important notes

- Canary’s LTCC ETF had net assets of $1.64 million through October 31st.

- Litecoin is underperforming the Solana and Hedera ETFs in terms of investor inflows.

- Stake.com currently accounts for approximately 16% of Litecoin’s daily on-chain transactions.

Litecoin price ended October at $99, up 3% after the US welcomed its first Litecoin ETF. Canary’s LTCC fund began trading on October 28th, joining the Solana and Hedera ETFs as the latest crypto derivatives assets listed for regulated trading in the United States.

As of October 31, LTCC’s cumulative net inflows reached $719,970, with total transaction value of $802,260 and total net assets of $1.64 million, according to SoSoValue data.

Litecoin ETF Market Performance as of November 1, 2025 | Source: Sosovalue

In comparison, Litecoin ETF performance has lagged behind newly launched funds. Solana’s fund accumulated $199 million in inflows and $502 million in net assets, while Hedera’s ETF recorded $44 million in inflows and $45.93 million in assets. Demand for the LTC ETF appears to be limited this week due to the correlation between Litecoin and Bitcoin (BTC). Net outflows on Friday were $191 million, bringing total Bitcoin ETF withdrawals to over $1 billion over the past three trading days.

Staking currently accounts for 16% of Litecoin transactions

While ETF adoption has been slow, Litecoin continues to attract demand in the online payments ecosystem. A report shared for the benefit of community analysts on X (formerly Twitter) revealed that Stake.com, a leading crypto gaming platform, processes almost 16% of daily Litecoin on-chain transactions.

Did you know?

Litecoin makes up the majority of the cryptocurrencies used there. In fact, Litecoin has been the most used cryptocurrency there for at least two years in a row.

Interestingly, @stake It accounts for about 16% of daily Litecoin on-chain… pic.twitter.com/hZJEo7aarq

— Bogley Ⓜ️🕸 (@FYI) October 30, 2025

The official Litecoin

Median Litecoin transaction fees remain below $0.0005, positioning LTC as one of the cheapest and fastest networks for large-scale microtransactions. This real-world usage is consistent with a broader trend of altcoins regaining ground in the payment utility market, especially in regions adopting low-fee payment rails. On Friday, Square, the payments platform in partnership with X founder Jack Dorsey, allocated $50 rewards to 20,000 users for enabling Bitcoin conversations within their apps.

Litecoin Price Prediction: Can LTC maintain momentum above $100?

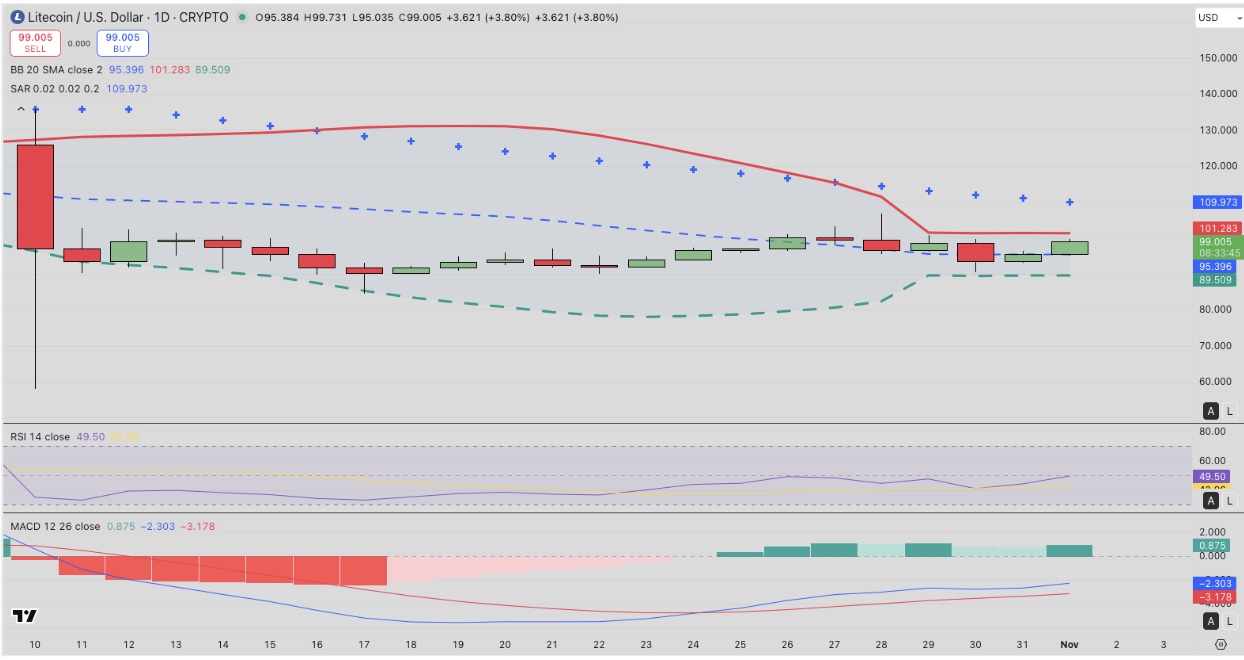

Litecoin’s recent rally towards $99.00 reflects an improvement in sentiment after weeks of turmoil. On the daily chart, LTC/USD is trading just below the upper Bollinger Band ($101.28), with the middle band located at $95.39, indicating that this zone is an important short-term support base.

The parabolic SAR point above the $109.97 price indicates continued bearish sentiment. The Relative Strength Index (RSI) is trending up to 49.5, indicating that sellers are relinquishing control as market momentum approaches neutral territory.

Litecoin (LTC) Price Prediction | TradingView

The MACD line has broken above the signal line (-2.30 vs. -3.17), indicating a possible bullish reversal. With the histogram turning positive, LTC price looks poised to regain the psychological mark of $100, followed by the $109.97 resistance.

Conversely, if the $95 support level fails to hold, a gradual retracement toward $89.50 could occur along with the lower Bollinger Bands.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is an experienced research analyst with a background supporting various Web3 startups and financial institutions. He holds a Bachelor’s degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger Technology at the University of Malta.

Ibrahim Ajibade on LinkedIn