Bitcoin price has struggled to maintain stability above $102,000 in recent days, and data shows this is due to a clear imbalance between selling pressure and new demand.

CryptoQuant’s on-chain data reveals that while long-term holders are actively taking profits, the market is showing limited ability to absorb their selling. This is in contrast to previous phases of the bull market, where increased demand was able to offset increased activity among long-term holders.

Related books

Long-term holders rally, sell pressure mirror after bull cycle

Data from on-chain analytics platform CryptoQuant. It was first shared Julio Moreno, head of research at CryptoQuant, points to an interesting shift in the dynamics of Bitcoin holder activity that could shape the next move for cryptocurrencies.

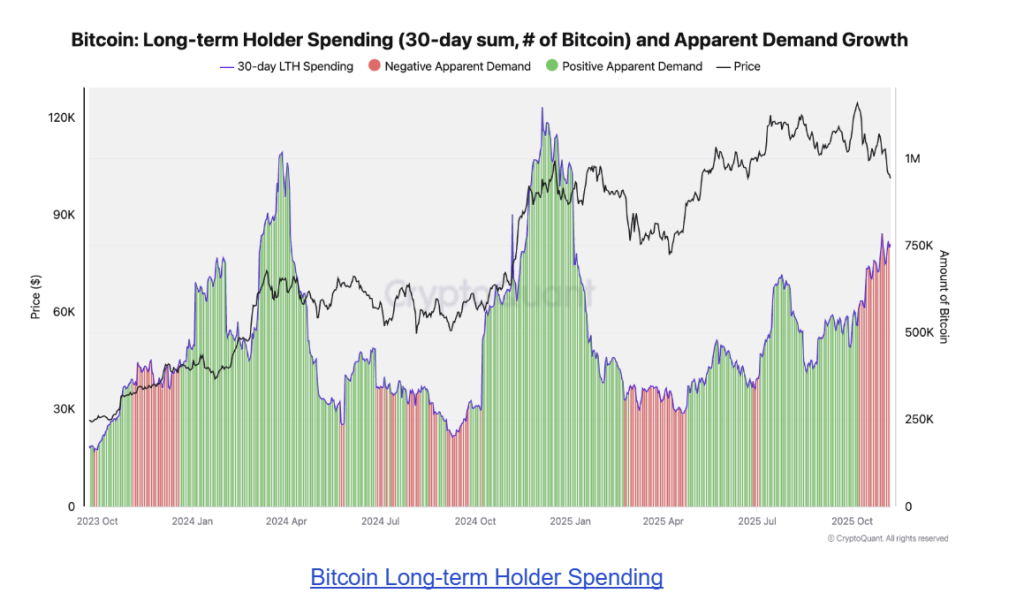

Julio Moreno explained that long-term holders (LTH) selling is a normal pattern in bull markets, as investors take profits when Bitcoin approaches or exceeds all-time highs. CryptoQuant data shows that the 30-day total of LTH spending, represented by the purple line in the chart image below, has increased since early October.

This move follows previous bull market upswings, such as those seen in early and late 2024, when a combination of profit taking and rising demand pushed Bitcoin prices to new records.

In the graph attached to Moreno’s post, the green areas represent periods of positive growth in apparent demand, while the red areas indicate contraction. From January to March 2024 and from November to December 2024, a decline in LTH occurred as demand expanded.

Spending of long-term Bitcoin holders

However, since October 2025, the trend has reversed. Despite the increase in LTH selling, demand has entered the red zone, indicating that the market’s ability to absorb this selling pressure is weakening. This coincides with Bitcoin struggling to maintain its position above $102,000, suggesting that the price’s upward momentum may be losing momentum.

If demand continues to slump, the next rise may be delayed.

Moreno pointed out that the key factor to look at is not just how much long-term holders will sell, but whether demand growth can keep up.

When demand is strong, an influx of supply from long-term holders often fosters healthy consolidation before prices spike again. In contrast, when demand lags, the outcome tends to be a prolonged adjustment or a plateau.

Most of that demand currently comes from spot Bitcoin ETFs, but inflows have slowed sharply. data From Soso Value According to , the US-based Spot Bitcoin ETF ended last week with net outflows of $558.44 million on Friday, November 7th, one of the largest single-day outflows in weeks.

Related books

Unless Bitcoin’s apparent demand starts to recover in the coming weeks and LTH continues to decline, this could continue to weigh on price trends and postpone Bitcoin’s next rally. In this case, Bitcoin could continue to consolidate between $101,000 and $103,000 for the remainder of November.

At the time of writing, Bitcoin is trading at $101,655, down 0.6% over the past 24 hours.

Featured image from Unsplash, chart from TradingView