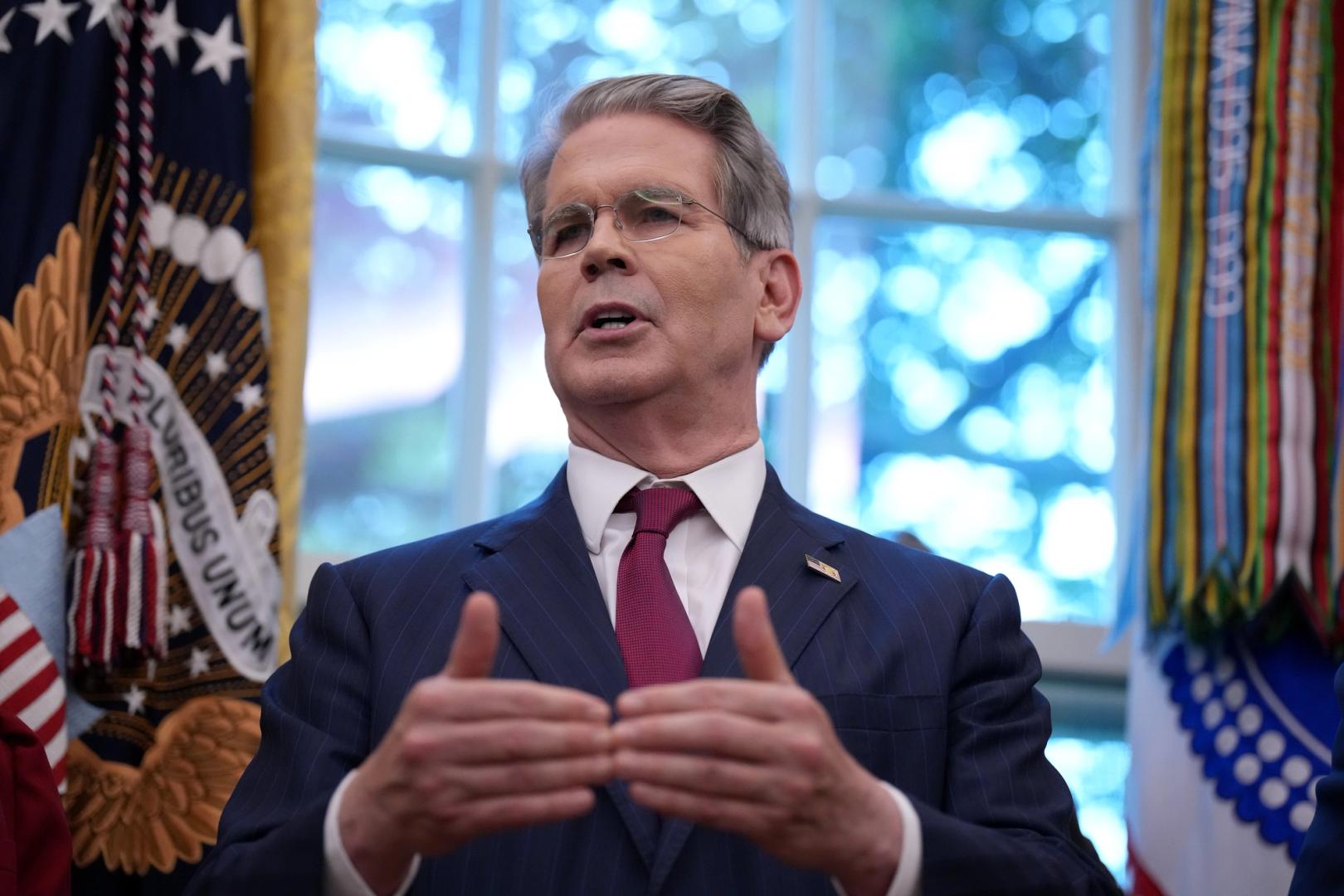

U.S. Treasury Secretary Scott Bessent on Friday commemorated the 17th anniversary of the publication of the Bitcoin White Paper, praising the network’s resilience in a post about X and attacking Senate Democrats, saying the system “will never shut down” and hinting that lawmakers could “learn something from it.” The comment was both a policy signal and a partisan elbow.

October 31st has special weight in cryptocurrencies. This is the day Satoshi Nakamoto released his nine-page Bitcoin White Paper in 2008. This white paper outlines a peer-to-peer electronic money system and prepares the network for continuous operation from January 2009. Proponents are using the anniversary to highlight Bitcoin’s always-on design and independence from a single operator.

Bessent’s memo is part of a year of crypto-forward messages from the Treasury Department.

In July, after President Trump signed the GENIUS Act, Bessent called stablecoins a “revolution in digital finance” and argued that the internet-native dollar rail could strengthen its reserve currency status while expanding access to dollar payments. The Ministry of Finance published the statement on its website.

In August, Bessent told X that the bitcoin confiscated in the U.S. would seed the Strategic Bitcoin Reserve and that the Treasury Department would look at ways to add to it in a budget-neutral manner, suggesting he was interested in building up the holdings without making new appropriations.

Reactions to Friday’s post exposed familiar rifts within cryptocurrencies.

Longtime Bitcoin Core developer Luke Dash Jr. countered that Bitcoin is “weaker than it has ever been,” echoing the controversy surrounding recent software releases and what it means for the purity of the network.

“Bitcoin died after the release of Core v30,” researcher Eric Wall sarcastically replied, commenting on the repeated disastrous behavior after the upgrade.

Investor Simon Dixon reframed Bessent’s argument as a criticism of monetary policy, arguing that Bitcoin’s purpose is protection from political corruption.

Trader Fred Krueger quipped that the Treasury Department should buy a strategic Bitcoin reserve, while digital asset strategist Gabor Garbacs urged Bitcoin to be “put on the balance sheet.”

The responses were broadly divided into two camps. Technology purists challenged blanket claims of resilience, and market participants were pressuring the Treasury to shift rhetoric to acquisition policy.

The political advantage was further sharpened by timing. The federal government has been in a partial shutdown since Oct. 1 after Congress failed to appropriate a budget for fiscal year 2026, resulting in the furloughing of about 900,000 people, about 2 million employees working without pay, and reduced operations at agencies such as the NIH and CDC. This is the 11th service outage, and is said to be the longest complete outage on record.

When read closely, Bessent’s post pays homage to networks that operate on weekends and holidays. Politically, the article contrasts Bitcoin’s uptime with Congress stalled on funding the bill, another sign that the Treasury secretary intends to keep digital assets in policy discussions on Washington’s busiest day.