Please join us telegram Channels where you can get the latest information on breaking news

Shares of Strategy soared about 6% in after-hours trading after the Bitcoin treasury firm’s third-quarter results beat analysts’ expectations and after Michael Saylor said it was unlikely to buy a smaller rival.

The company reported diluted earnings per share of $8.42 for the three months ended Sept. 30, beating Wall Street expectations of $8.15.

Revenue reached $2.8 billion, rebounding from a $340.2 million loss in the year-ago period, but significantly lower than the $10 billion profit recorded in the previous quarter.

Despite the strong financial results, Strategy’s stock remains under pressure, with Bitcoin’s decline weighing on its $47.4 billion crypto holdings, which have fallen more than 20% in the past month and more than 30% in six months.

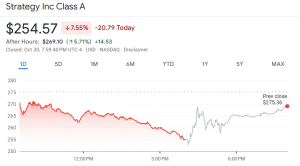

Strategy (MSTR) ended the most recent trading day down more than 7%, according to Google Finance.

Strategy stock price (Source: Google Finance)

Saylor says strategy is unlikely to involve acquiring smaller rivals

Companies such as Japan-based Metaplanet and leading Ethereum finance company Bitmine Immersion Technologies have recently suffered double-digit stock price declines, and the decline in their stock prices has narrowed further. Digital asset treasury (DAT) companies are struggling.

As a result, analysts predict that large DAT companies may start acquiring smaller rivals.

However, Thaler said Strategy has no immediate plans for a merger or acquisition, citing “a lot of uncertainty” among its digital asset finance divisions.

“We have no plans to pursue M&A activity, even though it could potentially increase,” he said. “Even if an idea looks good when you start, it may not be a good idea six months later.”

Saylor hasn’t completely closed the door on an acquisition, saying: “I think we’ll never say ‘never, never, never, never.'”

Price decline puts pressure on the strategy’s Bitcoin financial performance

Strategy is the world’s largest corporate Bitcoin holder, with 640,808 BTC on its balance sheet. The company started buying Bitcoin in 2020 and continues to buy major cryptocurrencies even as some competitors have slowed or stopped their accumulation strategies.

Top 10 Corporate BTC Holders (Source: Bitcoin government bonds)

Bought another 390 BTC for around $43.4 million earlier this week, with an average purchase price of $111,053.

Bitcoin’s 4% decline over the past month and the decline in Strategy’s stock price are also putting pressure on Strategy’s stock price. BTC financial performance, the company’s mNAV has declined from a peak of 3.89x in November to 1.16x currently. According to to SaylorTracker.

Despite the decline in mNAV, Strategy reported that its Bitcoin yield has reached 26% so far this year, an increase of $13 billion. The company also reaffirmed its full-year outlook of $24 billion in net income and a 30% BTC yield. This is based on predictions that Bitcoin price will reach $150,000 by the end of the year.

In the case of Bitcoin trading As of 1:50 AM EST, BTC price was $109,898.61, and BTC price would need to rise approximately 36% to reach the strategy’s year-end target.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news