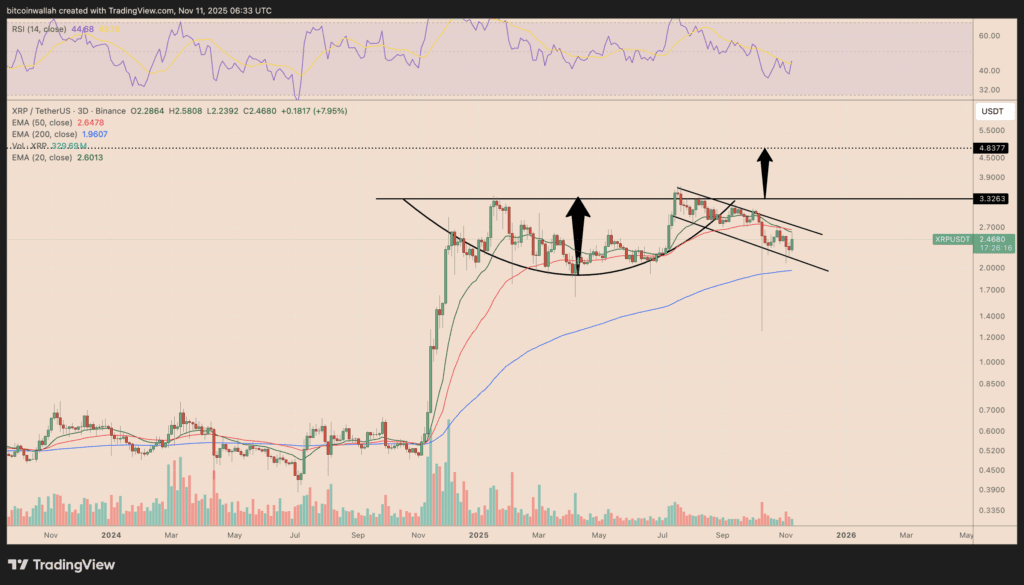

XRP (XRP) is gearing up for what technical analysts are calling a “mega breakout” after forming a classic cup-and-handle pattern. On the other hand, we may get the macro catalyst we’ve been waiting for, with a looming U.S. Treasury shutdown potentially unleashing locked-up liquidity.

$XRP Mega breakout has arrived pic.twitter.com/M4jpLNqgRA

— Mikybull 🐂Crypto (@MikybullCrypto) November 11, 2025

Cup & Handle Pattern is 100% XRP Rally Tips

Across the 3-day and weekly charts, XRP has carved out a textbook cup and handle. The round base (the “cup”) is followed by a small consolidation (the “handle”) that has been forming under major resistance in recent weeks.

To validate the breakout setup, the token needs to break above the resistance around the $3.30 to $3.40 zone. If that occurs during increased volume, XRP price could head towards a measured moving target cluster in the $4-$5+ area (or more), resulting in a potential rally of over 100% from current levels by the end of 2025.

This pattern suggests that accumulation is occurring and a strong upward leg may be imminent.

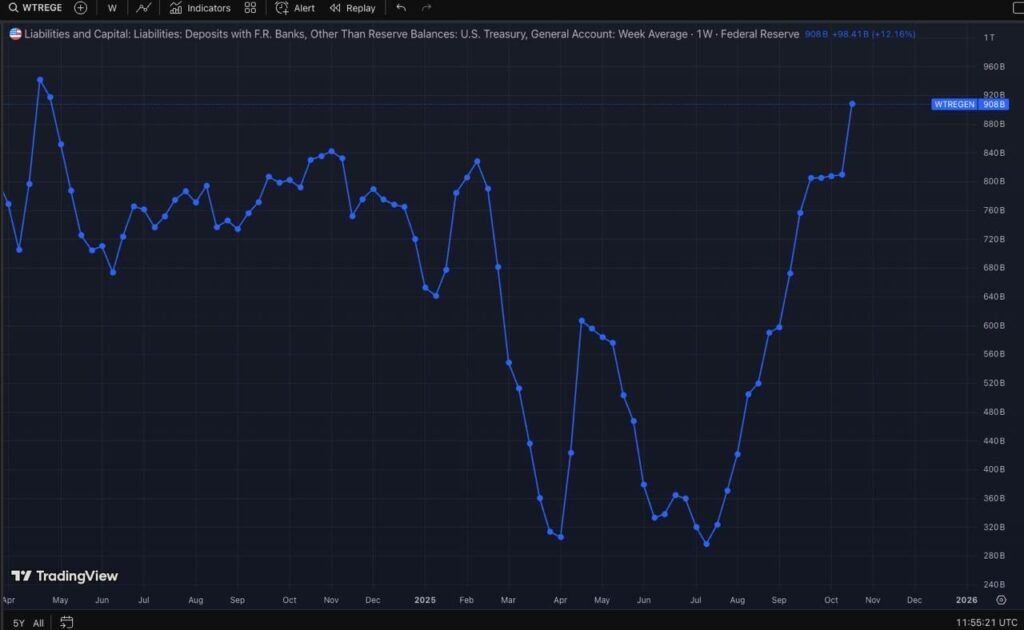

US government shutdown is ending: And it could be bullish for risk assets

The bullish technical backdrop for XRP is becoming more favorable. The U.S. government shutdown has swollen the Treasury’s General Account (TGA), effectively draining the broader financial system of liquidity.

U.S. liquidity is tight and SRF usage is increasing as TGA balloons to $965 billion, RRP rises, and bank reserves decline toward the “adequate” floor. But relief is at hand. The RRP drawdown after the end of the month, the shutdown resolution, and the end of QT on December 1st should provide a liquidity tailwind and drive XRP’s next rally along with the broader crypto market.

For Simpleton, reduced federal outflows during the shutdown meant swollen TGA balances, reduced bank reserves, and a strained financial position. Once operations resume, deferred and contract payments will be processed, bank reserves will increase and cash will be released into risk markets.

Must read: Top 3 cryptocurrencies to buy now if you missed out on sub-$1 XRP

This presents as a major tailwind for XRP and the broader crypto market. The combination of macro money growth and bullish chart patterns equates to a favorable situation.

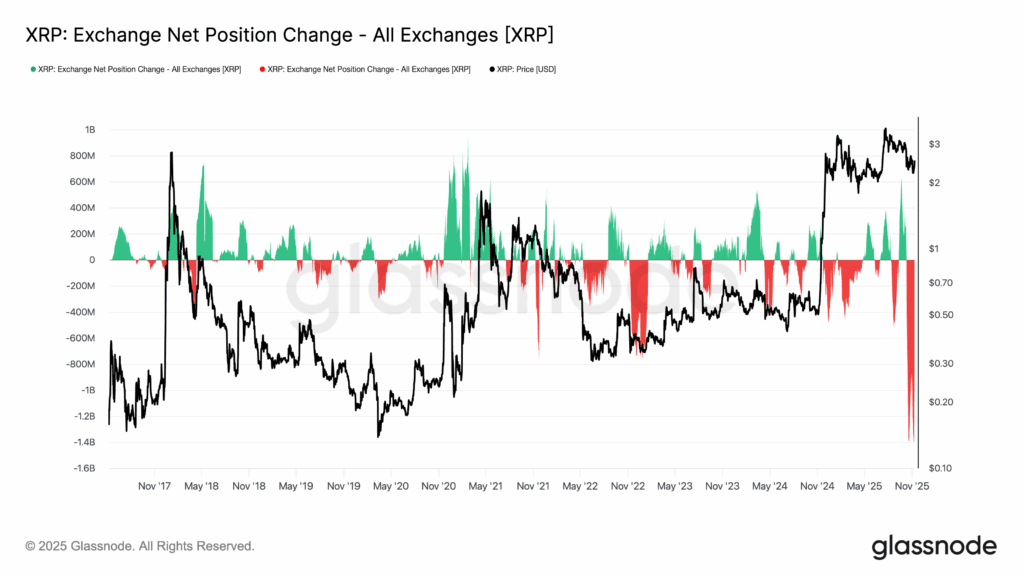

Record exchange outflows suggest strong accumulation of XRP

On-chain data from Glassnode shows that XRP has recorded the largest monthly exchange outflow on record, suggesting that investors are moving coins from trading platforms to self-vault, a classic sign of accumulation. Historically, such rapid outflow spikes have coincided with large price reversals and often signal the end of the distribution phase.

According to the data, more than 1.4 billion XRP has been withdrawn from centralized exchanges in two separate installments since early October, surpassing even the high volume of withdrawals seen before the 2024 XRP breakout. This means that supply on the exchange is tightening and potential selling pressure is decreasing, just as the technical chart suggests a bullish breakout setup.

If this accumulation trend continues, the combination of reduced foreign exchange reserves and improved macro liquidity could create a strong tailwind for XRP price once the US government shutdown ends, reinforcing the cup-and-handle breakout narrative targeting the $4.80 to $5.00 range.