- Privacy tokens like Zcash are gaining renewed interest due to institutional demand for confidential transactions.

- Zero-knowledge (ZK) proofs are central to enabling private, scalable, system-level privacy solutions on Ethereum and other blockchains.

- Financial institutions are seeking a privacy layer that allows visibility into internal transactions and facilitates blockchain-based clearing and payments without publicly exposing data.

- Emerging blockchain solutions aim to bridge private corporate networks and public liquidity while ensuring compliance and maintaining confidentiality.

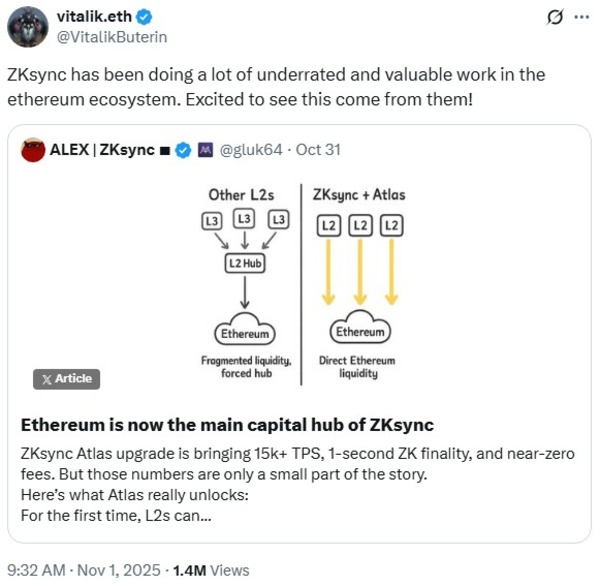

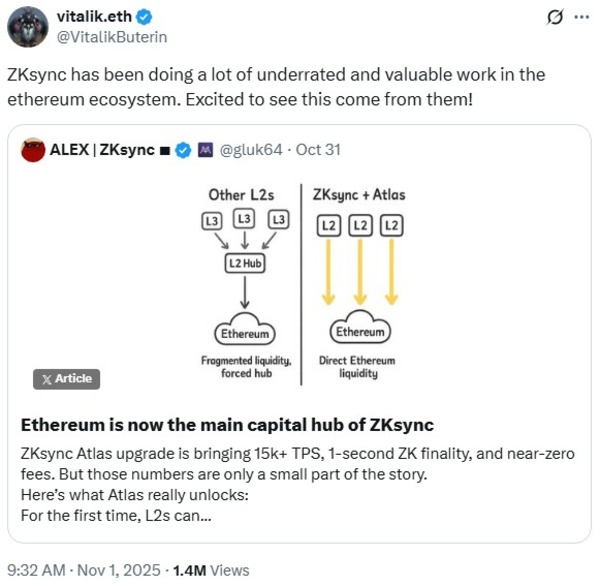

- Organizational use cases in DeFi are gaining traction, with layer 2 solutions like ZKsync leading the charge growth and adoption.

Privacy tokens and organizational attention gain momentum

Despite the slowdown in retail crypto speculation, privacy tokens have historically bucked this trend by gaining popularity during market downturns. Although projects like Zcash are gaining traction, the main driver now is the needs of financial institutions and businesses. Banks and asset management companies require confidential transaction channels on blockchain to meet regulatory standards and protect sensitive data, prompting a move to system-level privacy solutions.

said Alex Gluchowski, CEO of Matter Labs. “Each agency needs complete visibility into their flows while keeping data private from others.”

Gluchowski’s interest in blockchain began with Bitcoin in 2014, but his focus shifted during Ethereum’s ICO boom, where smart contracts opened up new use cases. His company, Matter Labs, is at the heart of the development of ZKsync, an Ethereum layer 2 network that leverages zero-knowledge proofs to enable scalable private transactions and power new-age privacy-focused enterprise blockchain solutions.

As of early November, many companies (more than 140 in total) held approximately $137 billion in crypto assets. However, Glukowski stressed that the future lies in moving payments and settlement flows to public blockchains, which will require a robust privacy layer to ensure confidentiality.

Changing perspectives on privacy and regulation

While the crypto cycle is often characterized by speculation such as meme coins with little real utility, the focus on privacy is highlighted through its direct functional role in the financial system. Regulatory pressure has previously led to the delisting of privacy coins and sanctions like those against Tornado Cash. However, recent policy shifts, particularly under the current US administration, suggest a more nuanced view that recognizes privacy as a technological capability rather than simply an enabler of illegal activity.

Glukowski said this attitude has gone from taboo to strategic necessity: “We need to embrace this technology or we risk falling behind.” The resurgence of privacy tokens like Zcash is indicative of the growing focus of organizations driven by the need to conduct sensitive operations on shared infrastructure without exposing internal data on transparent public ledgers.

This evolving approach is reflected within the Ethereum ecosystem, with privacy solutions being integrated as system-level requirements. Unlike consumer privacy, institutional financial privacy requirements include a private execution environment where data remains under the control of the organization and has limited external visibility.

Bridging privacy and connectivity in blockchain

Historically, private enterprise blockchains have faced trade-offs. Internal confidentiality was maintained but remained separate from the broader liquidity pool. Currently, solutions such as ZK Proof and locally operated private chains aim to solve this dilemma, allowing institutions to maintain privacy while seamlessly interacting with public markets.

Gluchowski highlights that incorporating zero-knowledge proofs into these private chains allows for the validation of transactions without revealing sensitive data, creating a hybrid model of privacy and interoperability. This approach will significantly strengthen the adoption of blockchain in regulated areas such as finance and corporate payments.

Growing layers of organizational privacy

Recent data shows increased fee activity on ZKsync due to new tokenomics and staking initiatives, indicating widespread institutional interest. Gurkowski attributes the surge not to retail speculation but to market readiness and the development of new economic models.

While consumer cryptocurrency use cases continue to grow rapidly, the next major phase of blockchain adoption will center on the participation of institutions where privacy and confidentiality are operational imperatives. ZKsync’s expansion into multi-chain networks with private system deployments exemplifies this trend, with several implementations already in the testing phase and ready for mainstream operation by the end of the year.

As the industry evolves, privacy layers embedded in blockchain infrastructure are becoming critical to the compliance, confidentiality, and seamless operation of institutional DeFi strategies.