Ethereum continues to solidify its dominant position in blockchain-based tokenized assets, with far-reaching implications for the future of crypto markets and institutional adoption. As the ecosystem evolves, the role of networks facilitating real-world assets and decentralized finance (DeFi) is expanding, driving critical activity and value.

-

Ethereum hosts approximately $201 billion in tokenized assets, nearly two-thirds of the $314 billion global total.

-

Institutional investors, led by companies like BlackRock and Fidelity, have contributed to an approximately 2,000% increase in on-chain fund assets since the beginning of 2024.

-

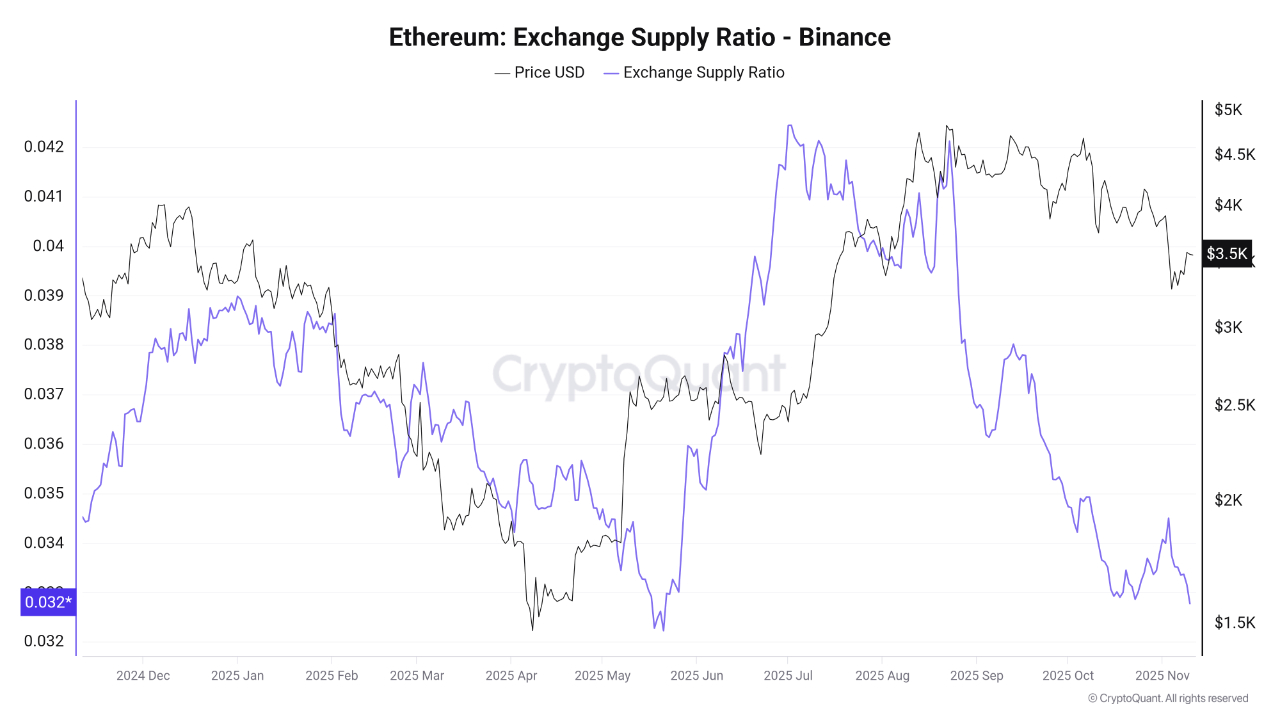

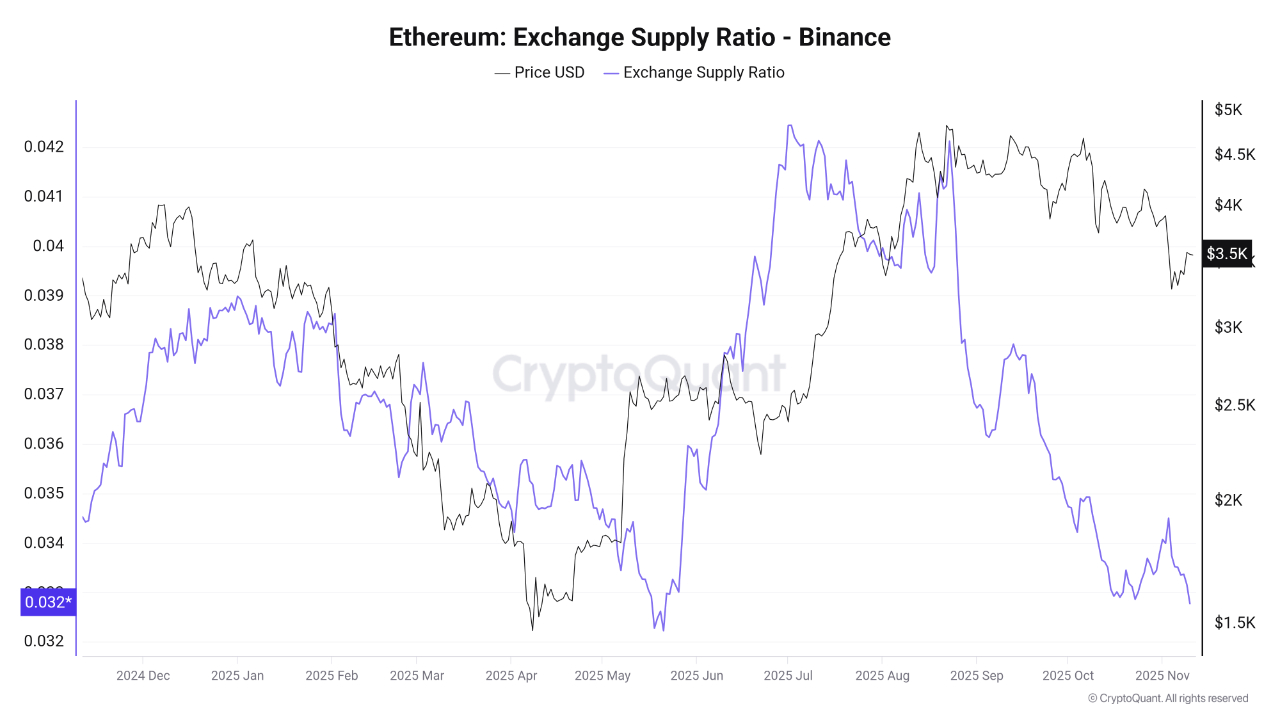

Ether exchange supply options are signaling a bullish trend, with exchange holdings falling to their lowest level in almost a year, indicating investor accumulation.

Ethereum’s dominant role in the tokenized asset market continues to grow, with its network currently hosting approximately $201 billion in tokenized value, according to recent data. This represents nearly two-thirds of the global total of $314 billion, highlighting ETH’s status as the industry’s leading payment layer and its widespread influence in DeFi, NFTs, and asset tokenization.

Stablecoins like USDT and USDC dominate Ethereum transaction flows, facilitating DeFi protocols, cross-border payments, and liquidity pools across exchanges. This activity maintains Ethereum’s high throughput and highlights Ethereum’s integral role in the global crypto economy.

The expansion of tokenized assets goes beyond stablecoins. Total assets under management (AUM) of tokenized funds on Ethereum have surged nearly 2,000% since January 2024 as traditional financial giants like BlackRock and Fidelity have introduced institutional investment products on the blockchain. Fidelity Digital Assets highlights that stablecoins processed more than $18 trillion last year, surpassing traditional payment giants such as Visa.

Meanwhile, real world assets (RWA), including tokenized government bonds, funds, and credit products, have emerged as Ethereum’s fastest growing niche market, reaching a cumulative $12 billion and accounting for more than a third of the global RWA market. Protocols such as Ondo, Centrifuge, and Maple offer yields of 4-6% and attract both institutional and retail investors.

Token Terminal highlights that this significant growth in tokenized assets underpins Ethereum’s roughly $430 billion market cap, effectively rooting it in tangible on-chain utility and potentially setting the basis for a lower bound on ETH’s valuation.

ETH exchange supply points enter bullish setup

According to CryptoQuant analysis, the amount of ETH held on exchanges has declined sharply since mid-2025, reaching its lowest level since May 2024. Significant outflows, especially from Ethereum’s main trading platform Binance, suggest that investors are moving coins into cold storage or long-term wallets, a classic sign of accumulation.

This decline coincides with ETH prices peaking around $4,500 to $5,000 in August and September before recently returning to around $3,500. Many analysts interpret the decline in currency supply as a sign that investors are expecting the market to strengthen, as an improvement in broader market sentiment could pave the way for prices to stabilize or rise due to reduced selling pressure.

Overall, continued developments in Ethereum’s tokenization, institutional adoption, and supply dynamics suggest a resilient and potentially bullish outlook for investors keeping a close eye on this evolving ecosystem.