Bitcoin’s price has struggled to rise above $100,000 as traders become cautious and selling pressure mounts across major exchanges. The broader crypto market is also showing signs of weakness, with most assets trading flat or slightly lower. But even as traders pull back, Tether, the world’s largest stablecoin issuer, has been quietly making notable moves behind the scenes, sparking renewed curiosity about what’s next for Bitcoin.

Tether secretly accumulated over 960 BTC worth $98 million

While traders remain wary, Tether, the world’s largest issuer of stablecoin USDT, is quietly accumulating more Bitcoin. The company recently continued its long-term strategy of converting a portion of its net profits into Bitcoin, adding over 960 BTC worth approximately $98 million.

The acquisition strengthens Tether’s position as one of the largest corporate holders of BTC, alongside companies like MicroStrategy. The move reflects institutions’ growing confidence in Bitcoin’s long-term potential, even at a time of low market sentiment. The continued accumulation of Tether could serve as a subtle vote of confidence, suggesting that major players may be preparing for a stronger recovery once the current consolidation phase ends.

Bearish sentiment dominates short-term trading

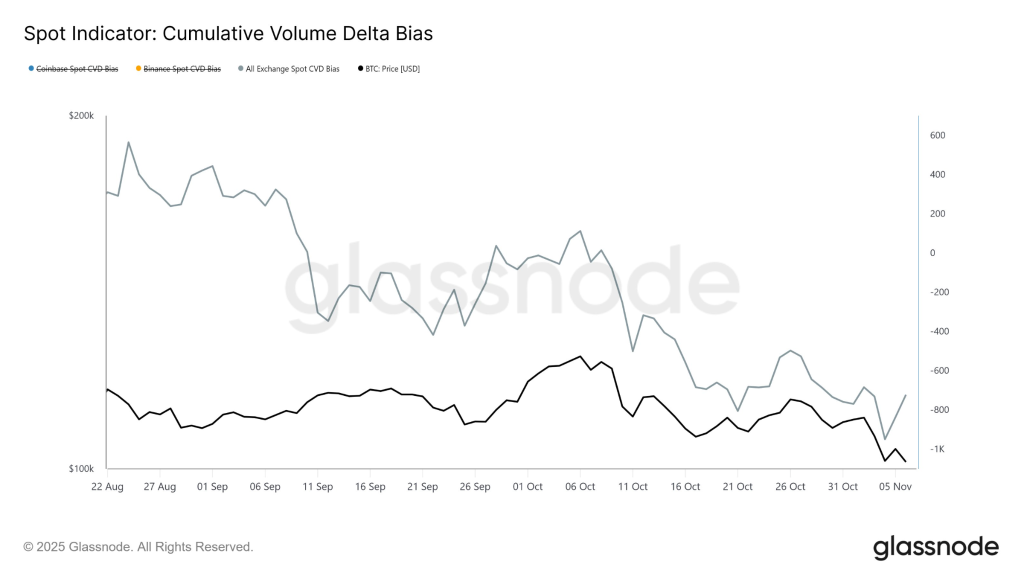

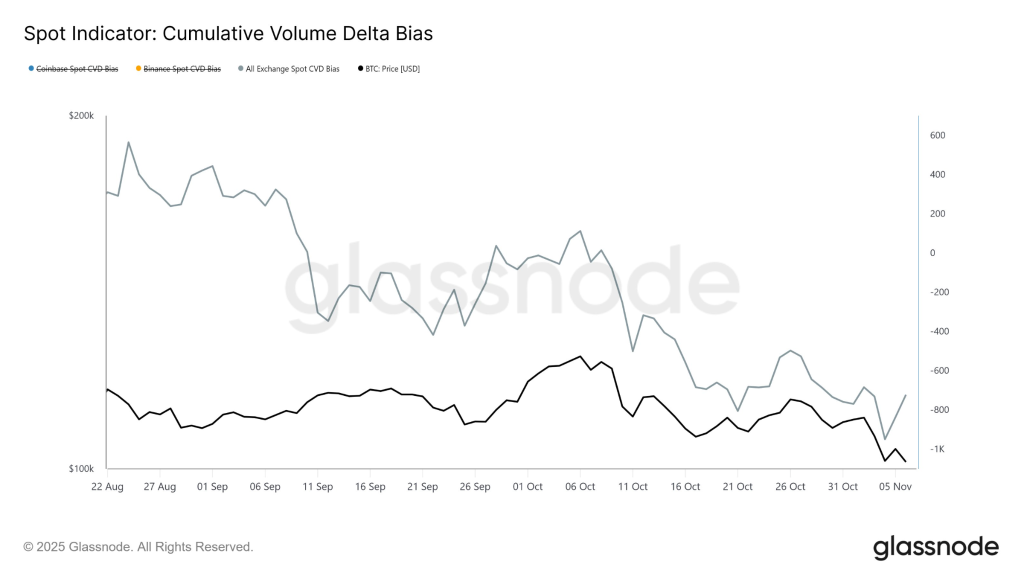

Despite occasional price rallies, short-term sentiment among Bitcoin traders remains largely bearish. Data shows spot cumulative volume delta (CVD) is trending downward across major exchanges, indicating sustained selling pressure and limited active spot buying. This means there are more traders selling on the upswing than buying on the downside.

Many short-term speculators are likely to be cautious due to recent volatility and uncertainty in the macro environment, including interest rate concerns and a slowdown in institutional investor capital inflows. However, while retail sentiment appears defensive, this environment often creates opportunities for large investors to quietly accumulate. This trend is in line with Tether’s latest moves and could set the stage for a potential momentum shift.

Smart money vs. market sentiment

The current regime of the Bitcoin market highlights a clear difference between smart money and retail traders. While most traders are hesitant or taking profits, Tether’s latest Bitcoin purchase signals a long-term, confident outlook. Historically, such divergences have often marked important inflection points where institutional accumulation quietly occurs before large market moves.

Sentiment could become bullish again if Bitcoin holds onto key support zones and buying activity from companies like Tether continues. For now, the market is at a crossroads. While retail traders are cautious, institutional investors’ actions signal confidence in Bitcoin’s future, creating tensions that could soon turn into decisive action.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, and tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.