- Bitcoin price correction falls 5% short of testing major support, widening the channel pattern.

- Derivatives data shows that the speculative environment among traders has cooled.

- BTC’s Fear and Greed Index has fallen to 42%, indicating that market sentiment is turning bearish.

Bitcoin, the pioneering cryptocurrency, was painted red on Monday, recording a 3.39% intraday loss and currently trading at $106,740. ETF outflows, long-term leveraged liquidations, and technical failures are the main factors contributing to the recent economic downturn. As bearish momentum builds, Bitcoin prices are headed for further collapse as several on-chain indicators suggest that the correction could continue in the near future.

BTC dips below $106,000 as on-chain data shows correction phase progressing

Today’s selloff saw Bitcoin drop nearly 5% to a low of $105,300 before recovering to $106,740. According to data from Coinglass, the bearish momentum spreading across the crypto market resulted in liquidations totaling $1.23 billion across 325,029 traders in the past 24 hours.

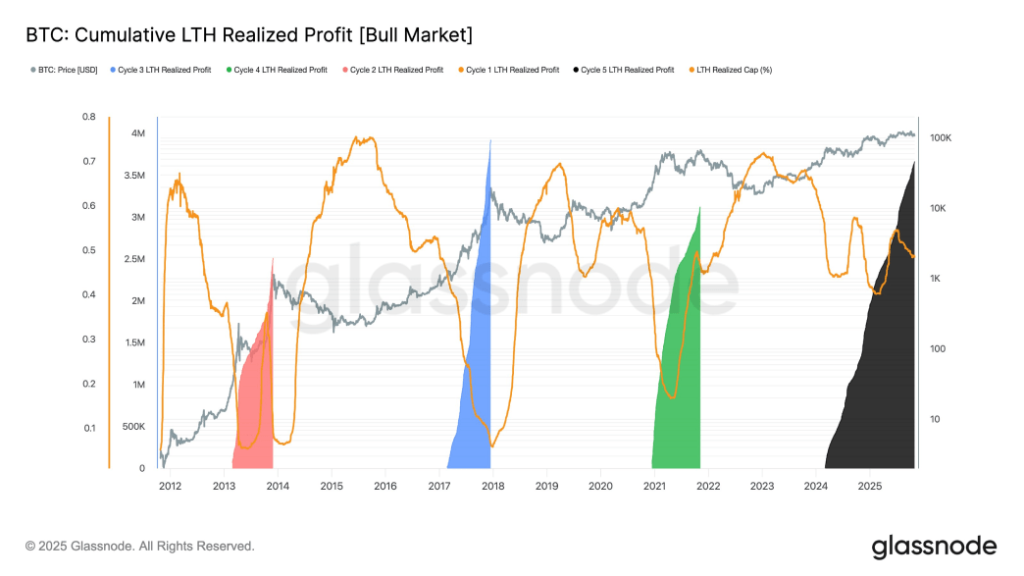

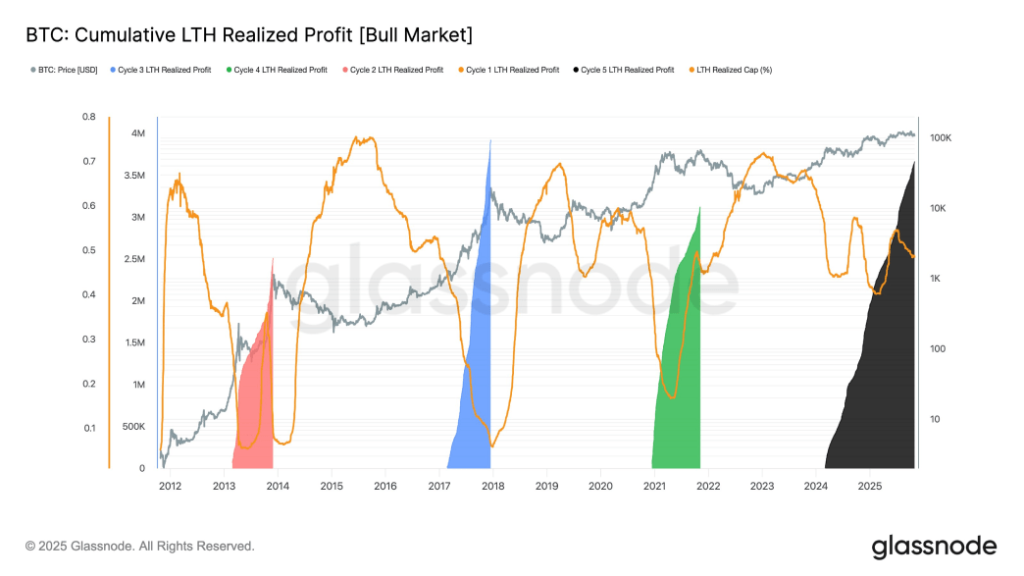

As BTC falls towards the $100,000 level, CryptoVizArt, a senior researcher at Glassnode, tweeted a list of on-chain indicators, pointing out that there is still room for the correction phase to continue. The chart below shows that long-term holders have already secured gains of nearly 3.67 million BTC since the peak of this cycle. This is a surprisingly large realization compared to previous market highs and suggests that a significant portion of veteran investors started releasing money early in the rally.

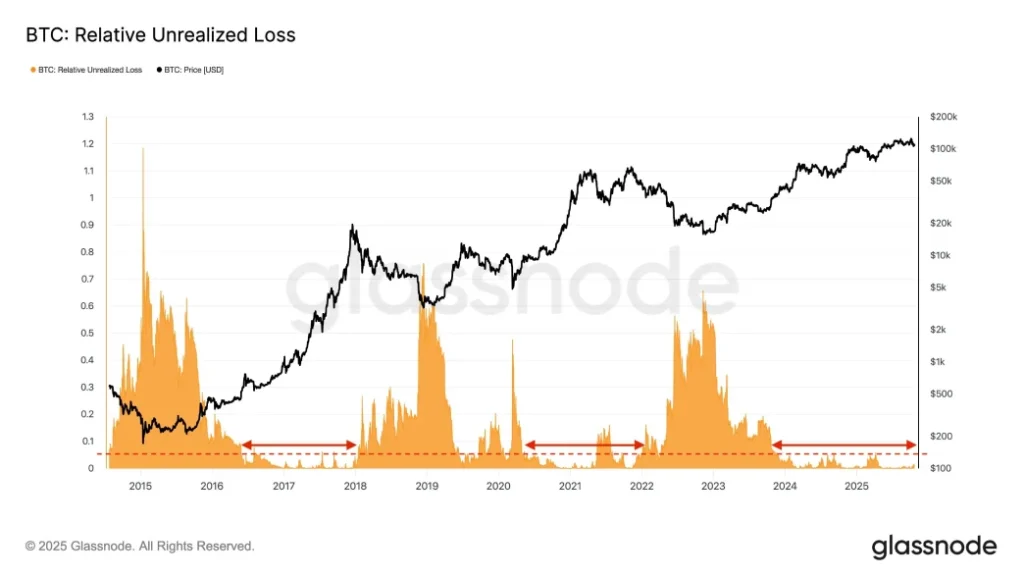

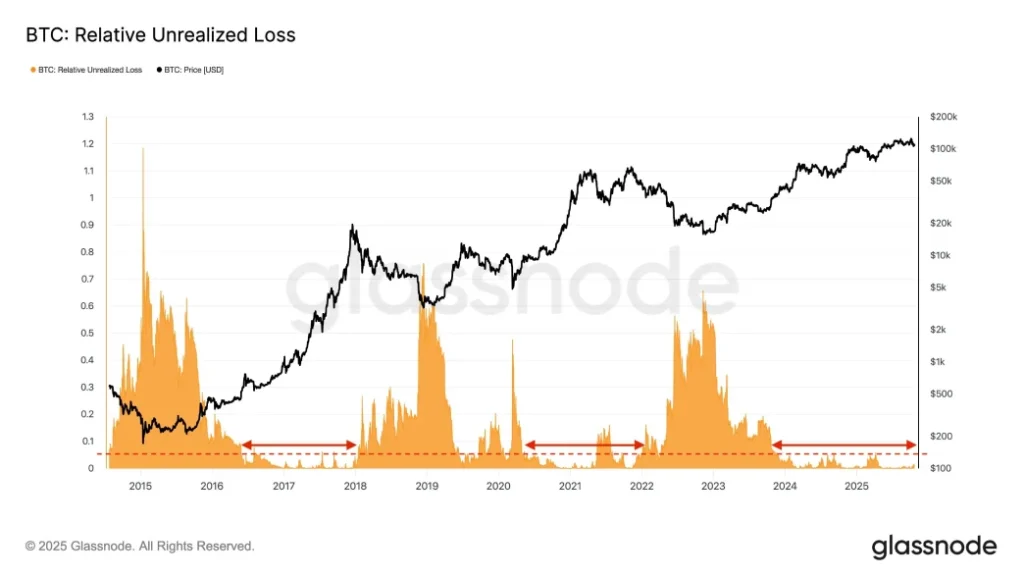

An analysis of network-wide unrealized losses shows that, despite the recent decline to around $107,000, the holdings of loss-making coins as a percentage of Bitcoin’s market capitalization are very low at 1.3%. Historically, readings below 5% are associated with bullish phases, and deeper contractions can push the ratio above 50%. The relatively subdued loss levels suggest that widespread market capitulation has not yet occurred.

Another metric that tracks investor positioning shows that since July, Bitcoin has consistently traded below the average acquisition cost of the top 1%, 5%, and 10% of coin supply. This pattern shows that high-cost buyers are steadily exiting, leaving holdings for new participants who seek to take advantage of the volatility and accumulate. Analysts say a further 80% review on a supply quantile cost basis could result in further redistribution before stability returns.

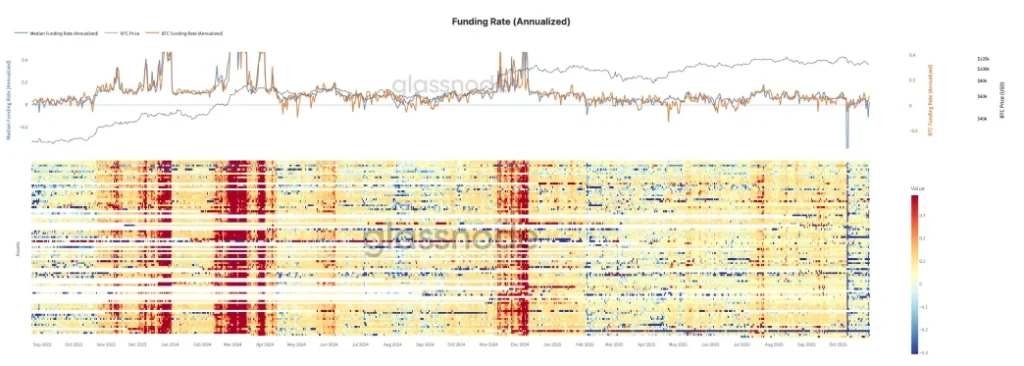

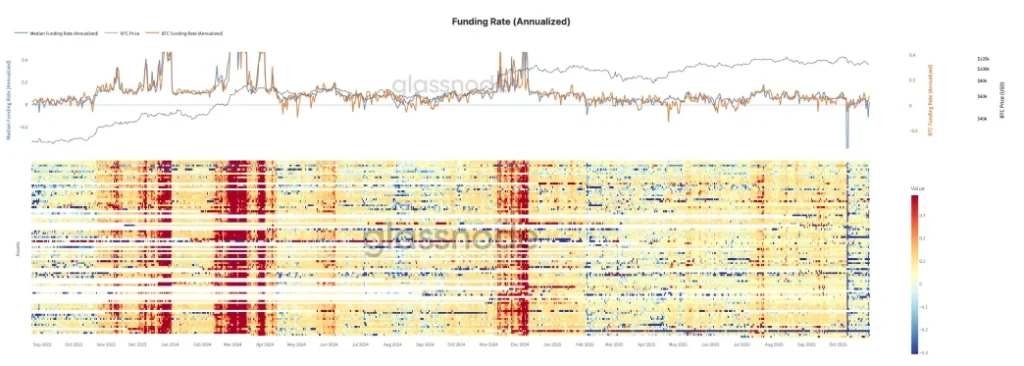

Meanwhile, derivatives data shows a cooling off period for market speculators. The rally to $126,000 earlier this year was not accompanied by the heavy leverage activity typically seen at the peak of the cycle. Perpetual funding rates have been lifted since the October 10th “Black Friday” market reset, highlighting a decline in enthusiasm among traders for aggressive long exposures.

Taken together, these data paint a picture of a market still in transition, where long-term holders are draining profits, speculative excess is being squeezed out, and belief is quietly shifting into new hands. The lack of a major washout indicates that the current correction may not be the result of a panic, but rather a delay in the realignment of market ownership.

Bitcoin price approaches bottom

For the past four weeks, Bitcoin prices have been trending sideways in the formation of an extended channel pattern, also known as a megaphone. The chart setup features two diverging trend lines, producing larger price movements with each cycle, indicating increased market uncertainty.

Today’s decline leaves Bitcoin price just 4.8% short of retesting the $102,000 level, the bottom trendline of the pattern. A potential retest would be BTC’s pivot level. The recent price movement of this pattern shows that the bottom trend line is acting as a strong accumulation point for traders during market pullbacks.

If history repeats itself, the coin price could regain its spent bullish momentum and rebound. Conversely, a breakdown below the bottom trend line will increase selling pressure and prolong the correction below $100,000.

Also read: Hyperunit Whale deploys $55 million in Bitcoin and Ethereum