Please join us telegram Channels where you can get the latest information on breaking news

Bitcoin prices have fallen 2% in the past 24 hours, and as of 3:30 a.m., trading volume was down 31% to $50.47 billion, trading at $111.33.

Glassnode warned that worse could happen from now on, and if the price fails to break above the cost basis of $113,000, a plunge to $88,000 could occur as long-term holders begin to reduce their positions.

🧠

Veteran seller takes action

Bitcoin is struggling to break above $126,000 as long-term holders continue to take steady profits. glass node #insight After months of accumulation, these pros have revealed gradual gains that add to continued downward pressure. ➡️… pic.twitter.com/h9PDRsGags

— CryptOpus (@ImCryptOpus) October 31, 2025

Some analysts say there is still a chance for the market to bounce back above $113,000 if it finds enough buyers, but demand remains weak for now.

Trading volumes also slowed as investors pulled back waiting for clearer signs.

Bitcoin on-chain signals show a mixed picture

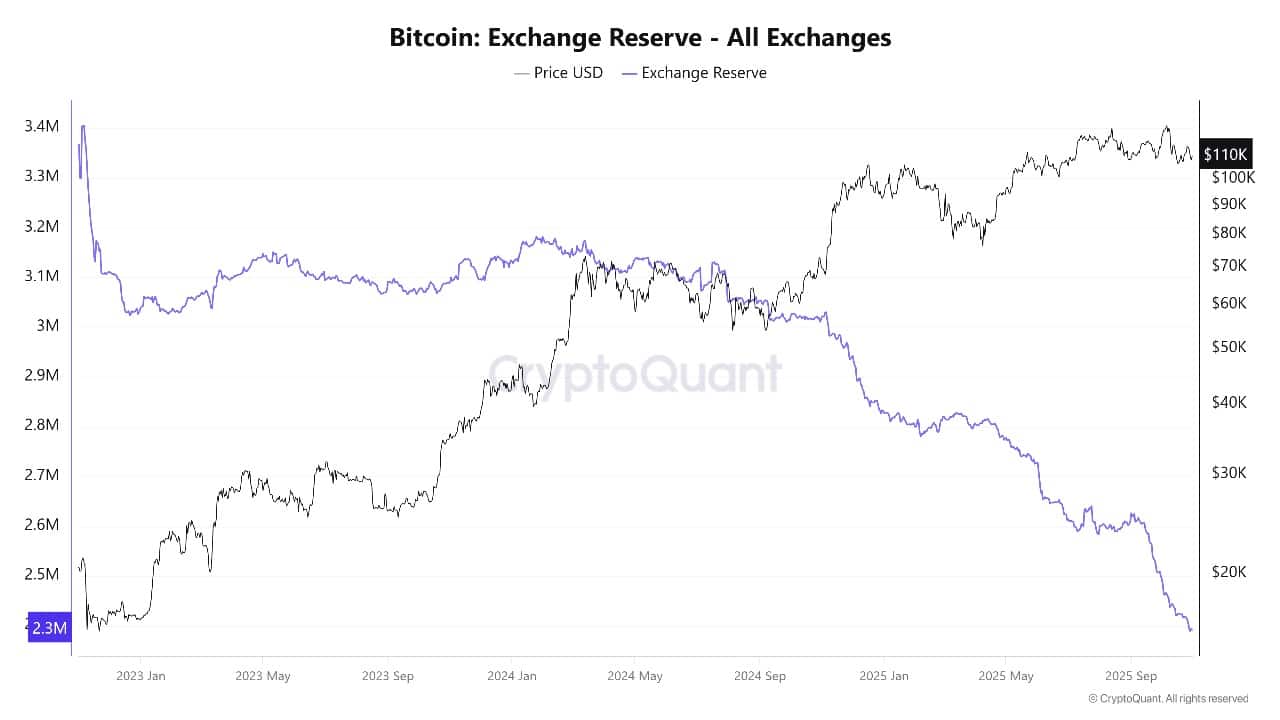

On-chain data speaks not only about prudence but also about long-term reliability. Bitcoin foreign exchange reserves have hit an all-time low as investors withdrew their bitcoins without selling them, suggesting that many holders are unwilling to part with them even under difficult circumstances.

Bitcoin exchange reserves Source: CryptoQuant

More than 200,000 BTC left the trading platform in October, reducing the available supply and making each remaining coin even more rare.

Still, selling by nervous traders and weak demand have caused BTC prices to fall on all major exchanges. Glassnode said failure to recover the $113,000 level could increase the risk of long-term holders turning sellers as fears grow. Whales and financial institutions remain cautious as markets lose leverage after the October crash.

Powell has completely lost his mind.

Markets are turning and chaos is everywhere.

Funds scream, whales laughRetail is trapped and panics on every chart 👇

Mr. Powell just keeps pushing buttons that no one is asking for.

Every statement, every hint, it’s like he’s stress testing the whole thing… pic.twitter.com/egDnCEOnvR

— FarmMyTears (@FarmMyTears) October 30, 2025

There are signs of renewed accumulation, especially as ETFs and custodial flows remain positive, but the overall downward trend has not yet reversed.

Emotions are fixed as neutral. Investors have not completely capitulated and some are waiting for a buy signal. Federal Reserve Chairman Jerome Powell said on October 29 that a rate cut in December is not a certainty, further increasing uncertainty for risk assets such as Bitcoin.

BTCUSD Technical Analysis: Strong Support Tested, Bear Flag Threat

Looking at today’s price chart, Bitcoin is moving within a narrow range, ending just below the $113,000 resistance and hovering around the $105,000 support. Recent price movements have shown strong resistance to repeated upside.

BTCUSD analysis source: Tradingview

If sellers push the price below the $105,000 level, it could quickly test the lows of $95,800, followed by a further decline towards Glassnode’s caution target of $88,000.

Momentum indicators point to further downside risks. The Relative Strength Index (RSI) is at 44.89, with weak buying pressure and no signs of an upward move. The MACD remains negative and the MACD line is well below the signal line, confirming a bearish trend. The price trend also shows a “bear flag” pattern, which is a technical signal that often leads to further declines if support breaks.

Investors should closely monitor the $105,000 critical zone. If buyers can sustain this level, Bitcoin price could attempt another move towards resistance and retest $115,000. If this support fails, the $88,000 area will be the next major target and sellers could quickly take control.

Price prediction: Downside risk remains if support breaks

Most price models, including the latest data from Glassnode, suggest that Bitcoin is at risk of further declines, especially if it fails to climb back above $113,000 soon. October’s extended decline wiped out leveraged traders, roiled the market, and without fresh demand, the price could fall toward $88,000 before finding real support.

There is also the possibility of a rebound if new buyers enter the market. There are signs of accumulation, especially as foreign exchange reserves have declined and some large investors have performed well. Some warn that if risk aversion continues, prices could continue to fall, especially if there is more bad news.

For now, Bitcoin remains below key resistance levels, with sellers in control. Keep a close eye on the $105,000 support. If this continues, a rebound may begin. If not, $88,000 could be next on the chart.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news