Please join us telegram Channels where you can get the latest information on breaking news

XRP price rose 8.6% in the past 24 hours and was trading at $2.49 as of 4:15 a.m., with trading volume increasing 82% to $4.74 billion.

This surge in the price of Ripple tokens occurred after the US Senate introduced a bill to end the government shutdown. Investors welcomed this political breakthrough, allaying concerns about prolonged regulatory turmoil and increasing risk sentiment across crypto markets.

🇺🇸Now: The U.S. Senate advances a funding bill to end the government shutdown, clearing the 60-vote threshold. pic.twitter.com/m1zJ1CFFJf

— Cointelegraph (@Cointelegraph) November 10, 2025

The bill, HR 5371, was advanced with bipartisan support and signaled that a resolution to the long-standing funding impasse is finally in sight.

Some analysts had warned that a prolonged shutdown could freeze key regulatory decisions and derail a broader crypto recovery.

Many people are looking forward to “ETF approval.” Few people understand how shutdowns work. Here’s what actually happens if this continues: Save this. 🧵

2/ If the shutdown is prolonged, some XRP ETF S-1 may become eligible for revocation under Section 8(a). It’s paperwork progress, not a trading bell.

👇👇👇 pic.twitter.com/3u2FRrPQB3

— XRP thread (@XRPthread) November 10, 2025

Now, the shutdown is likely almost over and the outlook for XRP looks brighter.

XRP fell below $2.18 during its worst decline just a few days ago, but has rebounded strongly and regained key support and turned green.

Just last month, technical support was threatened to be cut off, risking even greater losses if buyers did not intervene.

Liquidations spiked on Binance and across major exchanges, and volatility soared as bearish traders rushed to unwind their short positions.

XRP on-chain metrics show resilient holders

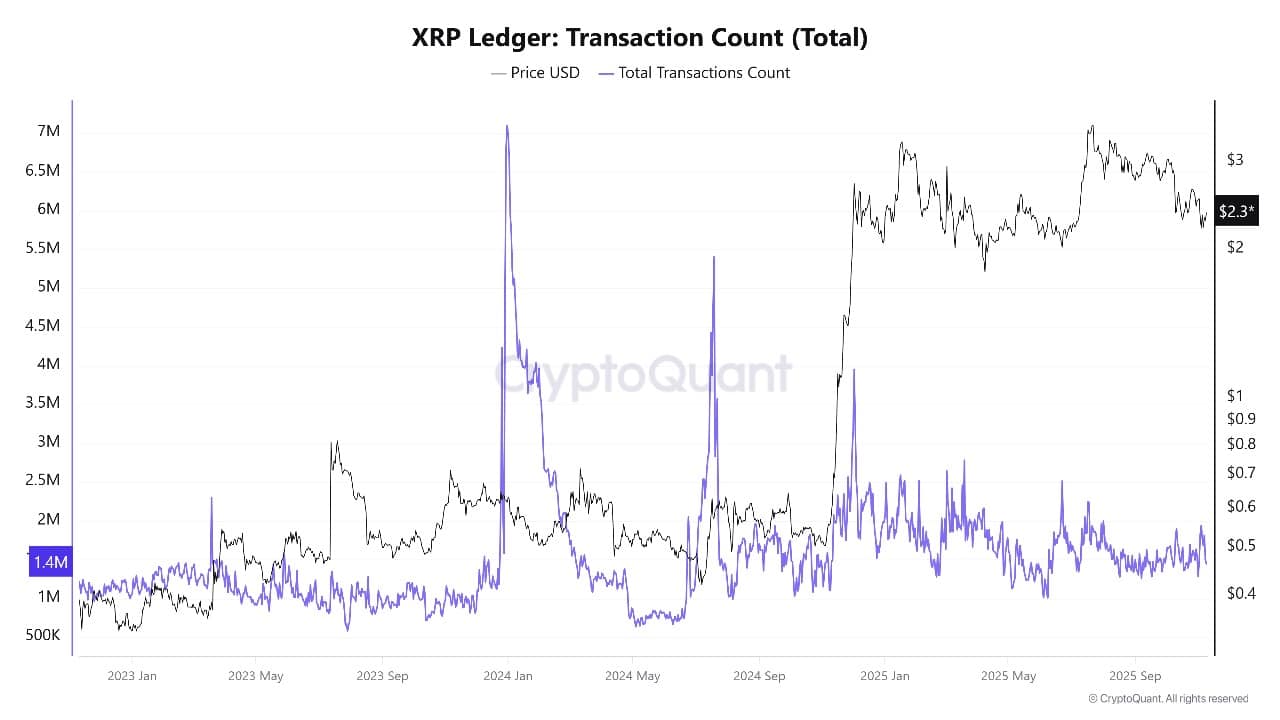

While price performance is leading the headlines, behind the scenes XRP’s on-chain data paints a complicated picture. In recent weeks, total network transfers have declined and the number of large trades has slowed, suggesting some traders have exited amid political uncertainty.

XRP Ledger transaction count source: CryptoQuant

Despite this drop in activity, analysts note that the segment of long-term XRP holders remains strong. According to wallet data, there were few large-scale outflows or panic selling during the shutdown period. Instead, many investors took the opportunity to accumulate at lower prices, supporting prices at important levels as exchanges reported a decline in liquid balances.

Institutional interest also appears to be stable. Several spot XRP ETF applications remain in the pipeline, and today’s Senate breakthrough could accelerate SEC review.

Sentiment should become even more positive for XRP holders once the total number of transactions and payments exceed the $1 billion daily threshold.

XRP Price Technical Analysis: Looking to $3.40, $4.20 and Beyond

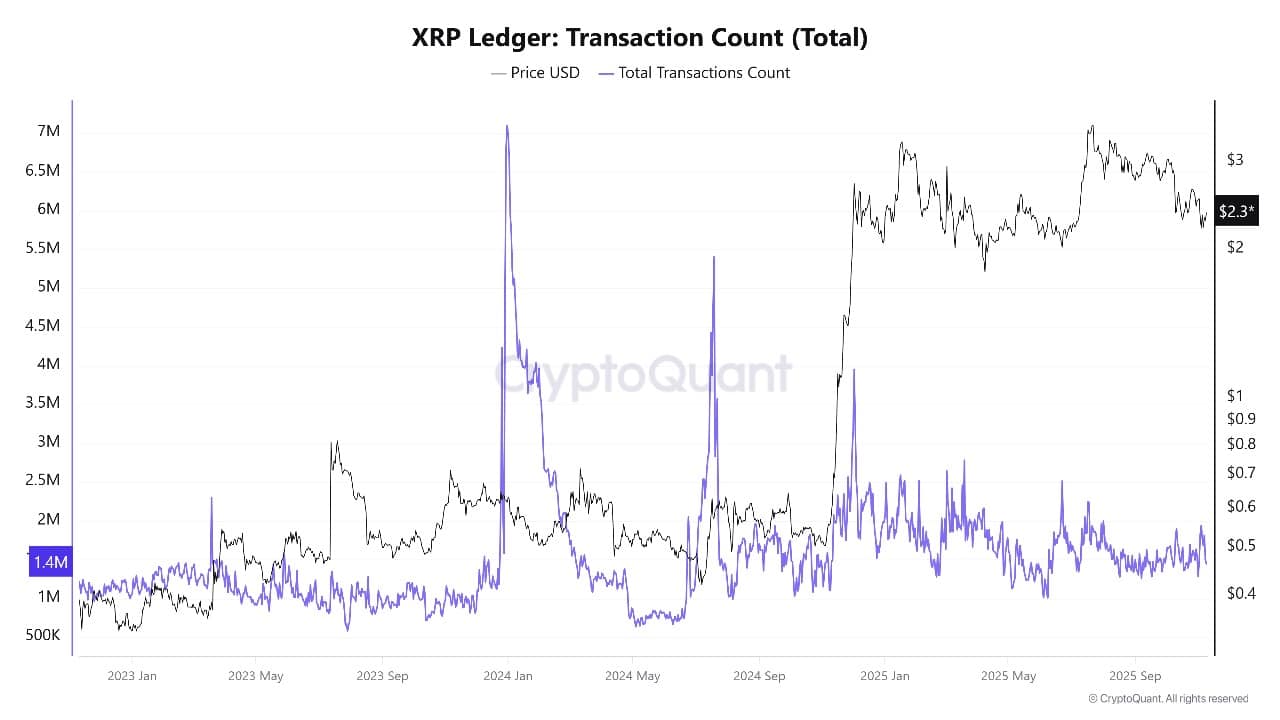

Looking at the chart, XRP has rebounded from a key support zone around $2.00-$2.20. The price is currently trading above its 50-week simple moving average, a key level that traders watch. A weekly close above $2.54 would confirm a bullish breakout and open the door for a rapid rally to higher levels.

XRUSDT analysis source: Tradingview

The main resistance levels are currently located at $2.75 and $3.41, where the previous rally was paused. Based on the weekly Fibonacci retracement levels, if buyers can break through these barriers, an upside target of $4.20 or even $5.21 becomes realistic.

This chart pattern indicates that momentum could quickly accelerate if volume continues to increase, especially since the new uptrend is supported by a rise in the 50-week moving average, which is well above the long-term 200-week average (currently near $1.04).

The relative strength index (RSI) is sitting just below 48, suggesting there is still room for the price to rise further before the coin becomes overbought.

On the other hand, the MACD (moving average convergence divergence) is trending sideways but remains in positive territory, suggesting a new bullish phase. Strong buying interest appears whenever XRP falls towards the yellow support zone in the $2.00 to $2.20 range.

If current trends hold, XRP price could quickly rise towards $3.41 and $4.20 in the coming weeks.

However, if the price cannot sustain above $2.50, traders should be wary of a short-term sell-off.

A drop into the $2.20-$2.30 range could present an opportunity for patient buyers, but a decisive break below $2.00 would signal the need for caution.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news