Important points

Why is Aster profitable again?

Because the buyback rate increased by 50%, a total of $39 million was spent, and 18 million tokens were burned, supply was tight and supported price momentum.

What are ASTER traders looking at next?

A sustain above $1 could initiate a rally towards the $1.17 and $1.23 resistance levels.

aster [ASTER] The stock soared 11.36% to reach a local high of $1.16, but has fallen slightly to $1.11 at the time of writing.

Over the same period, the company’s trading volume increased 90% to $667 million, indicating new demand and capital inflows.

But what triggered this price hike?

Aster’s share buyback brings new momentum

After a period of sloppy price performance and closing low, the Aster team stepped in to increase the token buyback rate.

Therefore, the ASTER team increased the repurchase rate from $5,000 to $7,500 per minute, a 50% increase. This means that if the rate remains constant, the team will spend $10 million per day on token buybacks.

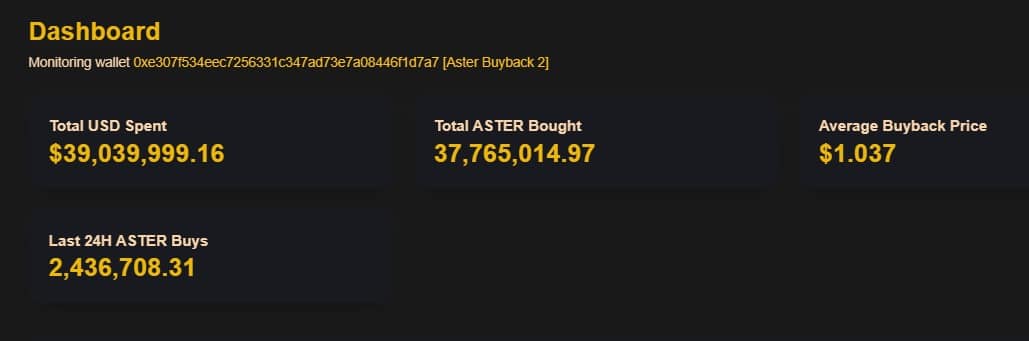

In fact, in the last 24 hours, the team purchased 2.4 million ASTER. Cumulatively, the Aster team spent $39 million to purchase 37.7 million tokens and launched a buyback program.

Source: Astarify

Approximately 50% of these buybacks were burnt out, reducing circulating supply by approximately 18 million tokens and tightening market float.

Importantly, the initiative was a strategic deflationary measure, contributing to a reduction in supply and thereby also stabilizing prices.

Spot demand intensifies

After the buyback update, buyers became more active in the spot market.

ASTER’s spot net flows decreased for the third day in a row to -$8.04 million as outflows ($129.28 million) exceeded inflows ($121.24 million).

Negative net flows reflect accumulation pressure from traders holding rather than depositing on exchanges.

Source: Coin Glass

Futures traders chase the rally

What’s interesting is that after Astor signaled a recovery, investors jumped into permanent investments to strategically position themselves. Perpetual transactions soared to 4.7 million and perpetual trading volume soared to $11 billion, according to Artemis data.

Source: Artemis

If volume and trading increase in parallel, it indicates an increase in participation and capital flows into the futures market. Therefore, investors entered the market and took short or long positions and waited for the next move.

The long/short ratio increased to 3.83, with 79.28% of positions being long. This shows that most traders are expecting further upside.

Source: CoinAnalyze

Can ASTER sustain above $1?

On TradingView, the Stochastic Momentum Index rose to 18, indicating a stronger buyer advantage.

If this momentum continues, ASTER could break through the next resistance at $1.17 (parabolic SAR) and test $1.23.

Source: TradingView

Failure to sustain demand could push the price back toward the $1.00 support, but as long as ASTER trades above that level, the bullish bias will remain.