- Ethereum price shows a breakdown below the lower trend line of an expanding channel pattern on the daily chart.

- According to data from Coinglass, Tuesday’s crypto market selloff led to liquidations by 450,642 traders totaling $1.99 billion.

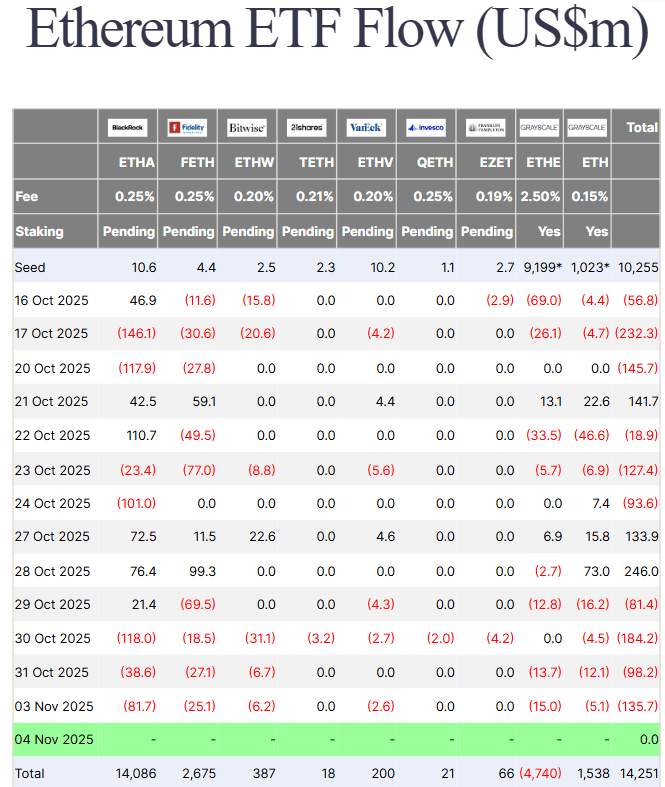

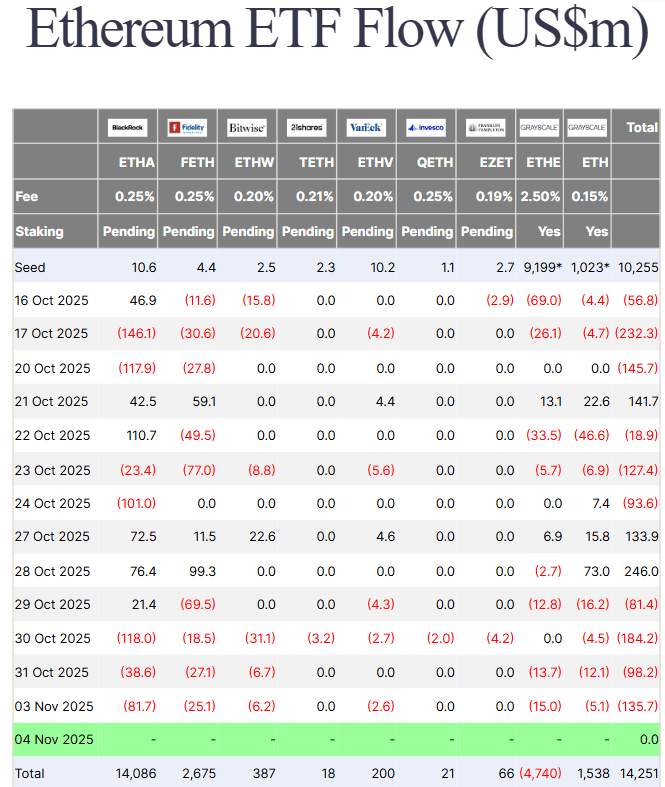

- The US Spot Ethereum ETF has recorded consistent outflows over the past four days.

- ETH Fear and Greed has fallen to 28%, highlighting the bearish sentiment among crypto participants.

Ethereum, the second-largest cryptocurrency by market capitalization, plunged more than 13% during U.S. market hours on Tuesday, trading at $3,057, its lowest since mid-July. Selling pressure is widespread across the crypto market as Bitcoin prices fall below $100,000. Key factors contributing to this downward trend include a strong US dollar, ETF outflows, and chain liquidations in the futures market. Will Ethereum price lose its $3,000 floor?

ETH faces heavy liquidations, ETF outflows, and strong dollar pressure

Over the past week, Ethereum price has shown a strong correlation from $4,250 to the current trading price of $3,057, with a predicted loss of 28%. Since then, the asset’s market capitalization has plummeted to $387.29 billion.

The downturn gained initial momentum from U.S.-China trade tensions and last week’s prediction of a hawkish tone from Federal Reserve Chairman Jerome Powell on a December rate cut. This has created a risk-off sentiment towards riskier assets such as cryptocurrencies.

After the FOMC meeting, the US dollar strengthened, pushing the DXY to a three-month high of 99.87. Since the majority of major cryptocurrencies are traded against the dollar, their negative correlation makes the cryptocurrency market expensive for investors and puts downward pressure on prices.

Another reason for the recent downtrend is the continued outflow of funds from the U.S.-based spot Ethereum exchange-traded fund (ETF) over the past four days. Based on data from Farside Investors, cumulative outflows for the Spot ETH ETF on November 3 reached approximately $135.7 million, indicating a wave of investor profit-taking and institutional demand withdrawal amid market-wide uncertainty.

Today’s 11% drop in Ethereum’s price accelerated market volatility and triggered liquidation cascades on major exchanges. More than $572 million of long Ethereum positions were liquidated, according to Coinglass data, one of the largest single-day liquidations since the October 10 crash.

The sharp decline highlights the volatile nature of leveraged positions and highlights the growing cautiousness among traders in a market where sentiment is increasingly risk-averse.

Ethereum price falls below monthly support of channel pattern

Over the past two weeks, Ethereum price has shown a steady correction that resonates within the two downtrend lines of an expanding channel pattern. The chart setup reflects two diverging trend lines, which theoretically indicates increased market uncertainty.

With today’s decline, Ethereum price has shown a bearish breakdown below the bottom trendline, reflecting active selling pressure in the market. If the daily candlestick is below the bottom trend line, sellers place further signs directly on this asset for a long-term decline towards $2,887 and then a long-term push towards $2,388.

A coin price below its 200-day exponential moving average reflects bearish sentiment supporting a further downtrend.

Conversely, the Relative Strength Index (RSI), a momentum indicator, has entered oversold territory at 27%, which is seen as a discount opportunity for investors. If coin buyers manage to sustain the bottom trend, ETH price could try to regain bullish momentum for a bullish rebound.