stakes all its holdings for a net reward of 7.20% with zero fees on the first $1 billion until January 2026.

Bitwise Solana Staking ETF (BSOL) options trading began on November 11th, with derivatives added to the spot exchange-traded fund launched on October 28th. This development allows institutional investors to hedge their positions and execute complex trading strategies on Solana.

sol

$157.3

24 hour volatility:

6.0%

Market capitalization:

$87.30B

Vol. 24 hours:

$5.96B

exposed vehicle.

Bitwise President Teddy Fusaro and CEO Hunter Horsley confirmed the option launch via an X post on Nov. 11, with a screenshot from the Bloomberg terminal showing active call and put contracts. CoinSpeaker confirmed that the options are available via Interactive Brokers with strike prices ranging from $16 to $26.

Today’s milestone —

Options are currently trading live $BSOLBitwise Solana Staking ETF.

Bridges are opening for investment professionals.

— Hunter Horsley (@HHorsley) November 11, 2025

Option chains display multiple expiration dates, including November 21, 2025, December 19, 2025, February 20, 2026, and May 15, 2026. The fund reported 22.4 million shares outstanding as of Nov. 10, according to an SEC filing.

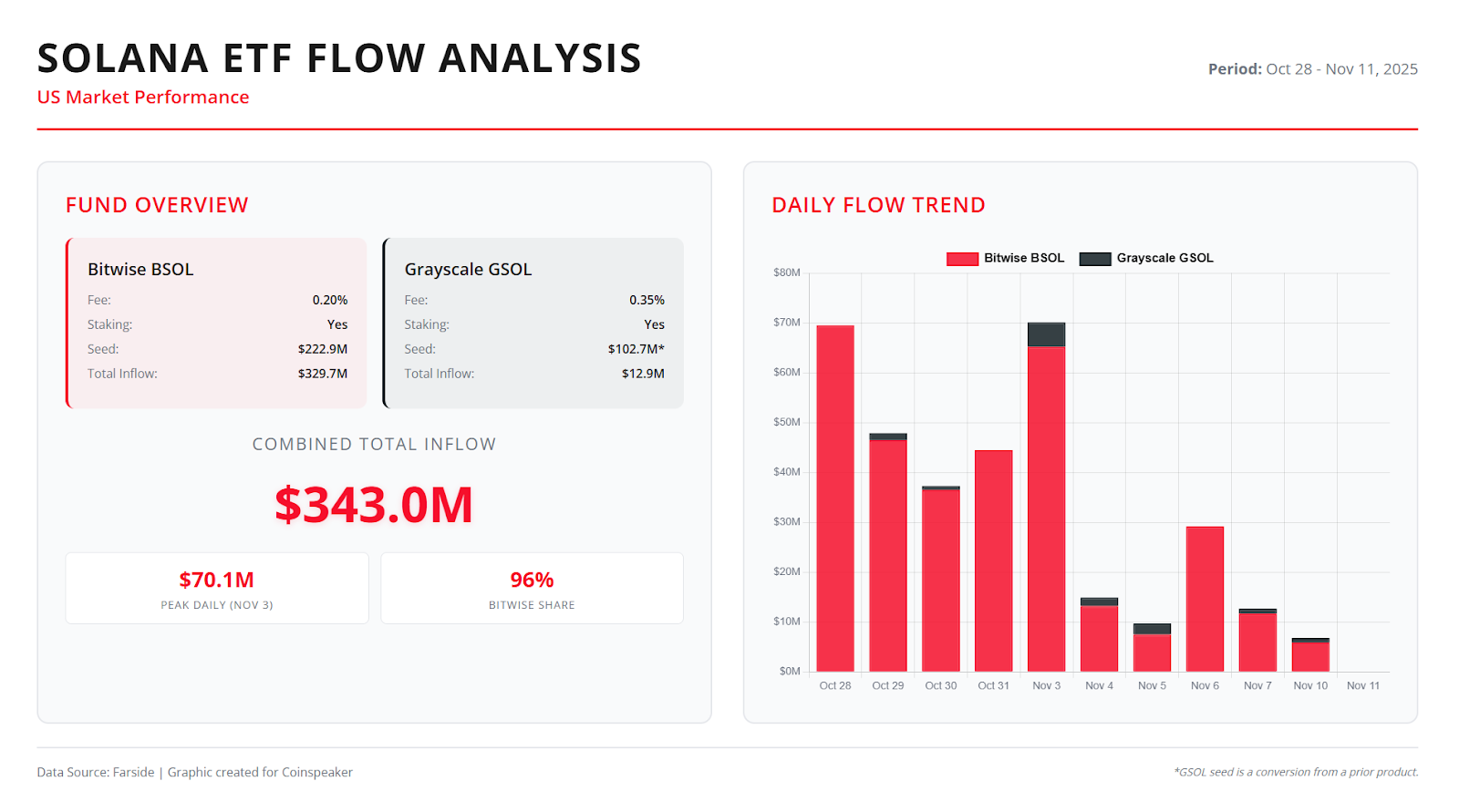

According to official fund data as of Nov. 9, BSOL has $497.2 million in assets under management and 22.7 million shares outstanding, making it the largest Solana ETF in the United States. Pharside Investors’ account balance is just $329.7 million. But the fund actually captured about 98% of the Solana ETF’s total inflows during its first trading period, outperforming Grayscale’s GSOL.

Coinspeaker Solana ETF Flow Analysis |Source: Farside

ETF structure and launch

According to Bitwise’s official announcement, the fund will be launched on NYSE Arca on October 28th with a management fee of 0.20%, and the first $1 billion in assets will be fully exempt until January 28, 2026. BSOL stakes 100% of its Solana holdings to generate a net staking reward rate of 7.20%, with rewards automatically reinvested into the fund. The trust operates as a grantor trust for federal tax purposes, meaning that income and expenses flow to shareholders.

Authorized Participants will create or redeem 10,000 units of stock at net asset value through in-kind transfer or cash settlement in Solana. Grayscale’s GSOL has become a major competitor in the U.S. Solana ETF market, with Solana ETF inflows reaching $150 million across products through October 31st.

The rapid progression from ETFs to options stands in contrast to previous crypto ETF timelines. Ethereum

Ethereum

$3,450

24 hour volatility:

3.3%

Market capitalization:

41.657 billion dollars

Vol. 24 hours:

$3.46 billion

ETF options were launched on October 23, 2025, approximately 15 months after the spot ETF debut in July 2024.

market activity

The Solana ecosystem is seeing increased activity coinciding with the launch of institutional products. Solana DEX trading volume exceeded $5 billion in early November, with network metrics showing sustained growth in trading volume and user activity.

Solana’s educational adoption continues to grow through regulated products. The introduction of this option provides portfolio managers with the risk management tools typically needed to make allocation decisions. Delaware Trust Company serves as trustee of the fund, which was established as the Bitwise Solana ETF on November 20, 2024, prior to adopting its current ownership structure. Coinbase Custody Trust Co. acts as a custodian of digital assets.

Bitwise manages several cryptocurrency ETPs, including recently approved Bitcoin and Ethereum products for retail investors in the UK. The company’s crypto fund lineup spans major digital assets, with both spot and staking capabilities where applicable.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.

Zoran Spirkovski, Web3 Marketing Strategist and former CMO of DuckDAO, transforms complex cryptographic concepts into compelling stories that drive growth. With a background in cryptocurrency journalism, he excels in developing go-to-market strategies for DeFi, L2, and GameFi projects.

Zoran Spielkovskiy of X