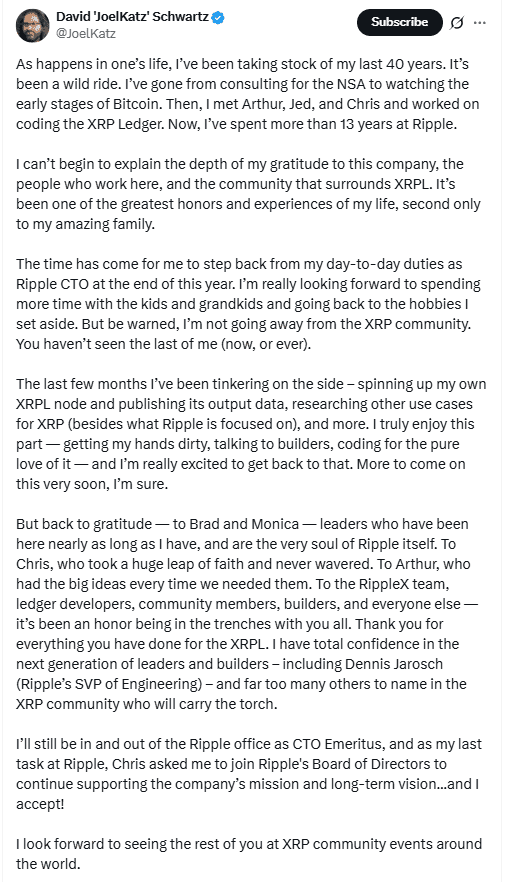

David Schwartz, longtime chief technology officer at Ripple, will step back from his day-to-day operations by the end of 2025. More than 13 years after the company, Schwartz confirmed that he would also be joining Ripple’s board of directors as CTO honor.

Schwartz is one of the original architects of the XRP ledger. His departure from daily responsibility represents a major change for Ripple’s technical leadership. The Senior Vice President of Engineering will take over his role in leading the technology team.

In his announcement at X, Schwartz emphasized that he will continue to work with the XRP community. He also said he plans to dedicate more time to his family and personal projects and signal another chapter while protecting his relationship with Ripple’s ecosystem.

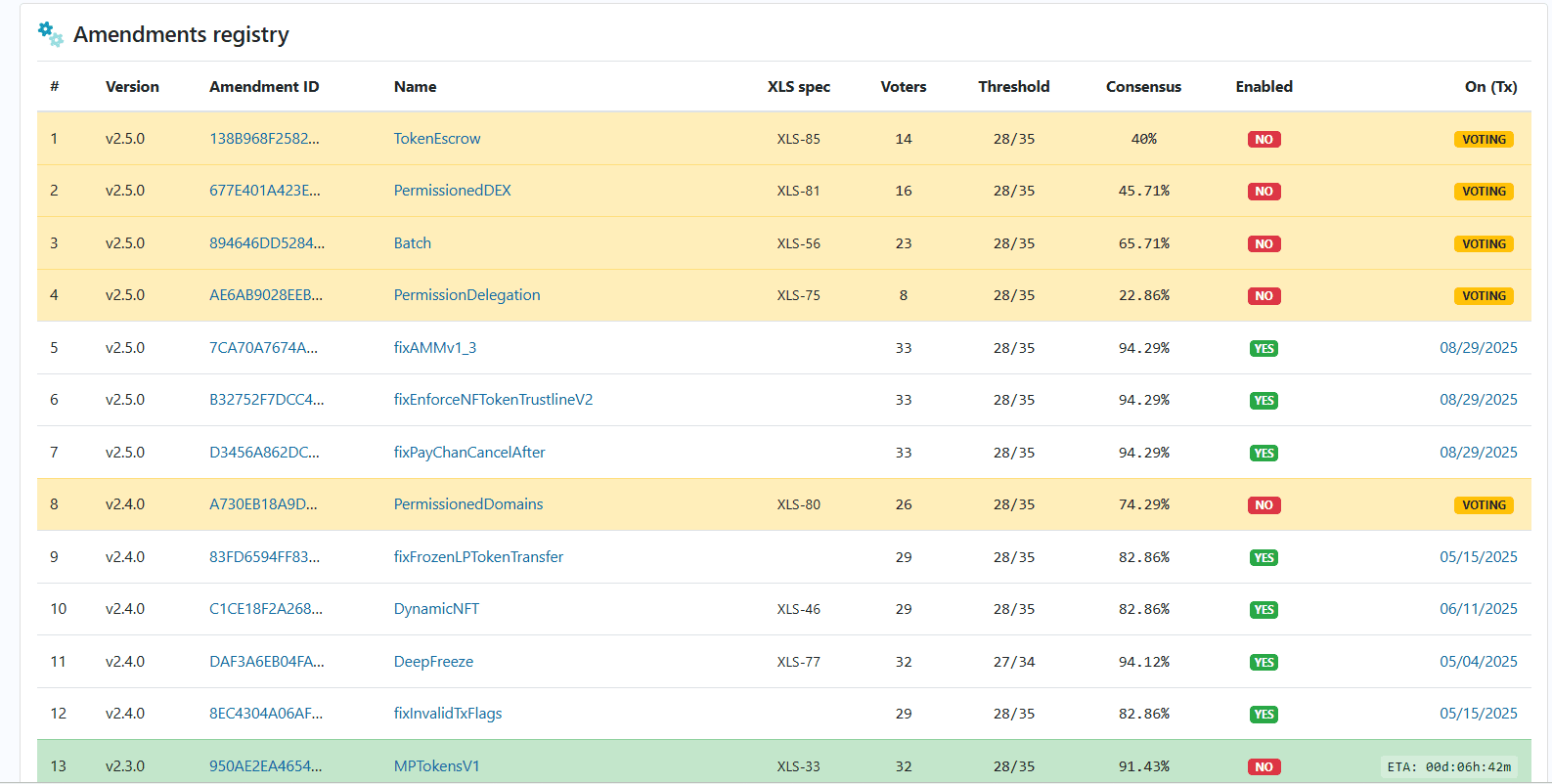

XRP ledger activates multipurpose token modification

The revision of the “Multipurpose Token” (XLS-33, MPT) in the XRP ledger has been officially activated today. The upgrade follows two weeks of Super Majority Varieter Support. This is necessary for changing the ledger.

MPT introduces a simplified token model designed for easy-to-understand assets such as Stablecoins. It is intended to reduce the complexity of creating and using tokens in an XRP ledger. This makes it easier for developers and businesses to issue digital assets directly on the network.

The activation date was highlighted on October 1st, after the community tracker and developer groups gained support for verification devices that need to be fixed. The official revised register for XRPL states that MPT is active, indicating a significant increase in the ledger’s capabilities.

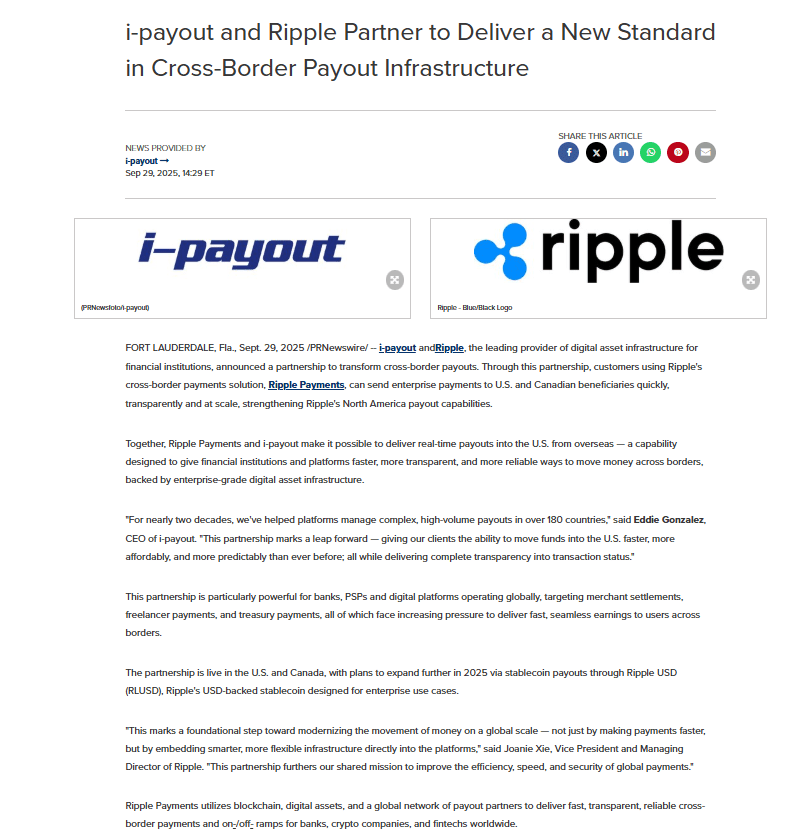

I-Payout adds ripple payments in the US and Canada

Global Disbursements Company I-Payout has announced that its payment system is currently running on Ripple Technology in the US and Canada. The rollout covers merchant settlements, freelancer revenues, and Treasury payments on various platforms.

The integration is already live, indicating the transition from pilot projects to production scale use. I-Payout said it will also add payments to RLUSD, RIPPLE’s USD-backed Stablecoin, RLUSD, as the service expands beyond North America.

This expansion places ripples at the heart of mainstream spending solutions. By pairing blockchain solutions with the Stablecoin feature, I-Payout is located to streamline cross-border transactions for enterprise clients.

FOMO Pay launches RLUSD for Singapore merchants

FOMO Pay, a licensed payment company in Singapore, today announced support for Ripple’s RLUSD Stablecoin. The deployment allows merchants to accept RLUSD for payments and cross-border transactions.

The company operates as a major payment institution under the financial authorities of Singapore. Extend existing multi-currency services by adding RLUSD to include Stablecoin rails. This allows merchants to access faster and transparent settlements in regional trade.

Ripple promotes RLUSD as an enterprise-grade Stablecoin. The integration with FOMO Pay highlights the growing adoption in Asia, where cross-border trade requires efficient payment channels.

Ripple Legal Chief urges the US Congress on Crypto Law

Ripple’s Chief Legal Officer Stuart Aldeoty has updated its appeal to U.S. lawmakers to pass comprehensive cryptography. In a statement, he said Americans already use cryptography and wanted stronger consumer protection.

Aldeoty warned that the lack of clear rules risks driving Crypto’s talent and innovation overseas. His remarks followed Ripple’s settlement with US regulators earlier this year, and he strengthened the company’s push for regulatory clarity.

The appeal comes as US regulators are considering broader policies, including ETF approval and digital asset monitoring. Ripple continues to position itself as the main voice in pushing for a clear framework around cryptocurrency.

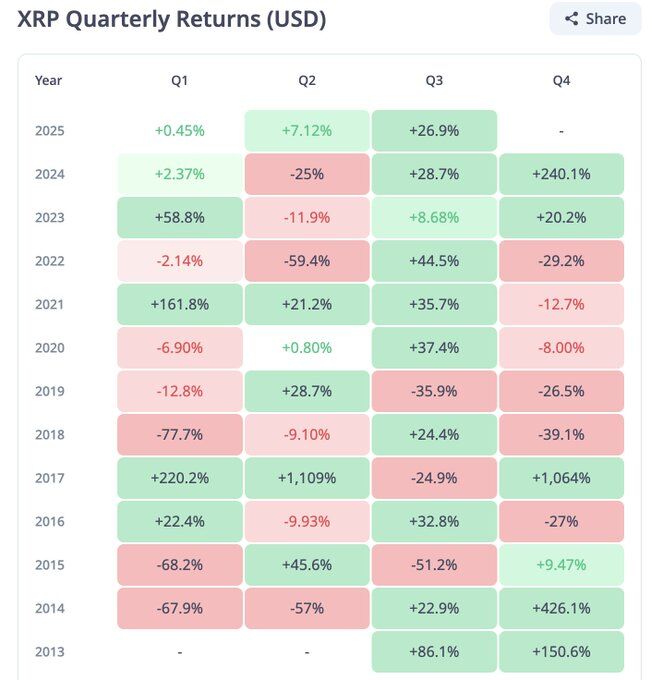

The XRP Q4 pattern stands out with its historic return

XRP’s quarterly heat map shows that its biggest surge often arrives in the fourth quarter. In particular, it closed at +1,064% in 2017, +426.1% in 2014, and +150.6% in 2013. Most recently, Q4 ended at +240.1% in 2024 and +20.2% in 2023.

However, this record also shows a sharp Q4 drawdown over a few years. Printed in 2022 at -29.2%, 2021 at -12.7%, and 2019 and 2018 at -26.5% and -39.1%, respectively. These swings emphasize how the outcome changes with the cycle.

Taken together, the data highlight the Q4 intensity that is repeated over multiple cycles, along with periods of significant debilitating. The combination of double and triple digit movements in both directions explains why the Q4 remains the most viewed quarter on XRP’s calendar.

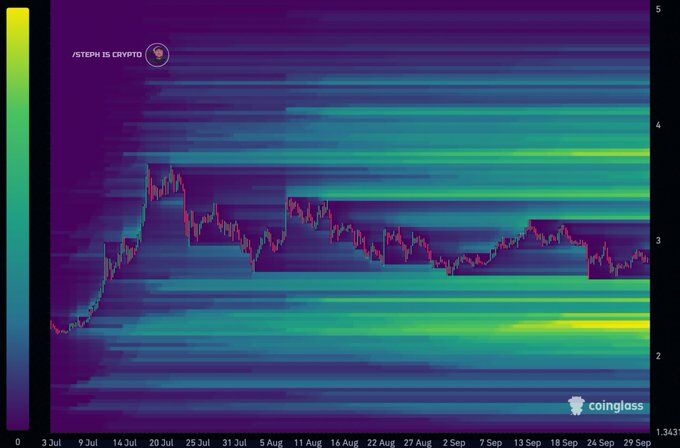

XRP heatmap signals heavy liquidity near $2.25

Coinglass’ new XRP heatmap highlights dense liquidity clusters at the $2.25 level. The chart shows intensive activities that have been placed in order depth in that zone since mid-September. Such liquidity pockets often attract price movements because of the range of market makers’ test support and resistance ranges.

The heatmap further reveals that the lighter but consistent liquidity bands are spreading between $2.00 and $3.00, suggesting that traders are actively placing orders in this corridor. Historically, such fluidity zones act as magnets and elicit price action before a large breakout or breakdown.

Based on this structure, my analysis suggests that it may have dropped towards $2.25 before the larger shift. Clearing fluidity at that point may set a stage of rebound, especially if the volume increases when the cluster is tested. Market responses in that zone are important for the short-term trends of XRP.

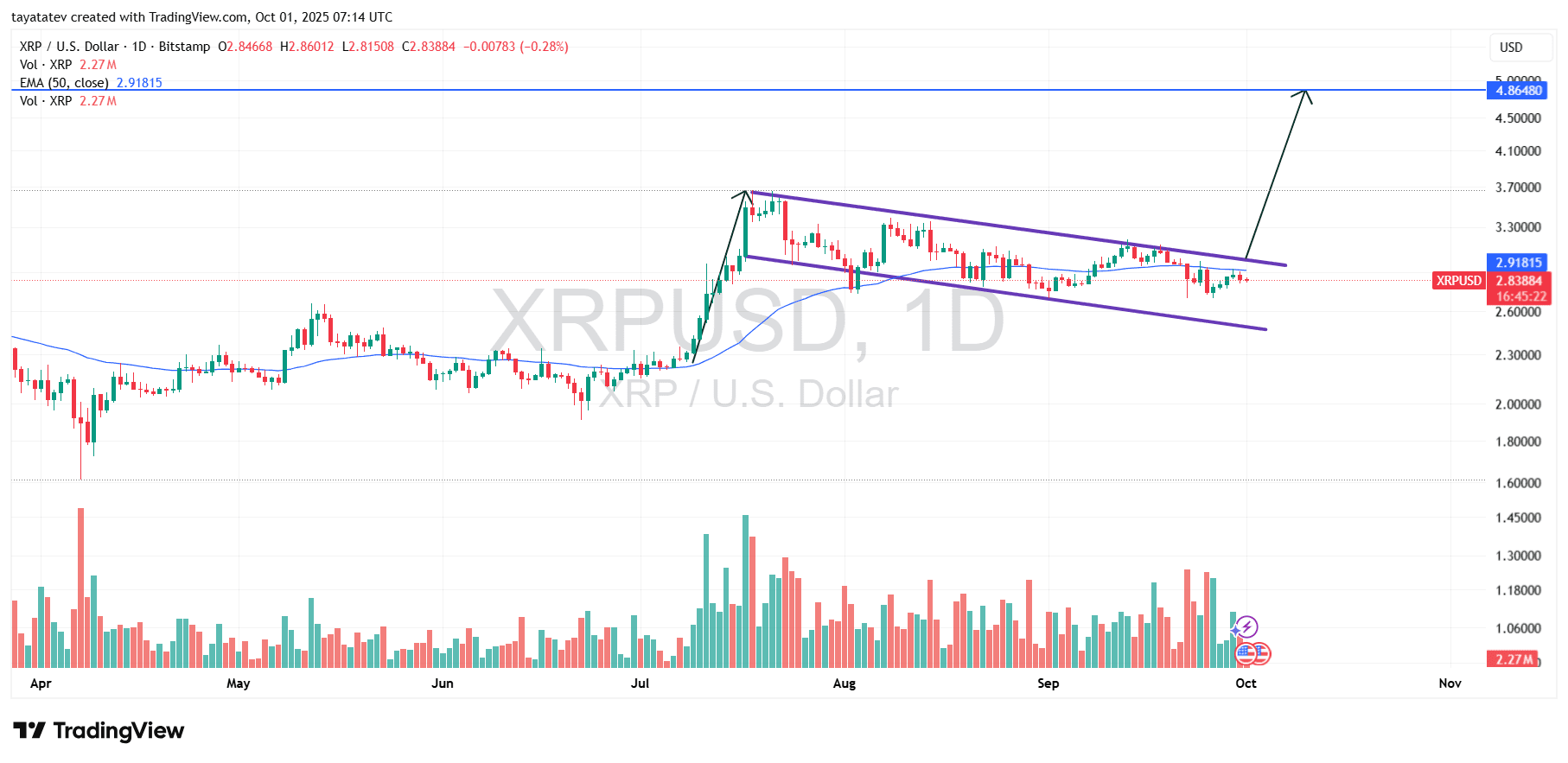

XRP forms a bullish flag. Confirmed breakouts cover approximately $4.85 (+71%)

On October 1, 2025, Bitstamp’s DailyXRP/USD chart shows a clear bullish flag. The price is around $2.84 while the flag cap is pressed after the July surge. The volume is cooled during the pullback and the 50-day exponential moving average is near $2.92.

The structure fits textbook flags. A sharp advance builds the flagpole and then the integration of parallel channel marks, downwards. Buyers will protect higher lows within the channel, while sellers will reduce lower heights along the upper rails. When prices exceed the rail above it at an increasing volume, the pattern indicates a continuation of the trend.

A bullish flag means measured movement based on the flagpole. From today’s chart, that projection coincides with a 71% advance from the current price, bringing the target closer to $4.85. Traders look for the daily closings above the channel top, which is on the $3.05-$3.15 area, as well as on the stronger volume, to see momentum.

The movement remains unconfirmed until that break. However, repeated tests of patterns, cooling volume during integration, and resistance keep the upside setup intact. A confirmed breakout shifts focus to a $4.85 objective and intermediate supply zone.

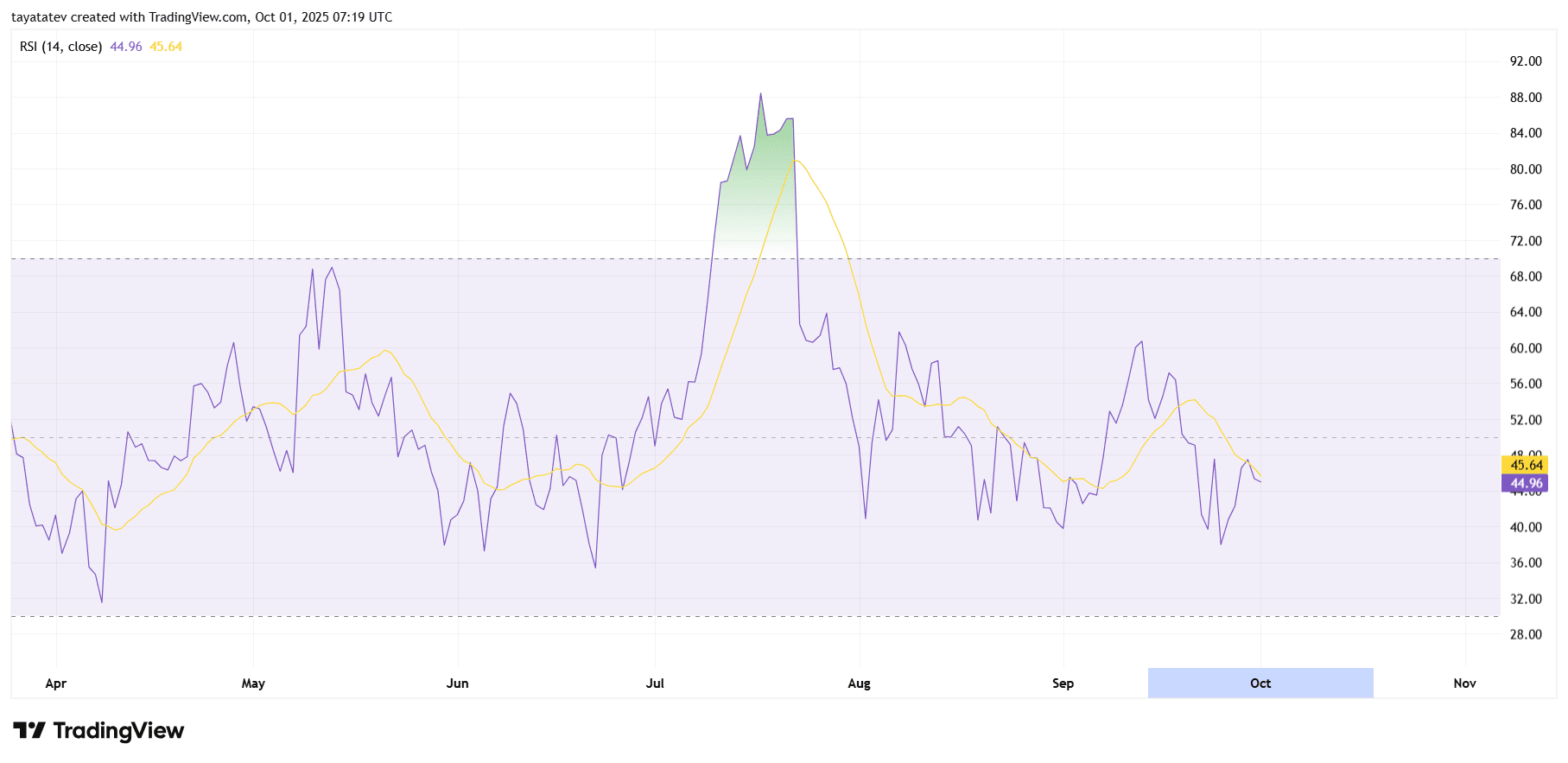

XRP Daily RSI is below 50, with neutral to weak momentum (October 1, 2025)

Today’s relative strength index (14) prints ~45, with its signal average being close to 46 on a daily chart. Its placement maintains momentum and sellers still hold a slight edge as they are below the midpoint of 50. However, the measurements are well above 30, so there is no excess pressure yet.

Until September, RSI was shaken from 40s to 50s. These movements show range-bound momentum rather than clear trends. There was also a surge in July to over 70 territories, followed by a steady cooldown in August. That comedown is now flattened, which often precedes a change of direction.

From here, look at line 50. If the RSI pushes and holds above 50 while the signal is occurring, the momentum coincides with bullish continuation and supports a breakout case for the flag. Conversely, if the RSI rolls under the age of 40, the Bears regain control and endanger a deeper retest of the price. In short, the gauge is leaning towards neutral beash today, with clean moves of over 50 being the first to make sure the buyer is in charge.

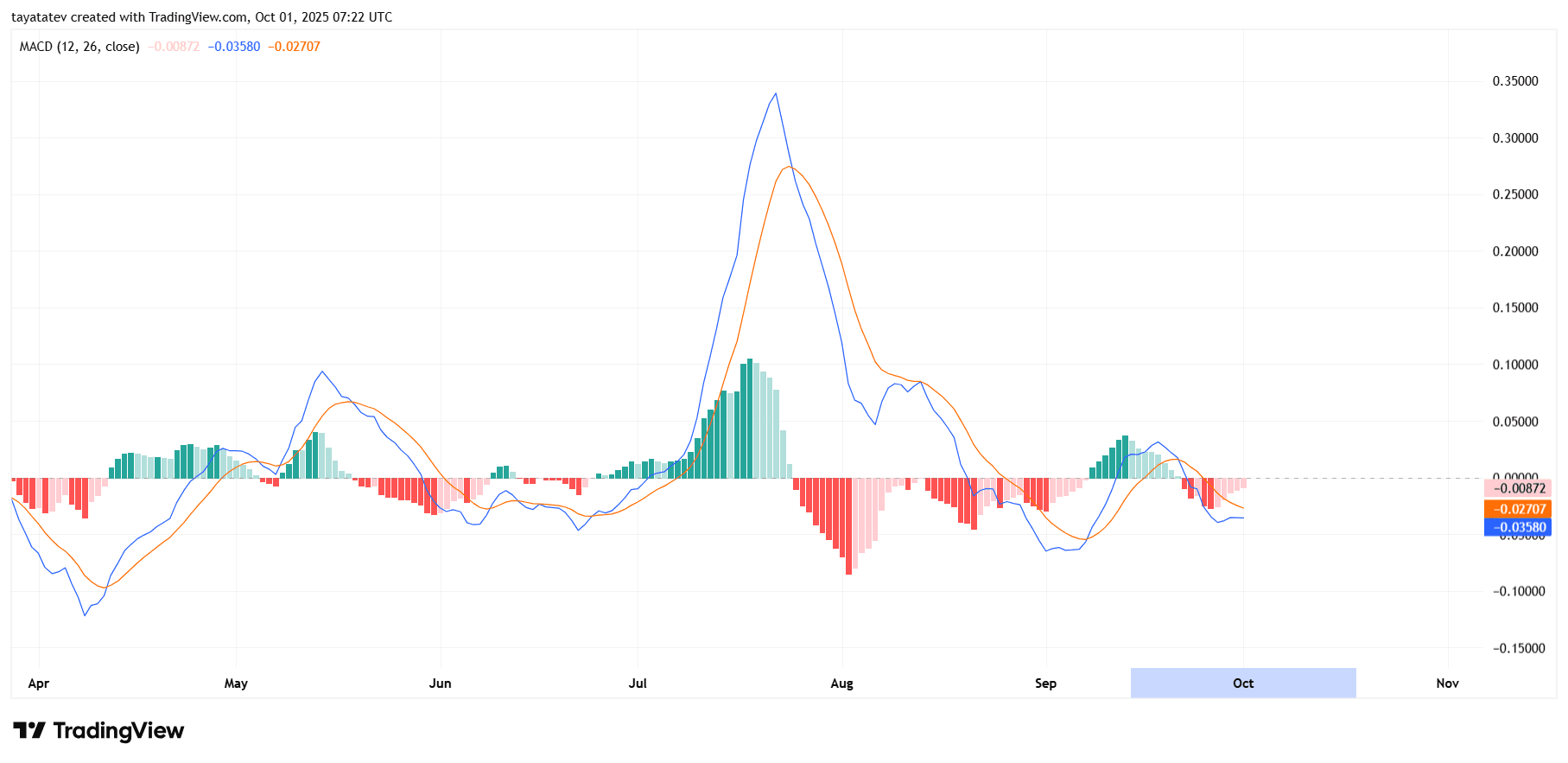

The XRP Daily MACD is below the signal and zero, with weak momentum but near inflection (October 1, 2025)

The divergence of the XRP moving average convergence shows the MACD line around -0.0358 and the signal line near -0.0271, with the negative histogram being close to -0.0087. This brings momentum below zero and below the signal, indicating today’s weak bias. The bullish push in September faded as the histogram reversed from green to red in the second half of the month.

Until July, the MACD spiked to highs, then rolled sharply in August, remaining in Sub-Zero for most of September. Modern bar clusters are closer to the zero line and often precede changes in direction. However, the current slope of both lines is still tilted, so buyers have not regained control.

From here, take note of two checks. First, a bullish cross that rises as the MACD returns above the signal while the histogram is held green. Second, zero line recalls match momentum to price-risking flag setups. As the histogram expands further negatively and the lines continue to drift, XRP risks retesting another support before breakout attempts.