Ethereum (ETH) remains under pressure, trading below the $4,000 milestone as bulls attempt to regain control after weeks of uncertainty following the crash. The sharp drop on October 10th not only flushed leveraged positions across the market, but also disrupted the uptrend that ETH had been building throughout the summer.

Since then, price trends have weakened and momentum has shifted downward, raising concerns among analysts that a more severe correction could occur if buyers fail to protect key demand levels in the coming days.

Related books

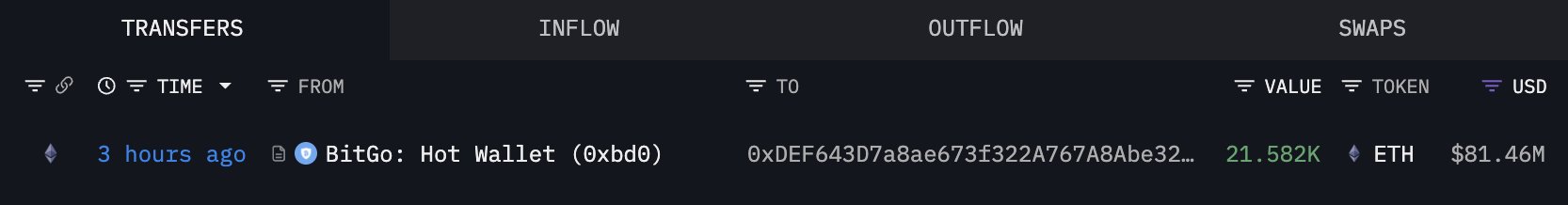

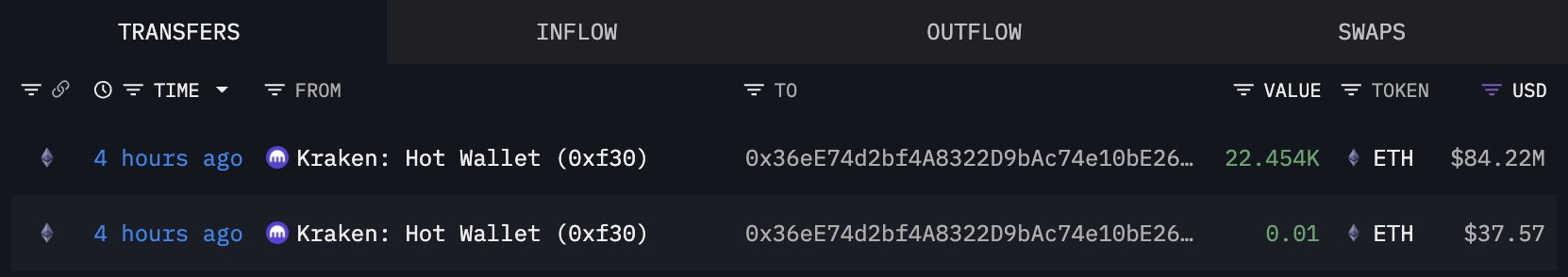

Despite these technical challenges, on-chain and intra-organizational flow data tells a different story beneath the surface. Large investors, including funds, corporate entities, and crypto-native institutions, continue to accumulate ETH during the downturn.

The disconnect between price weakness and institutional accumulation creates a pivotal setup for Ethereum. If ETH is able to stabilize and regain the $4,000 threshold, bullish momentum could be reignited. However, failure to maintain support could open the door to further decline before a sustainable recovery emerges.

Bitmine Adds ETH As Institutional Investor Accumulations Rise

According to data tracked by Lookonchain, institutional investor Bitmine continues its aggressive accumulation strategy. Bought 44,036 ETH (worth approximately $166 million) during the recent market decline.

The acquisition brings Bitmine’s total holdings to approximately 3.16 million ETH, worth approximately $12.15 billion, and strengthens the company’s position as one of the world’s largest holders of Ethereum. Such large-scale buying activity during a period of price weakness highlights the significant disconnect between institutional investor behavior and short-term market sentiment.

While retail traders and leveraged participants may be upset about Ethereum’s inability to regain the $4,000 level, long-term buyers appear unfazed. For them, falling prices are not a reason for concern, but an accumulation of opportunities.

This duality is becoming increasingly evident across markets, with spot inflows, currency outflows, and whale accumulation indicators all pointing to growing long-term confidence, even if the charts reflect hesitation or downward pressure.

This divergence highlights a familiar pattern in crypto market structure. Price movements often lag underlying fundamentals, especially during transition stages where macro catalysts and liquidity changes are still being digested. Ethereum continues to be structurally supported by increased institutional participation, increased staking demand, and an expanding Layer 2 ecosystem, all of which strengthen Ethereum’s long-term investment thesis.

Related books

Key support for Ethereum testing

Ethereum (ETH) is trading near $3,847, testing a key support zone after failing to sustain above $4,000 and breaking out of the $4,200 resistance area earlier this week.

The daily chart shows ETH below both the 50-day moving average (blue) and the 100-day moving average (green), indicating a loss of momentum and a shift to a more defensive market posture. This breakdown puts more pressure on the bulls to protect the $3,800 area, a level that has played a recurring role over the past two months.

If ETH loses this support, the next key demand zone will be around $3,500, followed by the 200-day moving average near $3,200, a deeper structural retest within the long-term uptrend. But for now, ETH remains above its long-term trendline, meaning the broader bullish structure remains intact despite the short-term weakness.

Related books

On the upside, the bulls need to regain $4,000 and then $4,150-$4,200 to revive bullish momentum and break the series of lows formed since September. Until that happens, price action is likely to be consolidated and cautious. With the macro shift underway and institutional accumulation increasing, Ethereum’s chart suggests a wait-and-see phase, and it will be important to hold support before aiming for a new rally.

Featured image from ChatGPT, chart from TradingView.com