altcoin analysis

Ethereum continues to trade under pressure as the world’s second-largest cryptocurrency struggles to regain its bullish momentum.

After weeks of sideways behavior; Ethereum It remains trapped within a consolidation range, increasing uncertainty among traders looking for signs of a trend reversal.

At the time of writing, Ethereum is trading around $3,846 and hovering just above the key support area at $3,802. Market observers note that this level has become a focus for both short-term traders and long-term investors, with many waiting to see if the asset can hold firm before the next decisive move.

Testing of critical technology zones

Renowned crypto analyst Michael Van de Poppe shared his outlook on X, noting that Ethereum is currently testing the 20-week moving average, a technical area that has historically characterized strong accumulation phases. He emphasized that ETH’s current configuration offers a favorable risk-reward ratio for long-term portfolios, describing ETH as “a very great spot to add to your portfolio.”

$ETH It’s a great addition to your portfolio.

Testing the 20-week MA and its confluence at a strong higher timeframe support level.

Corrections are not permanent. pic.twitter.com/nKnJxyr4On

— Michael van de Poppe (@CryptoMichNL) October 31, 2025

According to Van de Poppe, the confluence of the moving average and the support level on the higher time frame could be the basis for Ethereum’s next rally. “Corrections won’t last forever,” he added, suggesting the ongoing rebound may be nearing an end.

Analysts believe that if Ethereum is able to defend this zone, the next resistance level to watch would be around $4,150. A break above this threshold could signal new purchasing power and a potential move back towards the $4,300-$4,400 range.

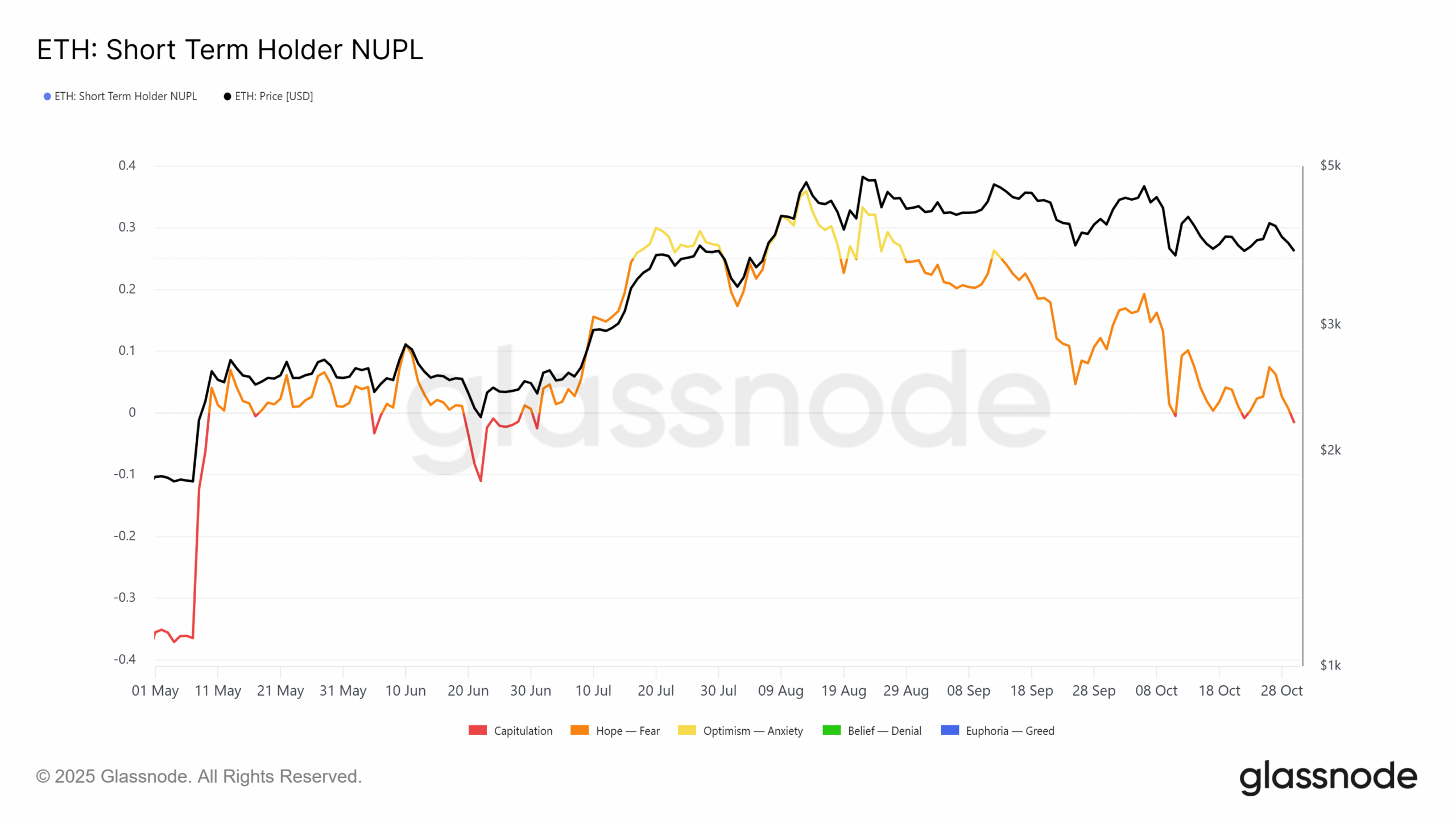

On-chain data shows investor nervousness

Beyond the charts, blockchain data paints a different picture. The Net Unrealized Gain and Loss (NUPL) metric, a metric used to measure overall market profitability, recently sank into the capitulation zone. This range often appears when many holders are near break-even or with small losses, and usually precedes a short-term rebound as selling pressure begins to ease.

Such periods of capitulation tend to reset market expectations. Short-term holders are known to react quickly to price changes and are often reluctant to sell at a loss. Historically, this action creates conditions for a temporary bailout rally as traders push prices higher in search of a quick recovery before taking profits again.

If this pattern holds, Ethereum could once again experience a short-term rally similar to the one observed earlier this month, where the asset briefly regained momentum before returning to consolidation.

Sentiment hits 9-month low

From a broader perspective, investor sentiment surrounding Ethereum has turned significantly bearish. Ethereum’s weighted sentiment has fallen to its lowest level since February, reflecting growing caution and fatigue among market participants, according to Santiment data.

This drop in optimism reflects the broader crypto landscape, where traders are increasingly opting into new positions. A prolonged bearish mood could hinder new capital inflows and ultimately weigh on price stability. However, such negative indicators are also known to act as contrarian signals, with peak pessimism often preceding market recovery.

In-range condition continues

For now, Ethereum appears to be in a range of $3,802 to $4,154. Analysts suggest that ETH could continue to fluctuate within this band until volatility returns or trading volumes recover. A definitive close above $4,150 is needed to confirm the start of a stronger bull run, but a drop below $3,800 could open the door to further losses.

Despite the current headwinds, Van de Poppe and several other market strategists maintain that Ethereum remains fundamentally strong, supported by ongoing developments in staking, scaling solutions, and institutional interest. Many believe that the current correction is not the beginning of a long economic downturn, but is part of a broader accumulation process.

Outlook: Patience may be the key

Ethereum’s long-term trajectory will continue to depend on macroeconomic factors, investor sentiment, and broader market liquidity. As traders await stronger signals from the Federal Reserve and put their assets at risk, the ETH consolidation could serve as a necessary cooldown before the next significant move.

While short-term uncertainty prevails, technical confluence and historical data suggest that Ethereum may be nearing a point of stability, which could pave the way for another rally once market confidence returns.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any particular investment strategy or cryptocurrency. Always do your own research and consult a licensed financial advisor before making any investment decisions.