In recent weeks, Ethereum has shown a promising recovery, with the price breaking through a critical level and many holders returning to profitability. This upward momentum indicates the potential for further gains, especially if ETH is able to hold support levels and break through key resistance points. As the broader crypto market remains volatile, investor sentiment and trading trends around Ethereum continue to shift, with bullish forecasts gaining momentum amid improving on-chain metrics.

- Ethereum’s price above $3,600 indicates that most holders are no longer in the red, increasing confidence in the possibility of a rally towards $4,000.

- A key resistance zone around $3,800 could act as resistance for the bulls as many investors are positioned at the break-even level.

- A hold above $3,500 will be key for Ethereum to reach its recent highs, with support levels seen around $2,870, $2,530, and $1,800.

- Market participants are keeping an eye on the $3,700-$3,900 barrier, with some analysts stressing the importance of converting this into support to reach new milestones.

Ethereum trades above cost basis, boosting bullish sentiment

ETH has soared about 20% from its four-month low of $3,050 on Nov. 4, trading above $3,650 on Sunday, according to data from Cointelegraph Markets Pro and TradingView. This recovery has pushed the price of Ether above its realized price (currently around $3,545). This indicates that the majority of holders are no longer facing unrealized losses, indicating a potential shift in market sentiment towards the bullish side.

This turnaround was driven in part by political developments, such as then-President Trump’s promise of a $2,000 tariff dividend payment and optimism about the possibility of lifting the U.S. government shutdown, which increased confidence across the market. The positive sentiment also pushed Ethereum above the market price, providing financial security to many investors and easing selling pressure from pent-up investors.

This emotional and economic turnaround is often preceded by a strong recovery in prices. Historically, when Ethereum regained its prevailing price, it experienced significant rallies, including an 89% increase from $2,165 to $4,100.

Holding support above $3,500 is essential for the bulls to retest the $4,000 resistance zone, which remains a major psychological and technical barrier. On the contrary, if Ethereum fails to sustain above this level, it could fall towards support zones around $2,870, $2,530, and even $1,800, according to its deviation price range.

$3,800 resistance and the fight to move higher

According to on-chain data, many investors currently hold approximately 4.2 million ETH at an average purchase price of $3,600 to $3,815. This cluster of cost-based positions models a potential resistance zone that could prompt profit-taking near current levels, thereby hindering any immediate upward momentum.

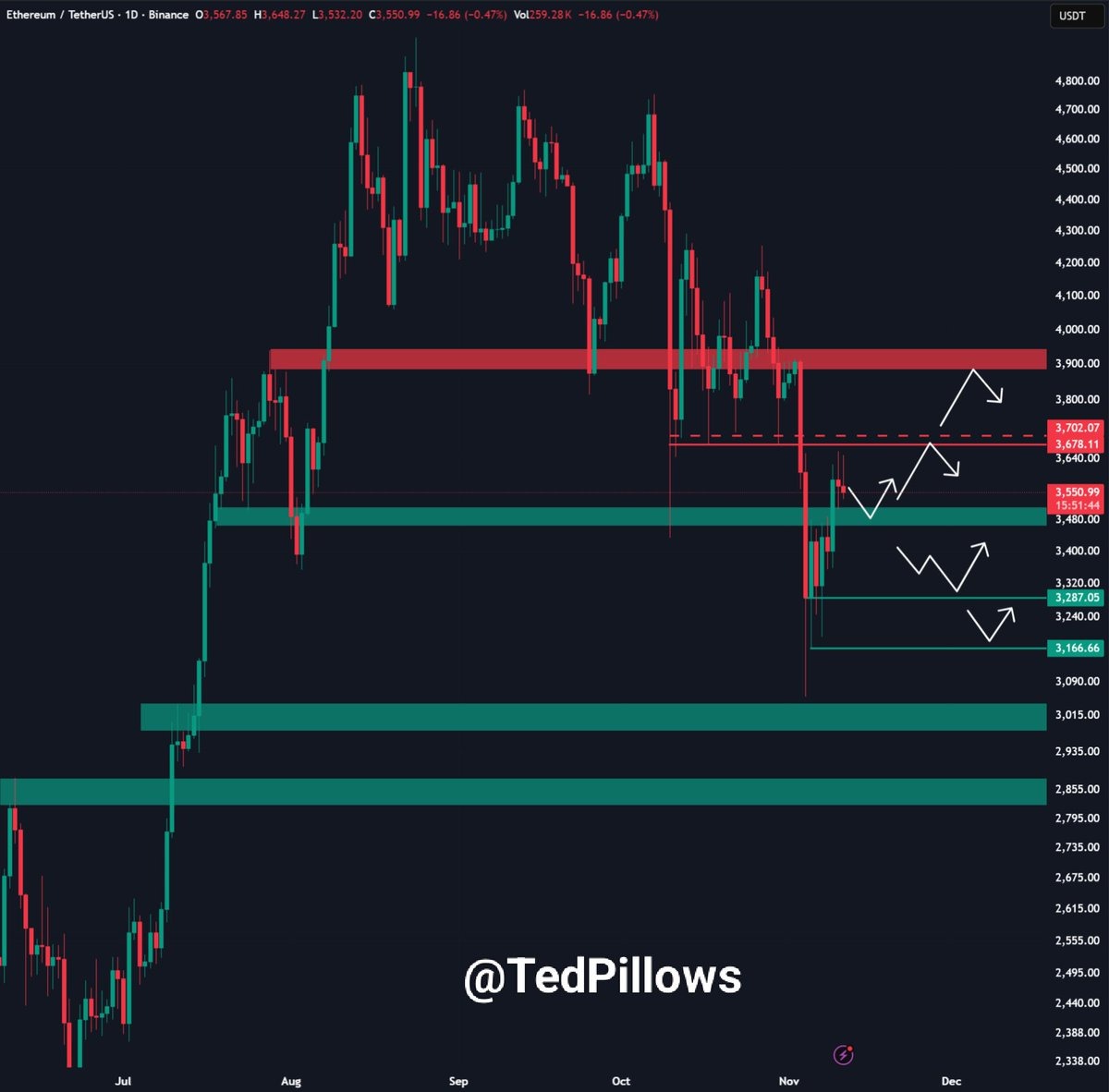

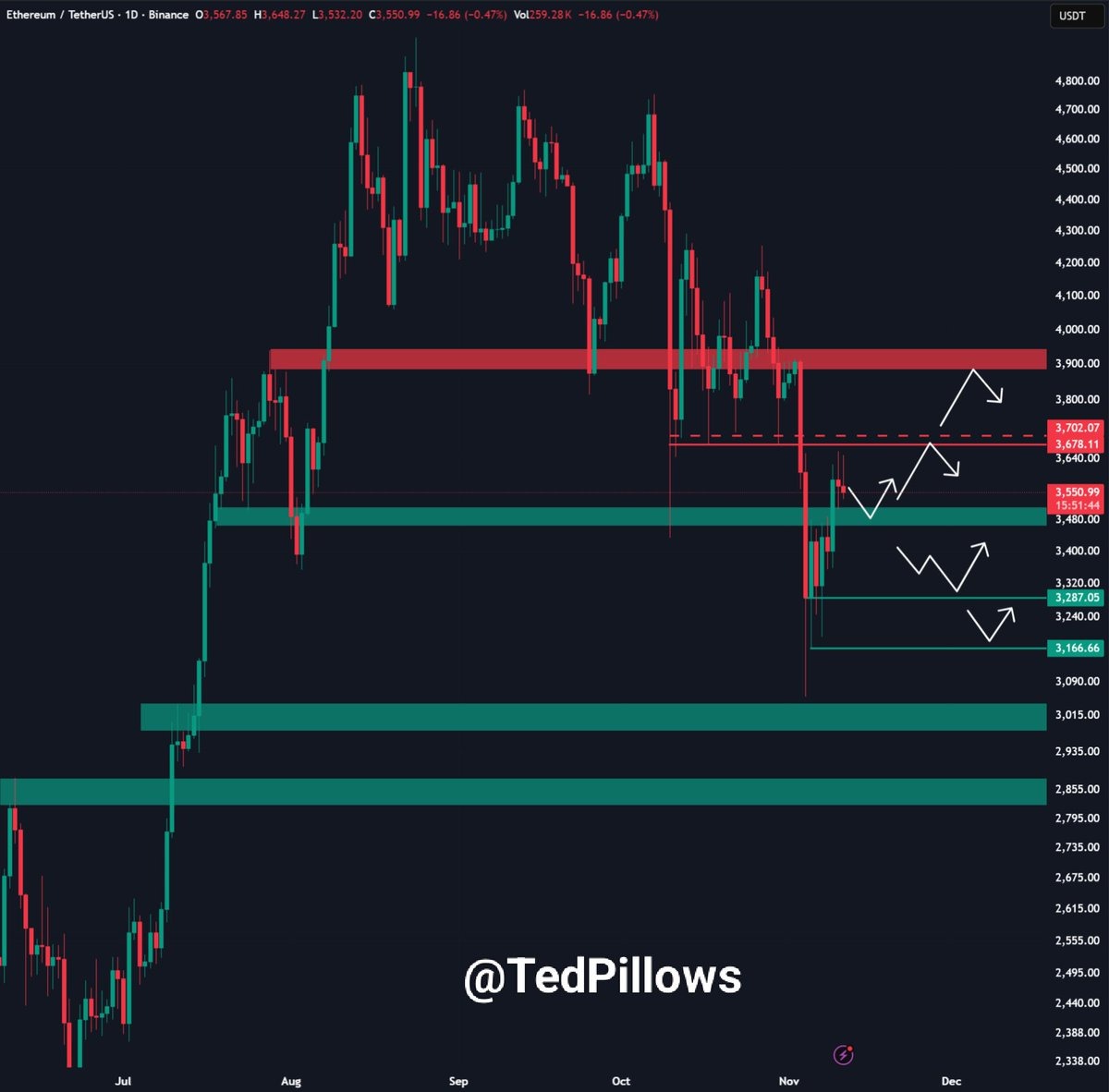

Traders have emphasized that Ethereum needs to break through the $3,700-$3,900 resistance area to gain the necessary momentum toward new highs above $4,000. As stated by analyst Ted Pillows on social media, ETH’s inability to regain the $3,700 level suggests a decline, but the possibility exists if it can regain this threshold by targeting the $4,000 to $4,100 liquidity zone.

Market analysts, including Michael van de Poppe, have suggested that breaking out of the $3,800 to $3,900 range is key to unlocking the potential of an all-time high, and Gell emphasizes the importance of rising above the $4,000 mark as soon as possible.

Furthermore, interest from institutional investors also appears to be increasing, with companies like BitMine expanding their holdings in Ethereum, accumulating over 110,000 ETH in the last week as part of a broader strategy to capture up to 5% of the total supply, demonstrating growing confidence in the resilience of the Ethereum network as debates over cryptocurrency regulation and DeFi growth continue.

This article is for informational purposes only and does not constitute investment advice. Investing in cryptocurrencies involves risks. Thorough research and careful decision-making are essential.